467 words / 2 minute reading time

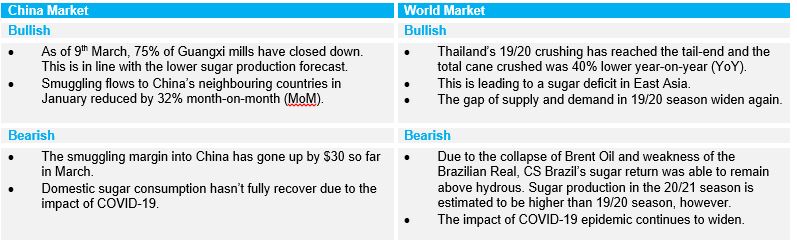

- The No.11 raws price fell below 13c/lb on Monday, due to the structural market collapse caused by COVID-19.

- The ZCE white sugar price fell by 2.57% on the day as well, but spot prices remained firm.

- This is due to the reduction in 19/20 sugar production and smuggling flows in as well.

Market News

Physical and Futures Prices

- The No.11 raw sugar price fell to 12.61c/lb on Monday, which was 1.2c/lb lower than the previous week; this is an 8.7% drop.

- The domestic ZCE white sugar price also fell sharply to 5580 yuan/mt, down 145 yuan/ton from the previous week; this is a 2.5% drop.

- The price range for Guangxi Grade One sugar was between 5750-5820 yuan/mt and Kunming quoted at 5680 yuan/mt.

- The firm spot price pushed up the physical premium from 100 yuan/mt to 199 yuan/mt.

Domestic Production and Sales

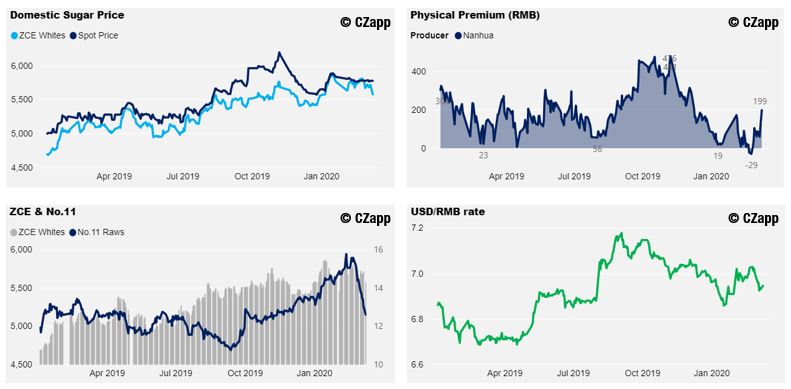

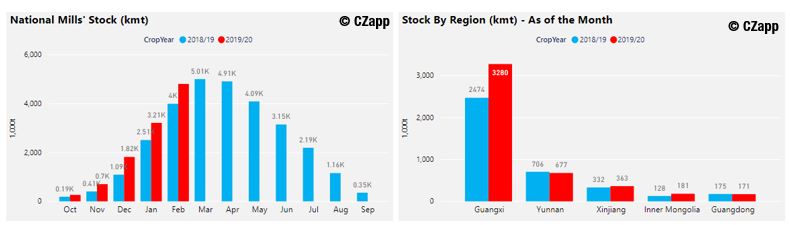

- As of the end of February, national factory sugar stock were at 4.8m tonnes, up 800k tonnes YoY.

- 88% of the stocks were cane sugar, located in the southern China.

- But sugar mills are not in a hurry to cut prices due to the good sales performance.

- National factory sales by Feb’20 were 640k tonnes higher YoY, even though 19/20 sugar production was estimated to be 500k tonnes lower than last season.

- However, the demand for sugar has slowed down due to the impact of the coronavirus.

- The recovery of consumption will still be crucial to the sugar price as well.

Smuggling Update

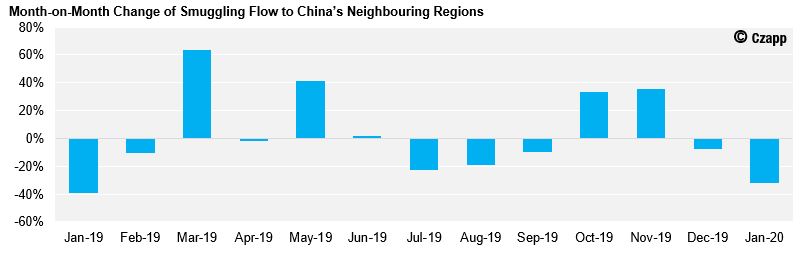

- The white sugar flows into China’s neighbouring regions reduced by 32% in January from December.

- We think February and March flow will remain slow, considering the impact of COVID-19.

- Current smuggling margins picked up to $230 per tonnes in light of the weak No.5 white sugar price.