Insight Focus

A major change in container shipping alliances has occurred. New alliances have reshaped the balance between major liners Maersk-Hapag-Lloyd, CMA CGM, COSCO and others. MSC remains independent, opting for direct port connections, while competitors adopt hub-based strategies. The reshaped landscape may lead to competitive pressure and lower freight rates.

February 1 marked a significant turning point in container shipping, as new alliances officially launched operations. After more than seven years, the sector is undergoing a major alliance restructuring, with shifts in dynamics that could reshape the competitive landscape.

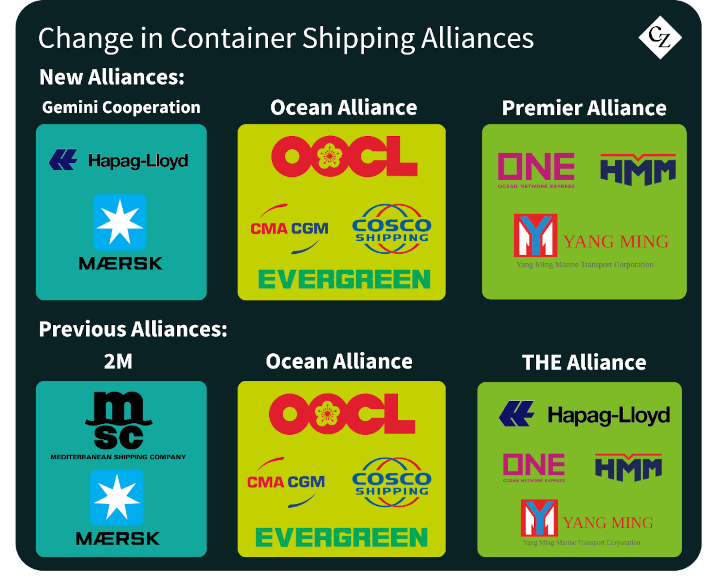

New Alliances

- Gemini Cooperation: Maersk and Hapag-Lloyd

- Ocean Alliance: CMA CGM, COSCO, Evergreen, and OOCL

- Premier Alliance: Ocean Network Express (ONE), HMM, and Yang Ming

Previous Alliances

- 2M Alliance: Maersk and MSC

- Ocean Alliance: CMA CGM, COSCO, Evergreen, and OOCL

- THE Alliance: Hapag-Lloyd, ONE, HMM, and Yang Ming

The most significant change is the dissolution of 2M, the industry’s largest alliance, following Maersk and Hapag-Lloyd’s decision to join forces and form the new big fish of the game. With this decision, the two European powerhouses are reshuffling the deck, setting the stage for a new competitive environment in the industry.

Gemini Aims for Record Schedule Reliability Through Central Hubs

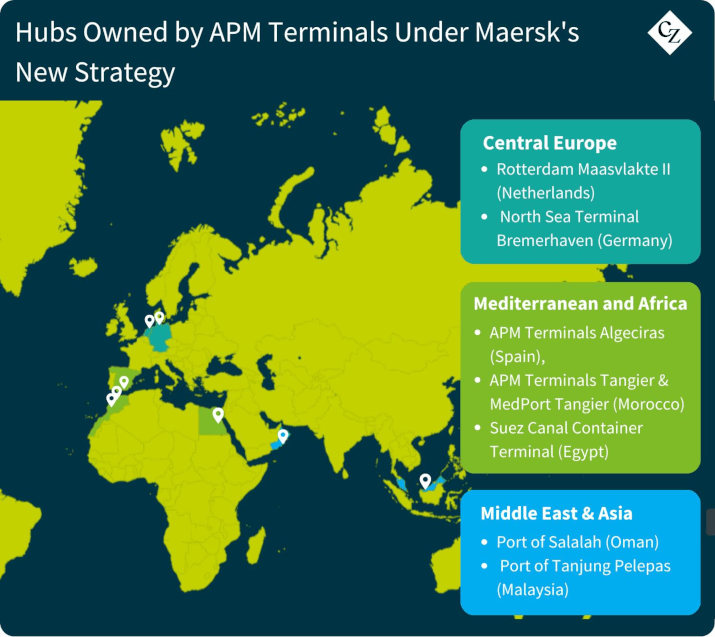

Gemini partners have made it clear that their primary focus is elite schedule reliability, setting an ambitious target of over 90%. The main tactic of the alliance to achieving this goal is a hub-based network strategy, in which specific ports will act as central hubs for the alliance’s services.

“The hubs will ensure smooth and seamless connections between our services,” highlighted Kenni Skotte, Head of Ocean Network Product at Maersk. “Centring our network around hubs owned and controlled by Maersk or our partner (Hapag-Lloyd) means we will have more control over the operational management of the hubs. It also means we can invest in world-class systems and processes to ensure they perform to the highest level and deliver the reliability and speed necessary for our new network.”

To support this strategy, Maersk’s port operator APM Terminals will play a key role, owning eight of the selected hubs for the new network.

MSC’s Standalone Strategy

A particularly noteworthy development is MSC’s decision to remain independent.

The world’s largest container shipping company has opted to rely on its own resources rather than join an alliance. With significant investments in expanding its fleet, MSC is well-positioned to support this strategy in terms of container and vessel capacity.

MSC Container Ship

While Gemini is focused on a hub-and-spoke model, MSC is taking a different approach, aiming for direct connections between ports. The company claims it will offer 1,900 direct port combinations, translating to a stark contrast to Gemini’s transshipment-heavy network.

The differing strategies of key industry players highlight that success in the container shipping sector isn’t just about offering the best rates or fastest transit times. It’s also about adopting the most effective market approach and truly understanding customer needs.

Market Share Shifts on Key Trade Lanes

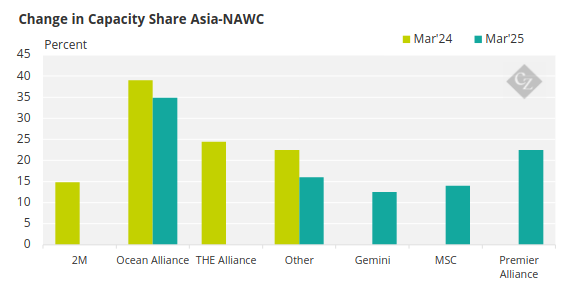

To assess the impact of the container shipping alliance restructure, Danish shipping data analysis firm Sea Intelligence analysed capacity shifts on the Asia–North America West Coast (NAWC) trade route. Between March 2024 and March 2025, there has been a huge shift in capacity share.

Source: Sea Intelligence

The findings of the analysis reveal a shifting competitive landscape:

- Ocean Alliance remains dominant, with 35% of planned capacity in March 2025, despite a drop in market share due to increased competition.

- Premier Alliance maintains the same market share as the former THE Alliance, despite losing its largest ocean carrier Hapag-Lloyd.

- Gemini Cooperation emerges as the smallest player in the Transpacific trade to NAWC.

A similar trend is observed on the Asia–North America East Coast trade, where:

- Ocean Alliance continues to hold the largest market share.

- Premier Alliance retains a similar share to THE Alliance.

- Gemini Cooperation lags behind, though the difference with Premier Alliance is marginal at just 0.2 percentage points.

Competitive Pressures & Freight Rates

Alan Murphy, CEO of Sea-Intelligence, predicts that the new alliance landscape will intensify competition and could potentially cause a drop in freight rates as carriers compete to adjust to the evolving market conditions and strive to attract new customers while retaining existing ones.

“The changes in the competitive landscape between the carrier alliances is likely to create a significant competitive pressure, as the carriers adjust to the new situation,” he commented.