Insight Focus

- China’s demand for corn as feed grain should hold strong in 2022 on high domestic wheat prices.

- It could import more US corn to plug Ukrainian supply gap.

- High international soybean prices could curtail China’s imports this year.

Chinese Corn Demand to Remain Strong in 2022

Russia’s invasion of Ukraine has severely disrupted Black Sea grains exports, pushing China to find alternatives to Ukrainian corn this year to meet its growing feed demand.

China’s demand for corn as feed grain should hold strong in 2022, following the country’s high utilisation rate of now more expensive wheat and rice as a replacement for corn last year.

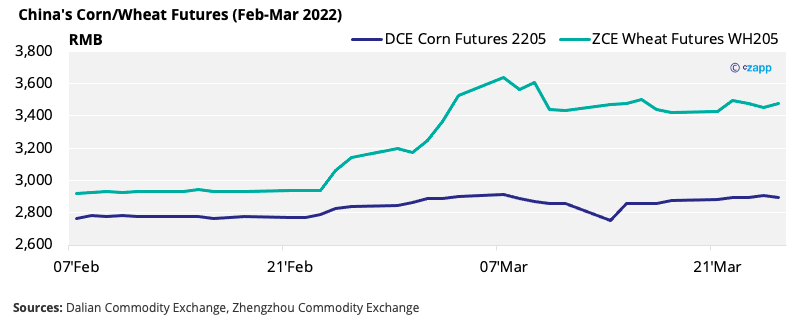

As Russian and Ukraine are major wheat producers, supply disruption has pushed global prices higher. The high-quality strong gluten wheat May 2022 contract (WH205) traded on the Zhengzhou Commodity Exchange (ZCE) surged to a record high at 3627 RMB/tonne ($569.72) on the 7th March. WH is equivalent to the international benchmark high-quality wheat.

Corn futures traded on Dalian Commodity Exchange (DCE) have remained relatively stable compared to wheat, below 3,000 RMB/tonne.

Ukraine’s Corn Export Suspension Hits China’s Supply

China is the world’s largest corn importer. It imported 28.35m tonnes in 2021, up 152% on the year. 70% of this came from the US, with a further 26% coming from Ukraine.

Most of China’s imported corn is used as animal feed. With China continuing to re-establish its pig herd following the African Swine Fever epidemic, the country’s feed demand should stay strong in the coming year.

In addition, China is the world’s largest feed-grade amino acid producer in the world. Amino acids are the building blocks of protein and key animal feed additives. They are manufactured by fermenting corn, which should further support Chinese corn demand.

Ukraine harvested a record 42m tonnes of corn last year, but exports were halted when Russia invaded Ukraine on the 24th February. As a result, only 18m tonnes were exported before the war, the Ukrainian Agribusiness Club (UCAB) said.

Prior to Russia’s invasion, Ukrainian corn was exported via Black Sea ports. Ukrainian ports will remain closed and commercial shipping will be suspended until the end of the Russian invasion, according to Ukraine’s Maritime Administration.

On the 19th March, UCAB said it had resumed some exports of corn via railroads across Ukraine’s western border, but the exports are limited by volume and would only be delivered to Europe.

“The surplus of corn is huge. Export through ports blocked. Establishing overland export routes across Ukraine’s western borders can provide up to 600k tonnes per month. Of course, this is only 10-15% of the capacity we had through seaports,” said Roman Slastyon, director of UCAB.

Prior to the war, Rabobank put Ukraine’s corn exports to China at 8m tonnes for 2022, but the actual volume will likely fall significantly below expectations with most Ukrainian export outlets shut.

Furthermore, Ukrainian corn plantings should be delayed in 2022/23. Planting would normally begin in April, but the war is disrupting farming.

According to USDA’s projection in March, Ukraine’s corn production could fall to 41.9m tonnes in 2021/22, down 0.24% from the previous forecast.

US Corn Could Fill the Gap

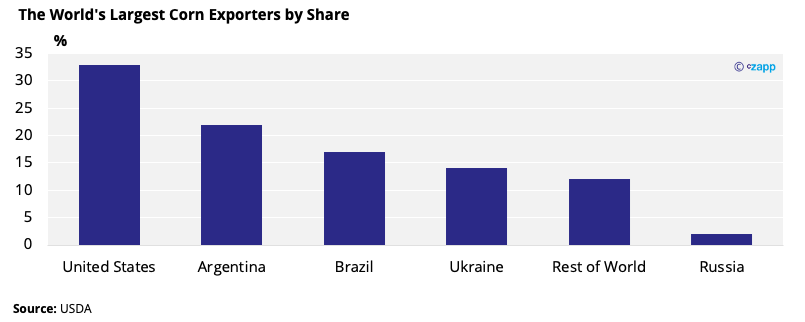

With no end in sight to the conflict and Ukrainian corn exports to China unlikely to resume in the short term, Rabobank’s Shanghai-based grains and oilseeds analyst, Lief Chiang, said in a February podcast that China could purchase more corn from the US to plug the shortfall left by Ukraine.

The USDA also said the US could bridge the supply gap as its corn production had increased over the past year. The US corn harvest increased to 383.9m tonnes in 2021/22, up 7% year on year, USDA data showed.

“Currently, U.S. supplies appear ample to fill unexpected import demand surges,” said USDA in its March report on world supply and demand.

High Soybean Prices Could Cap Chinese Imports in 2022

Chiang said high soybean prices could curtail China’s import volume in 2022. Imports in February and March could be lower because of “demand rationing”.

Soybean is crushed to make soymeal. Its high protein content means it’s an important component of animal feed.

According to Rabobank’s forecast, Chinese soybean imports in 2022 could stay flat or fall from the previous year as farmers reduced the inclusion rate of soybean meal to cut costs.

In 2021, China imported 96.52m tonnes of soybeans, down 4% year on year, China custom data showed. In 2020, imports hit a record high, surpassing 1b tonnes for the first time.

The May 2022 soybean contract traded on the Chicago Mercantile Exchange (CME) settled at 17.10 USD/bushel on the 25th March, at nearly 10-year highs. The last time soybean futures breached $17 was in September 2012.

The reduction of soybean meal in animal feed means protein content will be lower. However, the shortfall in soybean meal can be countered by increasing corn-fermented amino acids, which are key supplements in animal feed.

Other Insights That May Be of Interest…

EU Ups Grains Production as Ukraine Outlook Worsens

Brazilian Soybean Plantings to Hold Firm Despite Fertiliser Limitations

Russian Invasion Deals Another Blow to Oilseed Supply

Explainers That May Be of Interest…