425 words / 2 minute reading time

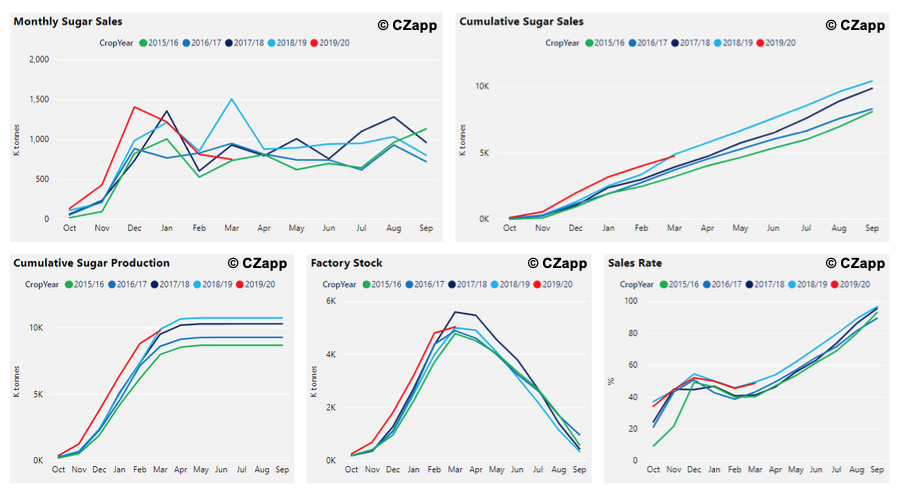

- China Sugar Association (CSA) released their March production and sales data today; our 19/20 sugar production forecast has since been amended 10.m tonnes, 100k tonnes lower than previous estimate and 660k tonnes lower year-on-year.

- Guangxi mills’ sales data in March hit a record low due to the impact COVID-19 has had on sugar consumption.

- Key factors to consider in April include sales performance and the refineries’ sales pace.

Market News

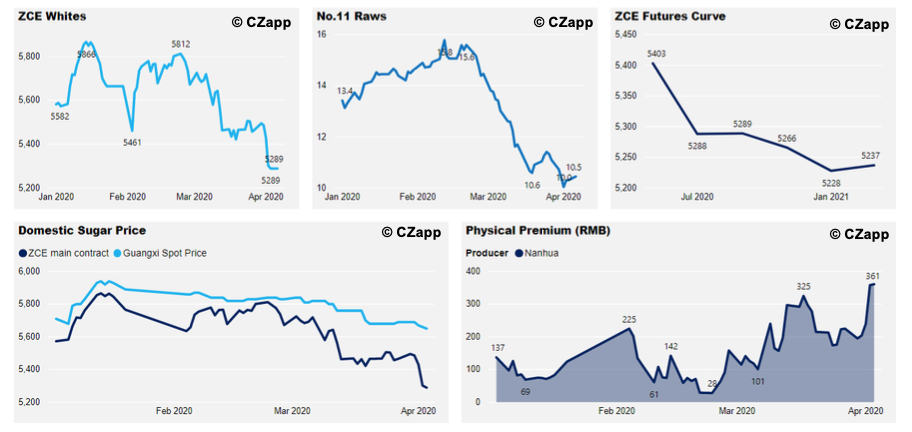

Physical & Futures Prices

- Last Friday, the No.11 raws settled at 10.31c/lb, down 7.1% from the previous week.

- Last Friday, the ZCE main contract settled at 5289 yuan/mt, down 3.22% from the previous week.

- The average price of Guangxi was 5605 yuan/mt, down by 44 yuan/mt from the previous week; the physical premium rose to 317 yuan/mt.

Sugar Production & Sales By March 2020

- As of the end of March, only 38 mills remained crushing and we think sugar production could be around 300k tonnes.

- This brings total sugar production to 10.1m tonnes, 660k tonnes lower year-on-year.

- Factory sugar sales in March totalled 752.3k tonnes; 50% lower than same period of last season. However, the high sales of last year were partly due to the reduced VAT policy. Still, the sales were the lowest they had been for the past 10 years, except for the 15/16 season.

- We think the COVID-19 pandemic caused the poor sales performance, due to its impact on sugar consumption.

- And we think this impact could continue to affect sales in April…