Insight Focus

- Tight supply in the US pushed up the price of urea by about USD 27/tonne.

- China announced resumption of 7 million tonnes of DAP and MAP from March 15.

- Surplus ammonia in Southeast Asia is looking for a home west of Suez.

NOLA Urea Price Increases

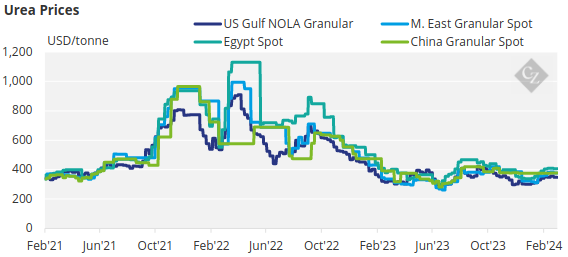

The international urea market was this week dominated by NOLA/US, where prices edged up more than USD 30/short ton (USD 27/tonne) on the barge. Prices are now closing in on USD 400/short ton (USD 363/tonne) for March delivery. Tight supply saw a major producer in the US import granular urea to meet demand, with favourable weather in the offing for the spring season.

Prices in Brazil edged up with offers in the USD 395-400/tonne CFR range up from as low as USD 370/tonne CFR last week. Egyptian producers are struggling to maintain prices above USD 400/tonne with paper traded as low as USD 380/tonne for March.

Iranian products appear to be dominating the 365,000 tonne Ethiopian tender held this week with the lowest offers for lots two to seven at USD 351/tonne FOB. Lot one was offered at USD 392.07/tonne FOB. The tender result in Ethiopia bodes badly for producers in both Egypt and the Middle East as the latter struggles to maintain prices at around the USD 385/tonne mark.

Pupuk Indonesia held an export tender this week and the price of USD 386.25/tonne FOB could mean that Middle Eastern producers may have to reduce their price expectation by about USD 10-12/tonne, which is the freight differential to the important Australian market, which is now entering its main import season.

Although news emerged from China this week on the export program for processed phosphates, there was no mention of the urea program. The understanding in the market is that urea export from China could resume May 1, but clarity should come in the next week or so.

Processed Phosphate Reaches Ceiling

Buyers of processed phosphates in Brazil and India held their nerve this week as China announced it would resume exports from March 15 onwards. The government announced an export quota of 5 million tonnes of DAP and 2 million tonnes of MAP.

But MAP prices held in Brazil at USD 565/tonne CFR and India is steadfast at USD 595/tonne CFR for DAP. The Indian government increased the phosphate subsidy by 38% for the Kharif season lasting April 1 to September 30 in response to importers suffering negative margins on imports.

The general consensus is that processed phosphate prices have reached ceiling level and that come Q2 and Q3, Chinese exports could create lower prices.

Brazilian Potash Sees Demand Uptick

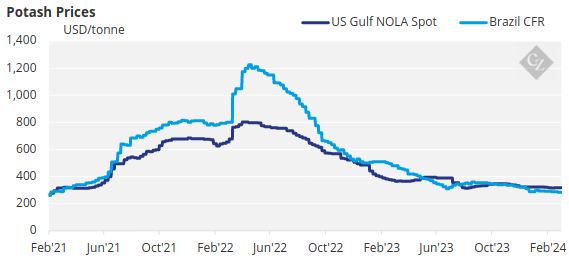

Potash prices in Brazil are coming alive with increased demand and suppliers expect prices to increase to above USD 300/tonne CFR, up from the current range of USD 285-295/tonne CFR.

Pupuk Indonesia tendered for standard MOP this week and although price discovery has yet to be officially announced, it appears that the prices will be in line with the previous tender of around USD 306/tonne CFR. The Southeast Asian price assessment is in the range of USD 280/tonne to USD 325/tonne CFR.

India’s contract price negotiations have not been finalized and the market expects the new price to be as low as USD 280/tonne CFR – down from the current re-negotiated price of USD 319/tonne CFR. The government of India kept the Kharif subsidy on potash unchanged from the Rabi season.

Suez Issues Present Ammonia Arb Opportunities

The global ammonia market is humming along with few spot sales recorded. OCP of Morocco appears to be snapping up reasonably priced ammonia east of Suez, taking advantage of arbitrage opportunities.

The March Tampa price between Mosaic and Yara rolled over at USD 445/tonne CFR. Ma’aden of Saudi Arabia is reported to have lowered its contract price to USD 295/tonne FOB.

Far East markets are quiet with significant surplus volumes in Southeast Asia. Industrial demand in Asia is low so producers are looking to place surplus volumes west of Suez.

Demand for ammonia in India could surface with an expected increase in domestic production of processed phosphates. Overall, ammonia prices are stable-to-soft with the expectation of lower prices in Q2 and Q3.