Opinion Focus

- Chinese state-owned company participates in railway construction in Brazil for the first time.

- The goal is to improve food export routes.

- China also invests in the ports of Santos and Paranaguá.

The city of Ilhéus, in Bahia, was the scene of an unprecedented ceremony in July. A group of representatives from the Brazilian government and an important Chinese state-owned company laid the cornerstone of the West East Integration Railway (Fiol). The event was attended by President Luiz Inácio Lula da Silva, who posed for photos alongside executives from China Railway, one of the largest civil construction companies in the world, in charge of the works on the initial section of the railway, in Bahia.

Railway construction. Credit: iStock

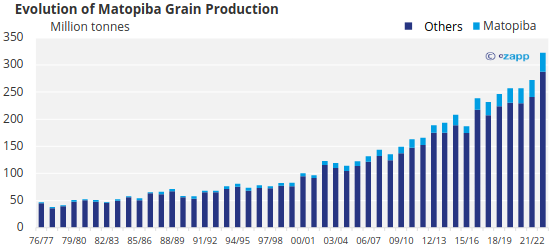

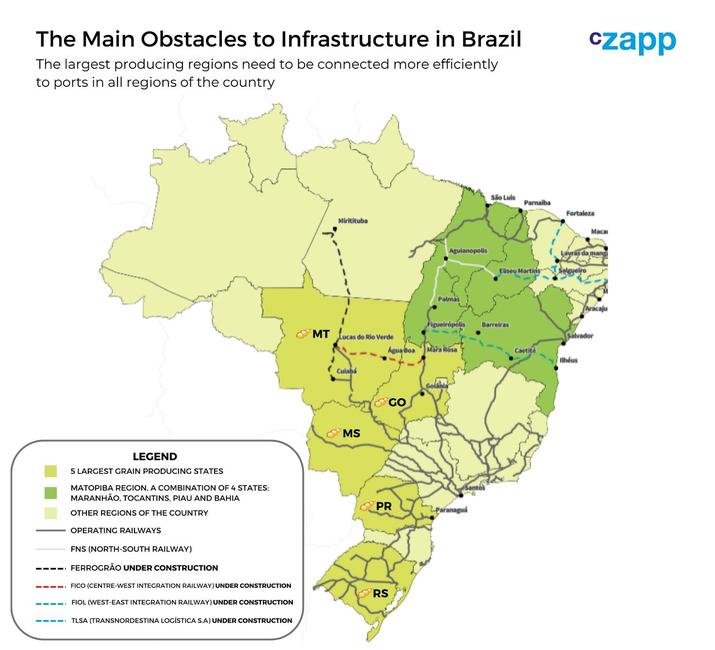

It is easy to understand the importance of the new railway network, which should be inaugurated in 2027. Fiol should facilitate the flow of grains produced in the region known as Matopiba (which includes Maranhão, Tocantins, Piauí and Bahia), the new Brazilian agricultural frontier. The railway will connect Figueirópolis, in Tocantins, to Ilhéus, where a port terminal should be built. The objective is to facilitate the flow of agricultural production in the region, which is undergoing major expansion.

Source: Conab

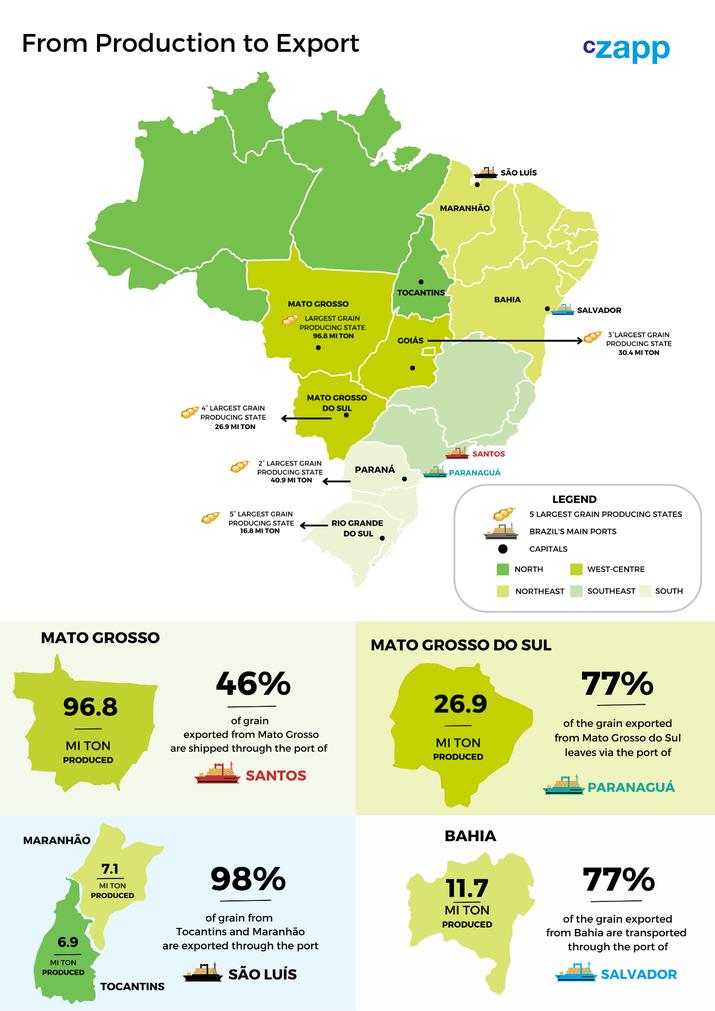

Matopiba is expected to produce around 35.2 million tonnes of grains in the 2022/2023 season, which represents an increase of 12% compared to the previous cycle, and is expected to grow 27% over the next ten years. Across Brazil, grain production is expected to reach almost 400 million tonnes in 2032, 23% more than this year. This level of growth isn’t just of interest to Brazil.

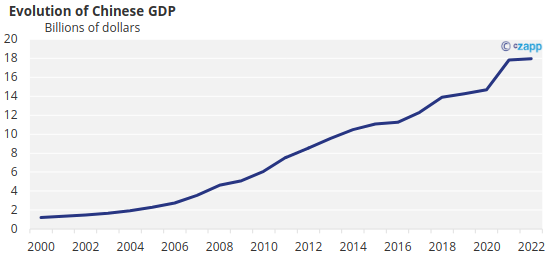

Source: Federal Reserve (FRED) St. Louis

The largest country in the world, with 1.4 billion inhabitants, China has plenty of reasons to keep an eye on Brazilian export logistics, on which it depends heavily. China’s economic growth, averaging 6.3% per year over the last decade, has driven the expansion of the Chinese middle class and the greater need for food imports, something that is expected to persist in the medium and long term.

In this scenario, food security has been an important point of attention for the Chinese government. Since Xi Jinping’s rise to power in 2013, the topic has gained even more importance. In April this year, the Chinese government announced a new subsidy program worth around USD 1.46 billion for grain producers, after offering almost USD 5 billion to farmers last year. One of the objectives is to boost soybean production, an essential food for livestock.

But, even if the increase in commodity production reaches 80% in the next ten years, as the Chinese government hopes, rising from 20.3 million tonnes to 36.7 million, China will still have to import a lot of grain, in addition of other foods. Today, the country buys 80% of all the soy it consumes on the foreign market.

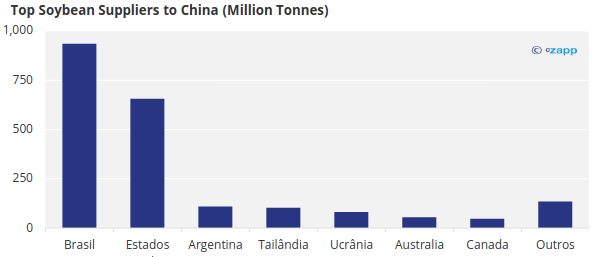

Around 44% of the grains that China imports come from Brazil (30% are produced in the United States). In relation to sugar and meat, this dependence is even greater. Around 90% of all sugar imported by China is produced in Brazil, in addition to 60% of meat.

In this context, China’s interest in Brazilian transport logistics is natural. After all, while agricultural production is going from strength to strength in Brazil, with record harvests, logistics infrastructure continues to be the Achilles heel of Brazilian agribusiness. “In a context of food security, it makes perfect sense for China to invest in improving Brazilian infrastructure in order to facilitate the export of goods”, says economist Hsia Sheng, professor of international finance at Fundação Getúlio Vargas. In other words, there is no point in just counting on Brazil as a major food producer. It is necessary to ensure that food crosses the ocean with increasing efficiency and predictability.

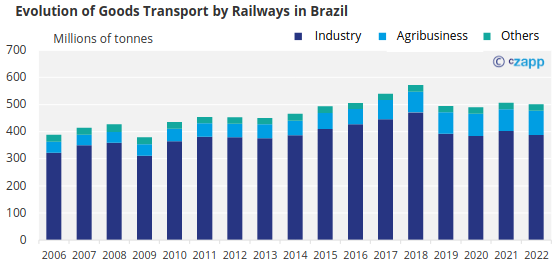

Source: ANTT

Today, Brazilian agricultural production is mainly transported via roads, responsible for transporting around 85% of food, according to the National Transport Confederation (CNT). Often, traveling on highways is a difficult task. Only 14% of the Brazilian road network is paved.

And 67% of roads, including paved ones, are in poor or fair condition, with deficiencies such as holes in the roadway and lack of shoulders, according to a survey by the National Transport Agency (CNT). This results in an increase in operating costs of around 33%, with expenses such as vehicle maintenance and greater diesel consumption per kilometer driven.

With Fiol, which attracted the attention of China, and other railway networks expected to come into operation in the coming years, there should be a reduction in costs and a gain in predictability when cargo arrives at ports. “The cost savings of rail transport are at least 5% and can reach 30% depending on the section and volume transported”, calculates Thiago Guilherme Pêra, coordinator of the ESALQ-LOG Group at the University of São Paulo.

The interconnection of different modes of transport, such as rail and port, also represents a competitive advantage. Not surprisingly, China is involved in construction at the port of Ilhéus (and not just the railway), seen as a new route for transporting Matopiba ‘s agricultural production.

the increase in agricultural production, ports have been experiencing increasing congestion. In August this year, for example, 8 million tonnes of grains and sugar arrived at the port of Santos, which has an operational capacity for just around 7 million tonnes. As a result, there was congestion of ships and delays in shipments. Soybeans had to wait 18 days to be shipped, 7 days longer than in the last five crops.

In this context, improvements in ports are essential. Although without fanfare, China has been actively participating in this process. Last year, COFCO, a Chinese multinational with more than 11 thousand employees and offices in 37 countries, won the auction to build the STS 11 terminal at Santos, committing to investments of around BRL 764 million. One of the main objectives is to increase operational capacity from 3 million to 14 million tonnes. Work began in August this year and the first phase should be completed in 2025.

China’s interest in the port of Paranaguá, in Paraná, the second largest in the country, is even older. China Merchants Group, a Chinese logistics and port operations company, acquired 90% of the container terminal at the port of Paranaguá for around USD 925 million in 2017.

The operation, which represented China Merchants’ first investment in Latin America, made it possible to increase the terminal’s operational capacity from 1.5 million TEUs (unit equivalent to a 20-foot container) to more than 2.4 million TEUs per year. “Brazil is one of China’s most important strategic partners and a trade counterpart in Latin America. The transaction serves to achieve our commercial objectives and strengthen strategic cooperation between Brazil and China”, said Hu Jianhua, vice president of China Merchants, at the time.

Another important port for Brazilian agribusiness exports has caught the attention of China. The port of Itaqui, in Maranhão is one of the strategic points of the new Silk Road, a Chinese logistics project that aims to expand international trade, although there are still no concrete projects.

Today, around 15% of the grains exported by Brazil are transported through the port of Itaqui, which is gaining importance – in 2022, 33.6 million tonnes of cargo were handled, with soybeans and corn accounting for 18 million tonnes, 8% more than in 2021.

The expectation is that Beijing’s investment scope will increase. Representatives of the Chinese government have held meetings in Brasília, with the Ministry of Transport and other federal bodies, and with governors. In August, for example, executives from China Railway met with the governor of Paraná, Carlos Massa Ratinho Júnior, to discuss projects such as Nova Ferroeste, which should connect Guarapuava (Paraná) to Dourados (Mato Grosso do Sul). For now, these are preliminary conversations. But given China’s interest in infrastructure projects related to food transportation, the future could be promising.