Insight Focus

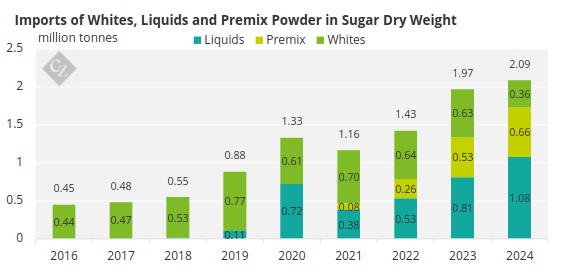

China imported 2 million tonnes of world market white sugar in 2024. The ban on Thai liquid sugar & premix imports, imposed on December 10th, remains in place.

Thai Government Has Moved to Address the Liquid Sugar/Premix Ban

On December 10, 2024, Chinese Customs issued a letter to suspend the import of Thai liquid sugar and premix powder to China. Early this month Thailand said it’s working on a solution.

Thailand also said that China had requested an inspection of 78 sugar mills in Thailand before the start of the talks and that the inspection was in progress.

We don’t know how long it will take but the hint seems to be that the ban may not be permanent. But we also suspect that with the tighter regulation, the previous loophole of importing Brazilian or Indian white sugar into syrups and premixes for export to China is no longer feasible.

2024 Finalised with Record Imports

Importers also appear to have received a reprieve in December. We heard that despite the ban starting on December 10, shipments shipped before that date (despite not arriving before the ban date) were still allowed to clear customs.

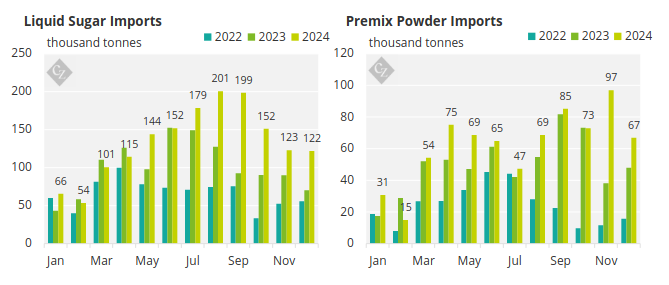

This may explain the high imports in December. The imports of liquid sugar and premix powder in 2024 have also been officially fixed at 1.6 million tonnes and 747 thousand tonnes, respectively.

Despite this, the Thai industry told the media that the value of the liquid sugar and premix powder stranded on afloat vessels reached about 400 million baht (≈11.76 million US dollars).

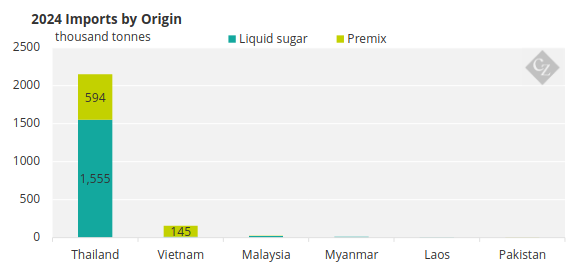

Thailand and Vietnam dominate the supplies. Although Vietnam’s manufacturers are rumoured to be under scrutiny as well. But so far, the registration information of Vietnamese manufacturers in customs still shows that it is valid, rather than suspended.

China’s 2025 Tariff Adjustment Plan

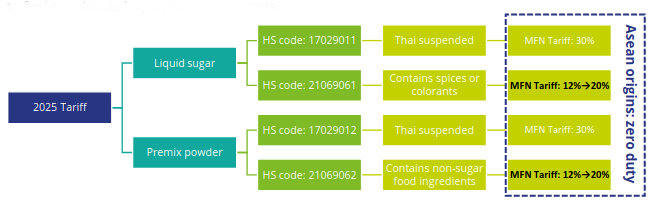

In December, the Tariff Commission of The State Council of China issued the 2025 Tariff Adjustment Plan. Some people got excited by the increase in the most-favored-nation (MFN) tax rate for two sugar-related tax codes (21069061,21069062 – sugar syrups containing added flavouring or colouring matter used as raw material for alcoholic beverages) from 12% to 20%.

My interpretation is different. Because the tariff agreement with ASEAN is still in effect, zero tariffs still apply for those countries. The real limitation of these two products is that they contain non-sugar ingredients, which limits the audience. However, we do not doubt that some importers may make efforts to find or cultivate buyers for new products.

In 2024, China’s demand for white sugar in the world market (directly or indirectly) reached 2.09 million tonnes. In the New Year, these needs may be shifted to demand for raw sugar, but this depends on the resolution of the ban.

However, both officials and importers are already gearing up for the Chinese Luna New Year holiday. Any further news will have to wait for the return after the Spring Festival, which is in mid-February. I wish you all a happy Chinese Luna New Year and I will see you after the holiday.