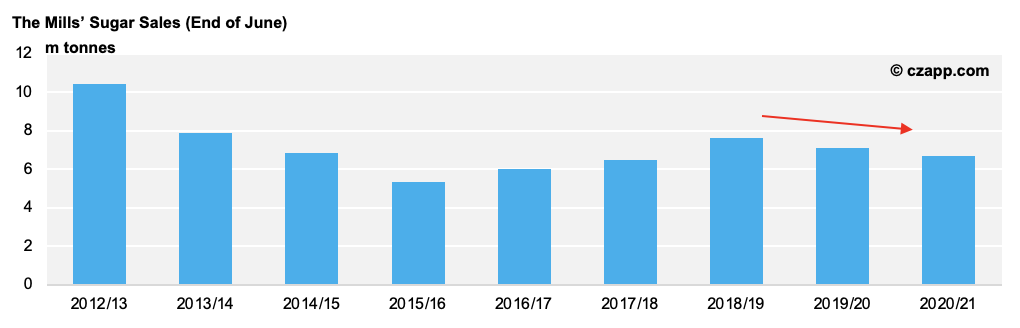

- China’s sugar mills have struggled to make sales this season.

- They had 653k tonnes of white sugar in stock at the end of June.

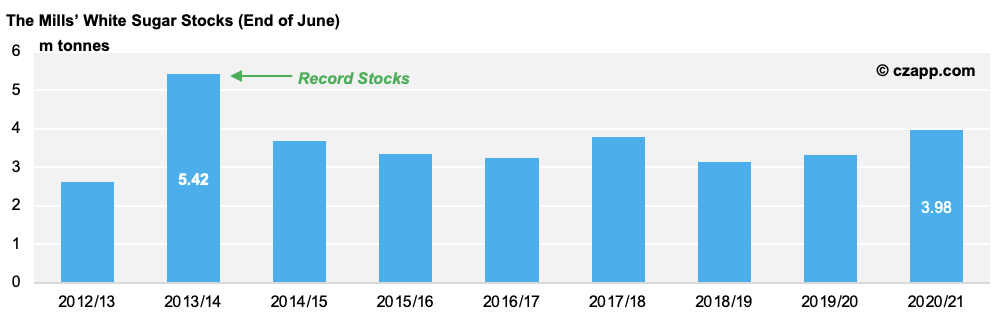

- With this, China’s stocks were at their second highest level since 2013/14.

Second Highest White Sugar Stocks On Record

- China’s white sugar stocks are the largest they’ve been since 2013/14, when it produced a record amount of sugar (13.3mmt).

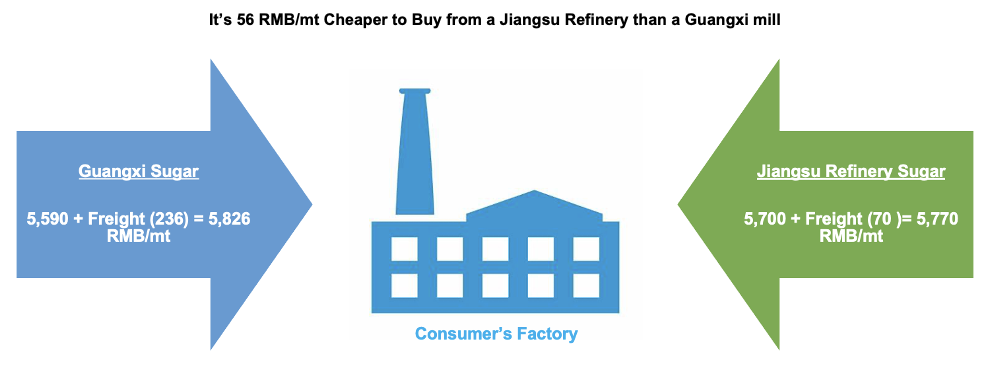

- The mills have struggled to make sales this season, with many consumers buying directly from the refineries, due to the increased freight costs from Guangxi.

- The Ministry of Commerce (MOC) delayed the issuance of import quotas/licenses to refineries until late April, in hope that the mills could shift their sugar.

- The majority of the refineries only use imported raws to produce refined sugar, whilst the mills use cane or beet to produce white sugar; the two are in competition with one another.

- The delay was supposed to protect domestic sugar industry by ensuring the mills were the main supplier before they started crushing in June.

- This wasn’t the case, though, as the mills were unwilling to make discounted sales.

- They’ve sold around 6.7m tonnes of sugar to date, down 402k tonnes year-on-year.

What Does This Mean for China?

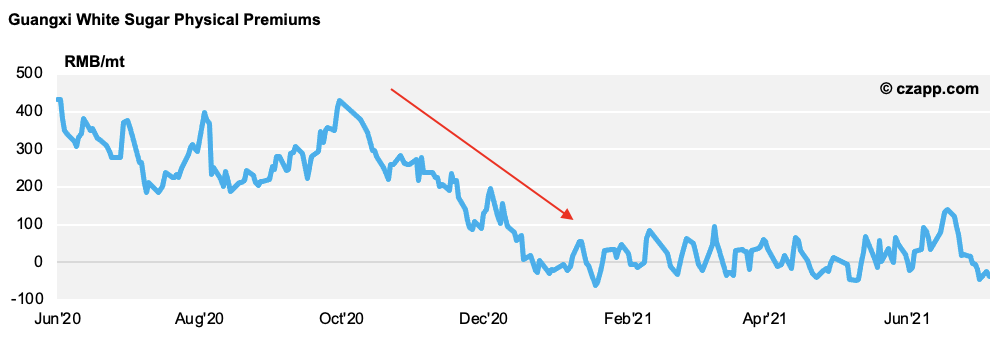

- High stocks meant physical premiums fell from 429 RMB/mt to 0 in the first three months of 2020/21.

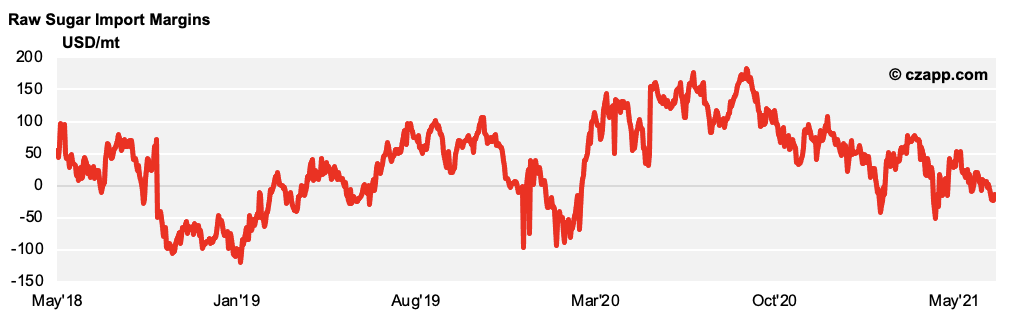

- They also suppressed ZCE white sugar futures, which in turn weakened the raw sugar import margin.

- With this, the refineries won’t likely import raw sugar until import margins are in positive territory.

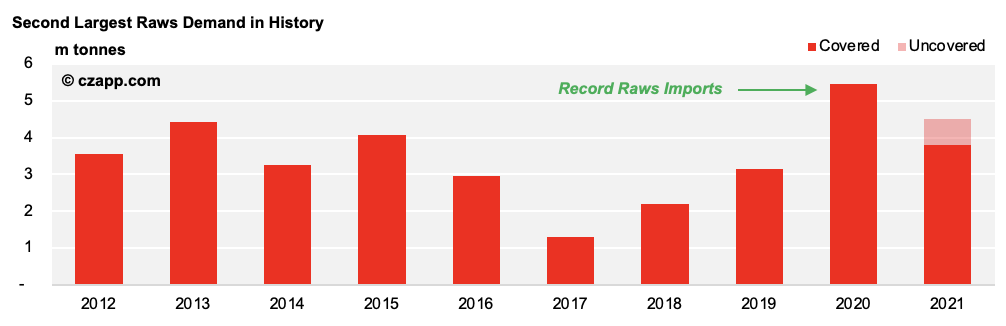

- They currently have less than 1m tonnes of demand left to cover (out of their yearly 4.5mmt demand).

- We still think they’ll try to fully utilise their Automatic Import Licenses this year, but if imports remain unviable, they could hold off until the last minute.

- If the No.11 moves towards the bottom of the range (16-17c), China should still import 4.5m tonnes of raws, marking its second-largest year of imports on record (after 2020).

Other Opinions You Might Be Interested In…

Explainers You Might Be Interested In…