Insight Focus

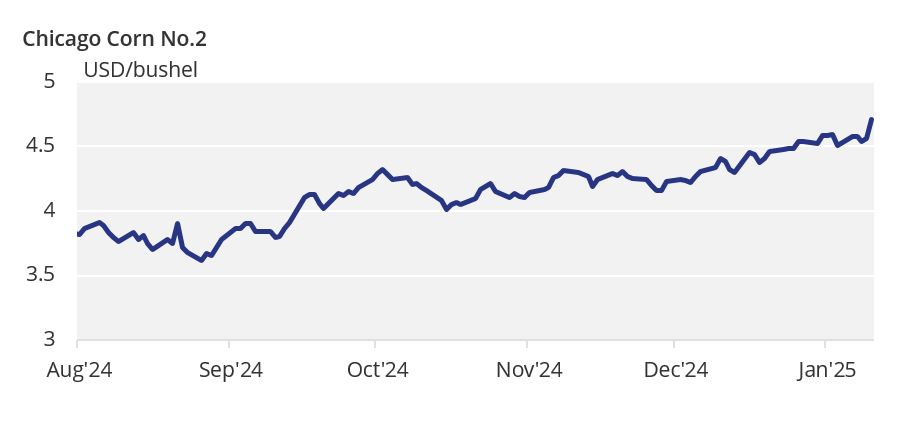

The January WASDE report tightened US corn supplies. This move pushed Chicago corn up 5% this week. The 2024/25 price forecast has been raised to USD 4.55/bushel due to reduced ending stocks and higher ethanol demand. The market remains tighter than expected, with upside risks ahead.

We have updated our projections based on the January WASDE report and have increased our forecast for Chicago corn for the 2024/25 crop (September/August) to an average of USD 4.55/bushel compared with USD 4.35/bushel previously. The average price since September 1 is running at USD 4.25/bushel.

The heavy cut to US corn ending stocks and the risk of another cut due to higher ethanol demand has made us increase our average price forecast for the crop. In the short term, we think Chicago corn still needs to price in the new lower carry, which leaves the market much tighter than expected. The risk should be to the upside.

On the weather front, dry conditions are expected in the US Midwest, which doesn’t really benefit wheat that has been already planted. Brazil is expected to experience rains but only during the second half of this week while Argentina is expected to have warm and dry weather. Europe is expected to have cold and wet weather, as is Eastern Europe and the Black Sea region.

Chicago Corn Rallies

The January WASDE report surprised, tightening the US corn supply and demand balance and taking Chicago corn up 5% in the week.

Since our last report on December 23, Chicago corn has rallied since the final days of 2024, consolidating at the USD 4.50/bushel level. Euronext corn displayed similar behaviour, moving from the low EUR 200s to consolidate around EUR 210/tonne.

This movement has been driven by the lower carry projected in the December WASDE report, as well as the expectation of another cut to ending stocks in the January WASDE published last Friday.

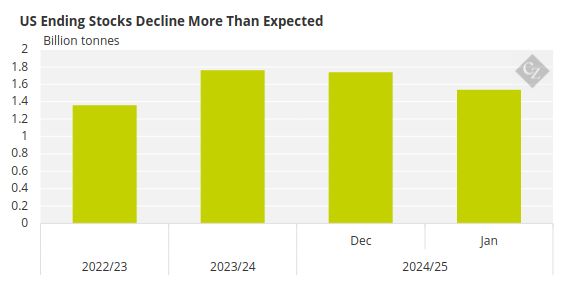

The January WASDE report surprised the market with a heavy cut to US corn ending stocks, down 198 million bushels. The market had expected ending stocks of 1.674 billion bushels, lower than the 1.738 billion in the December WASDE, but the actual figure came in at 1.54 billion.

Source: USDA

The reduction came from a lower yield of 179.3 bushels/acre (down from 183.1 bushels/acre) despite a small increase in harvested area of 200,000 acres. There was also 75 million bushels of lower demand, 50 million of which came from feed and residual, and the remaining 25 million from fewer exports.

We expected an upward revision in corn ethanol usage, which did not materialise, so a future revision remains possible.

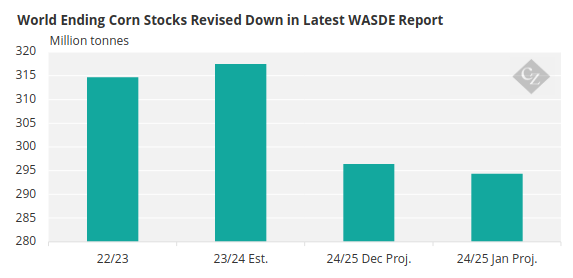

Global ending stocks were reduced by 3.1 million tonnes to 293.3 million tonnes, compared to the market expectation of 295 million tonnes and down from 296.4 million tonnes in December. Apart from the lower US production, only minor adjustments were made to Russian and Chinese production, both up by a combined 1.1 million tonnes.

Source: USDA

The reduction came from a lower yield of 179.3 bushels/acre (down from 183.1 bushels/acre) despite a small increase in harvested area of 200,000 acres. There was also 75 million bushels of lower demand, 50 million of which came from feed and residual, and the remaining 25 million from fewer exports.

We expected an upward revision in corn ethanol usage, which did not materialise, so a future revision remains possible.

Global ending stocks were reduced by 3.1 million tonnes to 293.3 million tonnes, compared to the market expectation of 295 million tonnes and down from 296.4 million tonnes in December. Apart from the lower US production, only minor adjustments were made to Russian and Chinese production, both up by a combined 1.1 million tonnes.

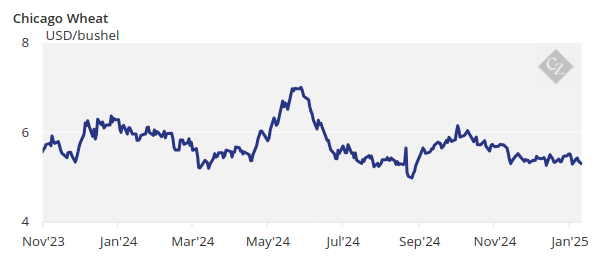

The January WASDE report placed US wheat ending stocks at 798 million bushels, up from 795 million bushels in December and above the market expectation of 793 million. Planted acreage was reported at 34.1 million acres, 2% higher year-on-year and above market expectations.

Global ending stocks were reported at 258.8 million tonnes, slightly up from 257.9 million in December and in line with expectations. Minor changes were made to some production areas.