Insight Focus

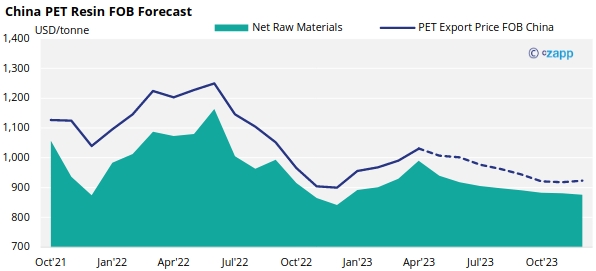

- Crude and raw material prices retreat from their April highs, PET resin prices also soften.

- PX/PTA tightness expected to ease through May, futures indicating downward trend in pricing.

- PET resin export margins far below typical seasonal levels, to remain constrained by H2 additions.

Overview

- PET resin export prices continue to cool going into May following the recent sharp decline in oil prices and easing of PX/PTA supply tightness.

- Current daily prices averaged USD 1005/tonne last Friday with forward prices discussed at the lower level of USD 1000/tonne, representing a decrease of around USD 35/tonne over the last fortnight.

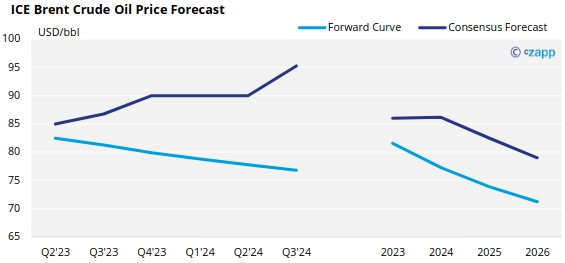

- Crude oil prices have slumped due to ongoing concerns around global demand and the fragility of the US economy, despite better-than-expected Chinese economic growth for the first quarter of the year.

- Oil price forecasts from major banks and market analysts are also at odds with one another.

- Goldman Sachs and Energy Aspects have turned more bullish after the shock OPEC+ announcement with Goldman Sachs raising its Brent Crude forecast to $95/bbl from $90/bbl at the end of the year.

- Others, including Morgan Stanley decided to interpret the cuts as an admission of weakness in projected crude demand, slashing its forecast for Brent’s 2024 average to $85/bbl from $95/bbl.

- In its latest April Short-Term Energy Outlook, the EIA also struck a bearish tone, forecasting the global oil market to remain in surplus this year and next, with a $85/bbl average in 2023.

- The current consensus among market analysts is for Brent crude oil prices to average close to $86/bbl in 2023 and in 2024, with price strengthening through H2’23.

PET Resin Export Price Outlook

- Whilst one major Chinese PET resin producer is sold out for export through May and June, most others have ample availability for prompt shipment in May. All are keen to see bids.

- Although domestic demand is reported to show continued improvement, export order intake is not coming through as expected.

- Overall, demand is unusually weak for peak buying season, an increasing concern for producers.

- Chinese export prices averaged around USD 1032/tonne in April, increasing USD 42/tonne on the previous month’s average of USD 991/tonne.

- Current projections are for China FOB prices to average USD 961/tonne in Q2’23; USD 941/tonne for H1’23; USD 967/tonne for full year 2023.

Market Drivers & Concluding Thoughts

- Crude oil price forecasts are anticipating price levels to range relatively rangebound over the next two quarters.

- However, a slower than anticipated Chinese recovery and fragile US economy may provide additional downside.

- Regarding PET raw materials, tightness in PTA supply is expected to ease through May and into June, as turnaround season ends and the market faces new oversupply, reflected in the steep backwardation of the current raw materials forward curve.

- The PET resin raw material forward curve currently shows the main Sep’23 contract trading at a USD 57/tonne discount to the current month, indicating lower forward costs for PET producers.

- Despite peak season upon us, the PET resin physical differential continues to shrink, with spot margins at 5-year lows and far below typical seasonal levels.

- Although new PET capacity additions are expected to face delays, with indications that some projects are to be pushed but 2-3 months, most are still expected to come-one stream H2’23.

- As such, H2’23 and the off-season may see export competition intensify and margins further eroded.

- The EU Antidumping Notice of Initiation against Chinese PET resin, published 30 March, is also already impacting European demand for Chinese PET resin, albeit it a relatively small proportion of total Chinese PET resin exports.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.