Insight Focus

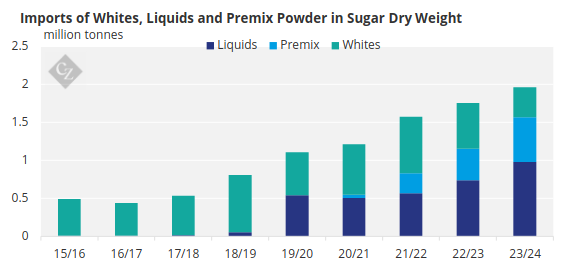

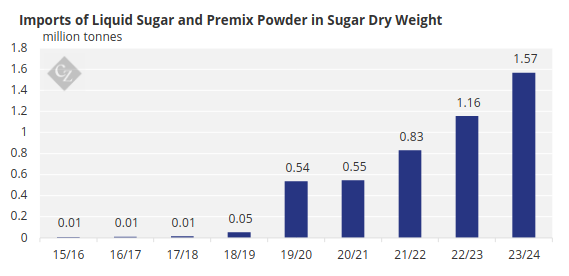

The 2024/25 Sugar Conference was held from 30 October to 2 November. An unchanged topic was to call for regulations on liquid sugar and premix powder imports, as it just hit record highs in 2023/24 season.

2023/24 Season Wraps Up with Record Imports

Imports of liquid sugar and premix powder closed at 1.57m tonnes dry weight in 2023/24 season, 0.4m tonnes higher than that in 22/23 season.

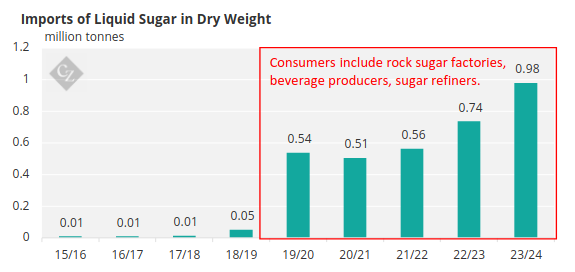

A sugar refiner said in the conference that refineries had no choice but to use liquid sugar as part of the raw material to produce refined sugar. As of today, China has a sugar refining capacity of 14m tonnes, and the operation rate was merely around 30%. And the rate dropped further to 25% in last 2 years due to negative AIL import parities.

Without regulations, the imports of liquid sugar should continue to grow from 1m tonnes in 23/24 season (1.5m tonnes in wet basis). But we don’t think any regulations will be in place soon. Almost all these imports came from Asean origins, under China-Asean Free Trade Agreement.

In 2023, the trade volume between China and ASEAN amounted to 6.41 trillion yuan (USD 911.7 billion), with both sides remaining each other’s largest trading partner for four consecutive years. And on October 10, 2024, the leaders of China and ASEAN countries announced the substantive conclusion of negotiations on the upgrade of version 3.0 of the China-Asean Free Trade Area.

Under such background, it may not be an opportune time to place regulations against Asean imports.

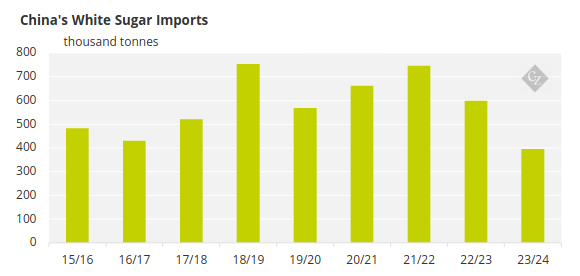

Meanwhile, nothing unexpected on the direct imports of white sugar. It totalled 400 thousand tonnes in 2023/24 season, 200 thousand tonnes lower year-on-year. And we expect the volume should be similar in 2024/25 season.

This brings the total imports of white sugar (products) to 2m tonnes, 0.2m tonnes higher than that in 2022/23 season. The volume could go up to 2.5m tonnes in 2024/25 season, with higher availability of Thailand sugar, and possibly higher demand from liquid sugar users.