Insight Focus

- China will continue to prohibit fertiliser exports until at least April 2024.

- China hopes to stabilise domestic fertiliser prices.

- The world’s urea, potash and ammonia markets are all oversupplied.

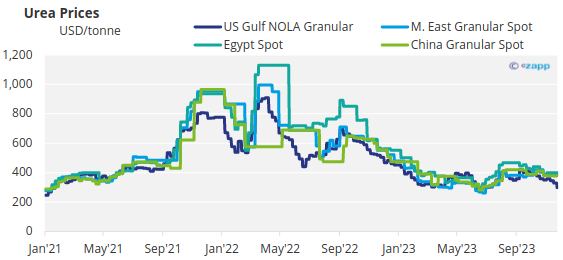

Urea Market Subdued Until 2Q’24

The international urea market continues to show weak demand and is expected to remain so unless major markets come into play with demand. This looks unlikely, however.

Major buying nations in Europe, as well as Brazil and the US are all holding out now that 2023 is coming to an end. There is some glimmer of hope that Brazil could come into the market with late season demand. It is also thought that the US will need to import sizable volumes for the spring season.

An announcement this week from China appears to shut down hopes of any fertiliser exports until at least April 2024 once the domestic season has come to an end. It is reported that export clearance (CIQ) will not be issued for any fertilisers until then. This to keep products within China in the hope to stabilise or even lower domestic prices.

Any prospects of an India tender are waning, and it is now understood that even if India comes into the market, the volume would be less than 1 million tonnes. A tender is most likely to be seen some time in January or even early February.

Current prices for sanctioned granular urea are said to be around USD 300/tonne CFR whilst non-sanctioned granular urea is closer to the USD 320-330/tonne CFR range.

Granular urea in the Middle East for spot buying appears to be around USD 325/tonne although returns from contract shipments for the US yields significantly lower returns. Egyptian producers are reluctant to sell to Europe below USD 350/tonne FOB, but they may have to lower this price to induce sales. Nigerian prices are said to be below USD 300/tonne.

Russian prilled urea is now said to be around USD 270/tonne FOB. Tenders in Southeast Asia saw prilled urea sold in Indonesia at USD 344/tonne, down from the previous price of USD 381/tonne FOB. Granular urea in Southeast Asia is said to be around the USD 340/tonne FOB level as witnessed during the most recent Indonesia tender.

India imported 3.79 million tonnes of urea during the April to October period this year, slightly higher than the 3.46 million tonnes imported in the same period of the previous year. Thailand’s imports for January to October totalled 2.24 million tonnes, up 34% from the previous year with Saudi Arabia sourced imports up 37% to 924,000 tonnes. Malaysia exported 1.388 million tonnes in the January to September period versus 1.394 million tonnes the year before.

Sellers Face Phosphate Price Stalemate in India

On the phosphate side, Indian buyers are refusing to budge on price with bids not exceeding USD 595/tonne CFR levels. With subsidies cut by 31% for the Rabi season starting on October 1, Indian buyers are looking for prices around USD 100/tonne CFR lower than before. As a result of this, DAP producers are now looking elsewhere for sales.

Saudi Arabian producer Ma’aden is reported to have sold more than 100,000 tonnes of DAP to Australia. Russian DAP is finding its way to Vietnam and Thailand.

China is absent from the market but there are reportedly about 400,000 tonnes of DAP/MAP sitting in Chinese ports export cleared. Despite the export ban, these volumes may find a way to be exported in the next few months. But China’s absence means the processed phosphate industry will be tight on products in the next few months and we can expect prices to increase.

Exports of DAP from China through October 2023 reached 4.053 million tonnes – significantly higher than the 3.125 million tonnes exported the year before. MAP exports were 1.695 million tonnes, roughly flat on the 1.613 million tonnes exported the year before.

MAP prices in Brazil remain flat in the range of USD 560-565/tonne CFR which is substantially less than the average peak in January to February price of USD 658/tonne CFR.

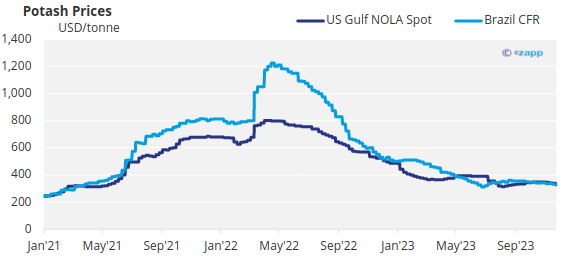

Bleak Outlook for Saturated Potash Market

The potash market is bearish with too much product chasing weak demand in major markets. Prices of granular MOP in Brazil are expected to fall in the next few weeks, although they are holding for now in the USD 330-335/tonne CFR range.

Similarly, in Southeast Asia, standard MOP prices are stable at between USD 310/tonne CFR and USD 330/tonne CFR. At the same time last year, the price was in the range of USD 550-600/tonne CFR. The market is looking for price guidance in India, which is expected to agree to a contract price between USD 310-320/tonne CFR.

China imported 9.273 million tonnes of MOP during the January to October period, up 38% from the year before. Malaysia’s MOP imports for the January to September period were 969,111 tonnes, down 12% from the year before. Russia’s share of imports increased 155% to 327,926 tonnes, while Canada dropped 46% to 315,604 tonnes.

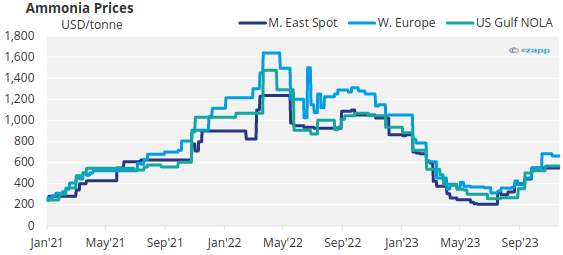

Ammonia Price on Downward Trend

This week, the December contract price settlement of the Mosaic-Yara contract saw a rollover of the current price of USD 625/tonne CFR.

The other big development is an apparent price drop with the Middle East ammonia price assessment this week down USD 30/tonne to a range of USD 480-510/tonne FOB. The global ammonia price is expected to fall in the coming weeks on the back of increased supplies and lull in industrial demand as the year comes to a close.

The European TTF month ahead gas price clocked in at the equivalent of USD 13.33MMBtu, which represents an ammonia production cost of USD 500/tonne before emission costs and a urea production cost of USD 370/tonne. It remains to be seen if this price will prompt European production to resume.

Morocco imported 1.059 million tonnes of ammonia in the January to September period, down from 1.370 million tonnes in the same period of the year before.