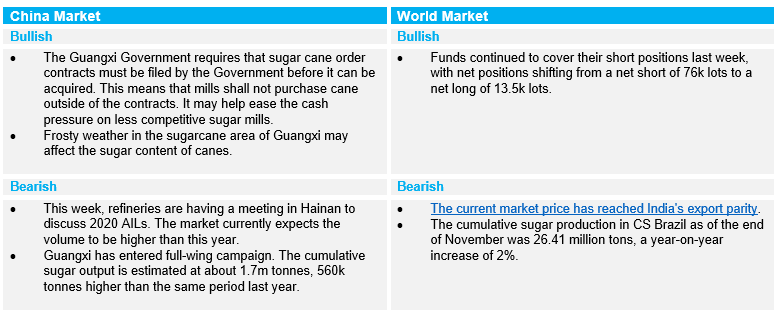

- Domestic sugar production is expected to reach a six-year high as the 19/20 crushing season comes to an end.

- The demand for sugarcane payment will increase the pressure on sugar mills.

- This may prompt sugar companies to sell at a discount.

Market Update

19/20 Season Supply & Demand

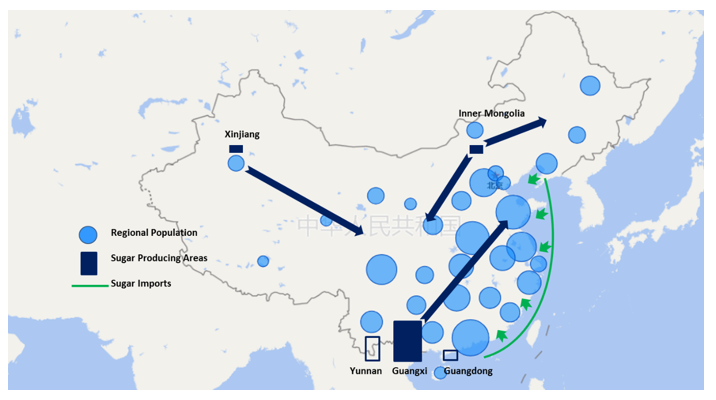

- Guangxi has reached a production peak already in December 2019. Guangxi is expected to produce over 1.3m tonnes of sugar by the end of December, becoming the main supply source.

- Beet sugar production is near the end. Most sugar mills have made good sales and the supply pressure in the northern parts of China is relatively small.

- Although raw sugar imports from November to December remained high, they were mainly put into bonded warehouses and waiting for customs clearance next year. The actual supply of tolled whites is modest.

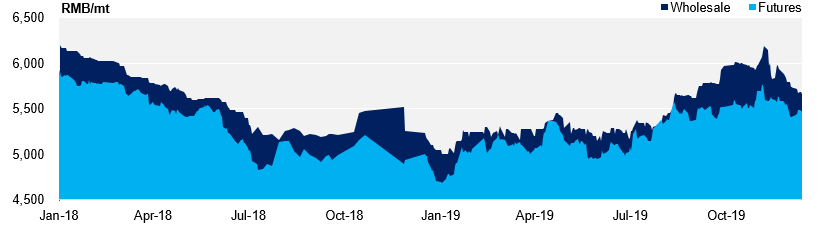

Sugar Prices

- Affected by increasing supply and pressure on demand for sugarcane payments, sugar mills are more willing to sell and spot prices continue to fall.

- The ZCE price fluctuated in a narrow range last week, and the spot premium against ZCE main contracts has fallen to the 150-yuan level.

- The current demand is weak and some sales areas are still digesting former stocks. The market is waiting for the start of the Chinese New Year stocking demand in 2H December.

Guangxi Sugar Wholesale Price & Futures Price

ZCE & ICE Futures Price

19/20 Crop Progress

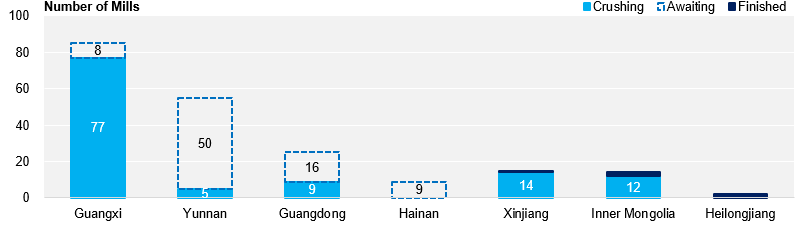

- Currently, there are 91 cane sugar mills in operation, 77 of which are in Guangxi, and nine in Guangdong.

- Guangdong is entering the full-wing campaign this week.

- Beet crushing is coming to an end: Inner Mongolia has finished 75% of the crushing and Xinjiang finished 85%.

Crushing Mills in Operation