- Central America has exported 764k tonnes of raw sugar so far this season, up 164k tonnes from our last update.

- Demand has dropped significantly after 600k tonnes were nominated in January and February combined.

- We think exports will pick up again as we near the end of the March delivery window, and a further 150k tonnes should be shipped over the next month.

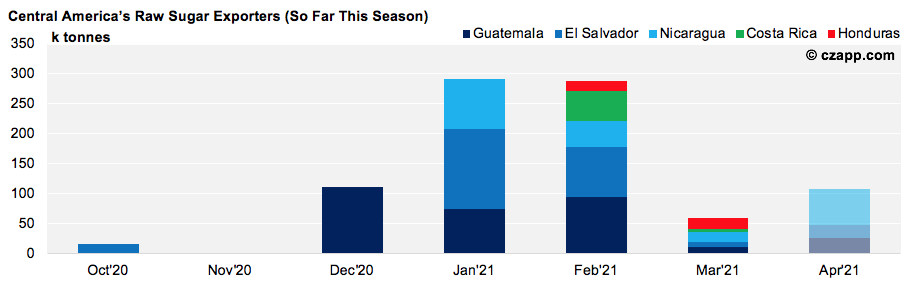

Which Central American Origins Have Exported Raws?

- Central America has exported 764k tonnes of raws so far this season, with a further 108k tonnes nominated for shipment in April.

- The suppliers have been Guatemala (290kmt), El Salvador (240kmt), Nicaragua (144kmt), Costa Rica (55kmt) and Honduras (35kmt).

- At least 258k tonnes of this was delivered to the March expiry, for which the terms of delivery state that the sugar needs to be nominated by the receiver before May 15th.

- So, unless a significant amount of the sugar is washed out between the receiver and deliverer, this should be shipped within the next 30 days.

- South Korea remains the most likely destination, as Central American suppliers work to fill the void left by Thailand’s poor cane crop.

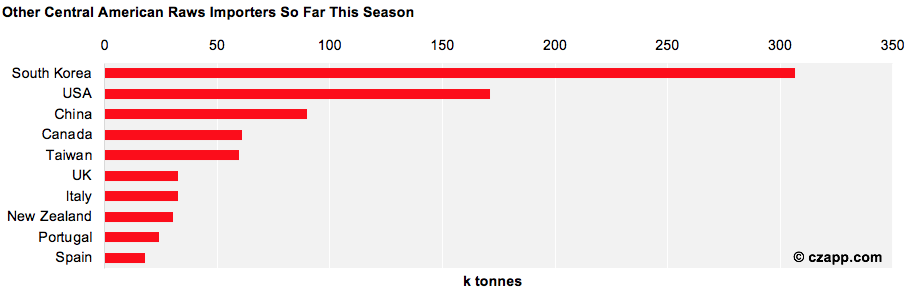

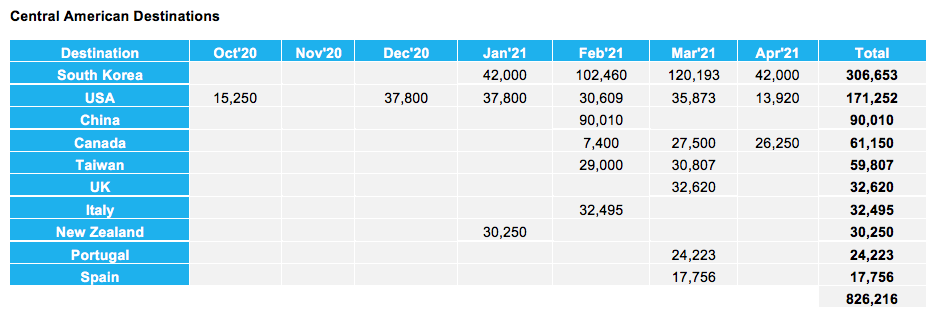

Who Has Imported Central American Sugar?

- South Korea is still the most important home for sugar from Central America this season.

- It’s already imported more than 300k tonnes of Central American raws this season, already matching the total for shipped int 2019/20.

- The US has also been a key destination via the Tariff Rate Quota for raw sugar, so we think another 20k tonnes will be shipped there.

Note: You Can Track Global Shipments Using This Interactive Data Tool

- The EU quota has a significant open balance as well, with 120kmt still to be shipped (UK does not count against the EU quota).

Other Opinions You Might Be Interested In…

Explainers You Might Be Interested In…

Interactive Data You Might Be Interested In…