Insight Focus

Corn in Chicago rallied as Argentina’s production was revised lower. Brazil’s weather is favourable, but Argentina faces ongoing dry conditions, posing some risk. After two weeks of rallying, we expect a slight correction but overall consolidation, with a small downside risk.

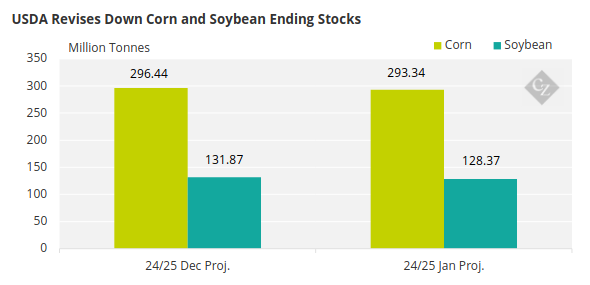

Last week, the market adjusted to the new price levels after the January WASDE report, with corn and soybeans seeing the biggest cuts to ending stocks, which influenced wheat prices. Dry weather in Argentina is a growing concern, with expectations for a downward revision in the next WASDE.

Source: USDA

Looking ahead, South American weather remains crucial. Brazil is performing well, though some small drought-affected areas remain, while Argentina’s weather continues to be dry, keeping risks high. After two weeks of rallying based on new US and global supply and demand pictures, we expect some correction but overall consolidation, with flat to small downside risk.

There is no change to our forecast for Chicago corn for the 2024/25 crop (September/August), which is expected to average USD 4.55/bushel. The average price since September 1 is running at USD 4.28/bushel.

Chicago Corn Rallies

Corn in Chicago started positive last week, continuing to price in the new carry estimates from the January WASDE report published the previous Friday. The market debated whether higher prices were justified or if the rally from the previous week was enough, and after some mid-week doubt, it rallied further on Friday following a 4-million-tonne downward revision to Argentina’s production, closing the week 3% higher.

Euronext corn followed Chicago at both the start and end of the week, but a mid-week correction prevented weekly gains, leaving it basically unchanged by Friday’s close. Wheat mirrored corn, closing positive in Chicago, but the mid-week selloff on the Euronext resulted in a negative week despite a strong finish on Friday.

We saw positive fundamental news for corn, with US corn inspections reaching 1.4 million tonnes (+64% week-on-week), well above market expectations. Net sales published last Thursday were strong at 1 million tonnes, and exports reached 1.4 million tonnes, the highest of the crop year so far.

BCR in Argentina reduced its corn production forecast to 48 million tonnes, down from 52 million tonnes, compared to BAGE’s 50 million tonnes and the latest WASDE estimate of 51 million tonnes. Corn planting is 95.1% complete compared with 96.1% last year, with 85% of the crop rated good or excellent, up seven points week-on-week.

CONAB in Brazil’s January report slightly reduced its estimate for corn production to 119.5 million tonnes, down from 119.6 million tonnes, and above last crop’s 115.7 million tonnes. This compares to the 127 million tonnes projected in the latest WASDE.

Wheat Struggles Despite Strong Corn Rally

On the wheat front, the week started positive, largely driven by corn in both the US and Europe, but the Euronext couldn’t close the week in the green. Northern hemisphere wheat remains dormant due to cold weather in the US and northern Europe.

BAGE in Argentina reported the end of the wheat harvest with 18.6 million tonnes of production.

In terms of weather, cold and mostly dry conditions are expected in the US growing regions, while Brazil will continue receiving rains in the centre-south. Argentina faces little rain and warm weather, raising concerns, while light rains are forecasted across Europe, including the Black Sea region and Ukraine.