Insight Focus

Urea prices remain weak amid low demand, but Q1 2025 may see a rebound. Potential export restrictions from China are creating uncertainty in the DAP/MAP market, while ammonia prices reached their highest levels since December 2023 after the December Tampa settlement increase.

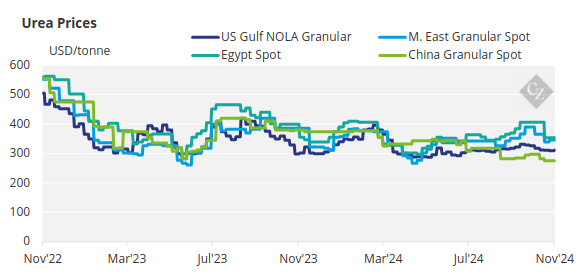

Urea Market Faces Low Demand

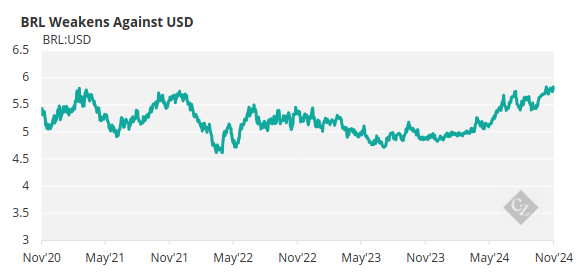

The urea market price is still bearish with lack of demand in major markets. Brazil urea bids were sub-USD 330/tonne CFR for non-sanctioned urea compared with offers of USD 330/tonne CFR. The exchange rate is not helping, as the Brazilian real reached nearly BRL 6 against the greenback.

Source: St Louis Fed

Buyers in Turkey and Romania stepped in and secured tonnes sub-USD 370/tonne CFR duty paid either to be sourced from the Black Sea or Egypt. Bids from Turkey for Iranian tonnes were much more aggressive reflecting USD 280-285/tonne FOB which would equate to USD 335-340/tonne CFR duty paid, a number that still sits quite a way below seller expectations.

Iranian producers are said to be sitting with more than 350,000 tonnes of inventory that needs to be moved. It remains to be seen if other buyers in Europe will view purchasing for December as an opportunity as Q1 2025 prices could be much higher on the back of an anticipated strong return to the market by the US.

Amid talk of traders liquidating positions from Egypt as low as USD 350/tonne FOB, sales were reported at USD 355/tonne FOB, although confirmation from producers was not forthcoming. MOPCO, however, contrary to market sentiment, secured the sale of 5,000 tonnes at USD 360/tonne CFR for December shipment. Buyers in Europe have generally been pitching for much lower numbers of USD 340/tonne FOB or lower in some cases.

High gas prices continue to underpin this market in Europe and the risk of it falling much below USD 340/tonne FOB today seems unlikely. Middle East producers are busy fulfilling contracts in India and US NOLA is on Thanksgiving holidays. The imminent outlook for the urea market is bearish but with some expectations that Q1 2025 will bring some enthusiasm and thereby increased prices.

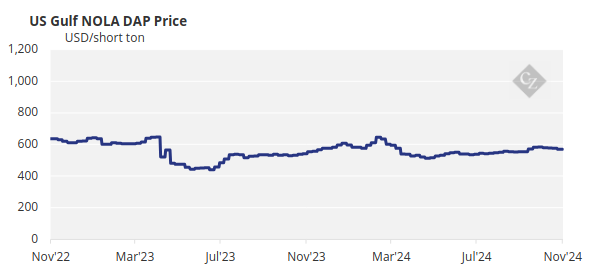

China Halts DAP/MAP Exports

On the processed phosphate side, the big news emerging at the end of the week is of the Chinese government playing hide and seek with the international market. According to unconfirmed news circulating, the government will stop issuing export clearance of DAP/MAP as of December 1 with resumption only in April 2025.

As reported in the grapevine, the NDRC and the China Phosphate and Compound Fertilizer Industry Association (CPFIA) have approached producers to hold discussions. One of the reasons for the halt in exports is the significant increase in sulphur prices, which has pushed up the production cost of processed phosphates. Sulphur prices account for around 30% of total process phosphate costs.

Apparently, producers can load December shipments provided they have cargoes and obtained CIQ approvals. If the controls follow the pattern set out last year, then previously concluded cargoes will be allowed to secure CIQ clearance. This means that the cargoes already agreed for December/January loading to markets like Brazil and Australia will still be given the go ahead, and DAP awards in the recent Ethiopia tender (which run right through until April 2025) should also be given clearance.

In 2023, despite the November 9 halt, 1.1-1.2 million tonnes of DAP/MAP still moved from China between mid-November 2023 and mid-January 2024 before exports effectively dried up until April 2024. Time will tell what will happen.

Mexico and Canada could be hit hard on exports with President-elect Donald Trump having announced a 25% tariff on all imports once he resumes office on January 25, 2025. Chinese imports will be hit with an additional 10% over and above current import tariffs rates. The US market imported 190,000 tonnes of DAP/MAP between January-September this year with the total expected to reach 240,000 tonnes by the end of the 2024 calendar year.

Although the Mexican shipments of DAP/MAP to the US account for only 8% of imports, it includes 22% of US MAP imports and would add to the list of issues forcing US farmers to pay premium prices even despite an expected slump in demand due to weak affordability.

India is reported to have bought two cargoes of Russian DAP at USD 636/tonne CFR. No demand has emerged in Pakistan this week following reported two purchases last week at around USD 635/tonne CFR. US NOLA should be slow this week due to Thanksgiving celebrations.

MAP prices for sales to Brazil remained unchanged at USD 635/tonne CFR amid a persistent lack of liquidity. Sellers continued to resist pressure for declines despite a lack of demand as buyers focused on alternative products at more favourable prices. The price has been unchanged since mid-July.

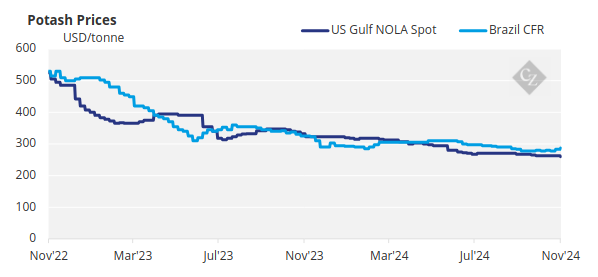

Potash Prices Rise on Demand

Bullish sentiment is set to remain, exerting pressure on global potash markets and driving spot prices higher in Brazil, Southeast Asia and China this week. Brazilian spot MOP prices rose USD 5/tonne CFR to an average of USD 290/tonne CFR after four weeks of stagnation. Prompt sales in the region remained limited, with most looking ahead to the season in Q1.

Offers have increased to USD 290-310/tonne CFR for Q1 sales. Still, offers are limited to only a handful of producers. Southeast Asian standard potash prices increased USD 8/tonne at the high end of the range to an average of USD 295/tonne CFR. Prices have climbed back to their highest levels since April on the back of favourable affordability and demand expectations in Q1.

Chinese importers have signed the cross-border contract for white standard MOP at USD 270/tonne CFR delivered at port by rail with Russia’s Uralkali for December shipment. This is up by USD 12/tonne from the previous month. Annual seaborn contracts from regular suppliers by vessels were settled in early July at USD 273/tonne CFR.

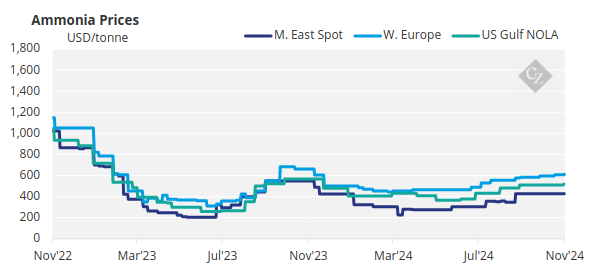

Ammonia Prices Steady Westward

On the ammonia side, fresh spot business was largely lacking this week as ammonia benchmarks began to ease in the East but continued to hold steady – for now – in the West following news of an increase at Tampa for December.

While some had mooted the possibility of a rollover or even a decrease for December, Yara and Mosaic instead agreed to a USD 10/tonne increase for shipments into Tampa, with the USD 570/tonne CFR monthly settlement equating to the highest levels since December 2023.

The outlook for prices in the East should continue to ease, with benchmarks west of Suez seemingly reaching their peak with December’s Tampa settlement.