- China is the world’s largest consumer and producer of PET resin.

- Energy curbs are impacting provinces that contain 6.9m tonnes of PET capacity.

- Restrictions on PET resin production may limit supply levels in the short-term.

China’s Energy Crisis and Supply Gap

- Fuel shortages and record thermal coal prices have caused China’s electricity generation to plummet.

- The country is experiencing power cuts, crippling industrial output in key regions.

- A swift rebound in industrial output post-COVID means China’s coal producers are unable to satisfy surging demand, whilst imports have fallen by 10% in 2021.

- Compounding the situation, China plans to become carbon neutral by 2060 with a targeted reduction in electricity consumption.

Transitioning to a New Industrial Era

- China’s entering a new industrial era that’ll move the country beyond an economy that’s driven by energy and carbon intensive industries, to one that embraces an accelerated energy transition.

- China’s latest five-year plan (2021-2025) focuses on prioritising the quality of growth and includes several longer-term goals for 2035 and beyond.

- Among these goals is the lofty ambition to become carbon neutral by 2060.

- To achieve this, China must quickly embark on an ambitious multi-decade structural transformation of its entire economy.

- Whilst China continues to scale up its clean power generation, most electricity consumed is generated by coal power stations, the largest source of CO2emissions.

- Whilst 2060 seems far beyond the horizon, next year’s Winter Olympics in Beijing are firmly in view.

- With China wanting to avoid images of smog engulfed cities, planners launched the Blue Skies initiative, which has been increasing efforts to reduce air pollution in parts of north China, close to where the Winter Olympics will be held.

- Rail transport will be favoured over road, and output caps on highly polluting and energy intensive industries are being targeted.

- As a result, industrial operations now find themselves in the crossfire, with China’s National Development and Reform Commission (NDRC), China’s top economic planner, capping regional energy consumption and energy intensity.

- Success in transforming China’s energy and industrial sectors will not come overnight; progress will be measured over decades rather than months.

- According to China’s National Energy Administration, the country’s energy consumption grew by 16.2% in H1’21, versus the same period of the previous year.

- Industrial power use was the main contributor to the industry, with the use of coal for electricity generation up 10.7% on the previous year.

- These increases run counter to China’s aims to cut coal use to 56% of total energy consumption this year, down from 57%, while lifting electricity consumption to 28% from 27%.

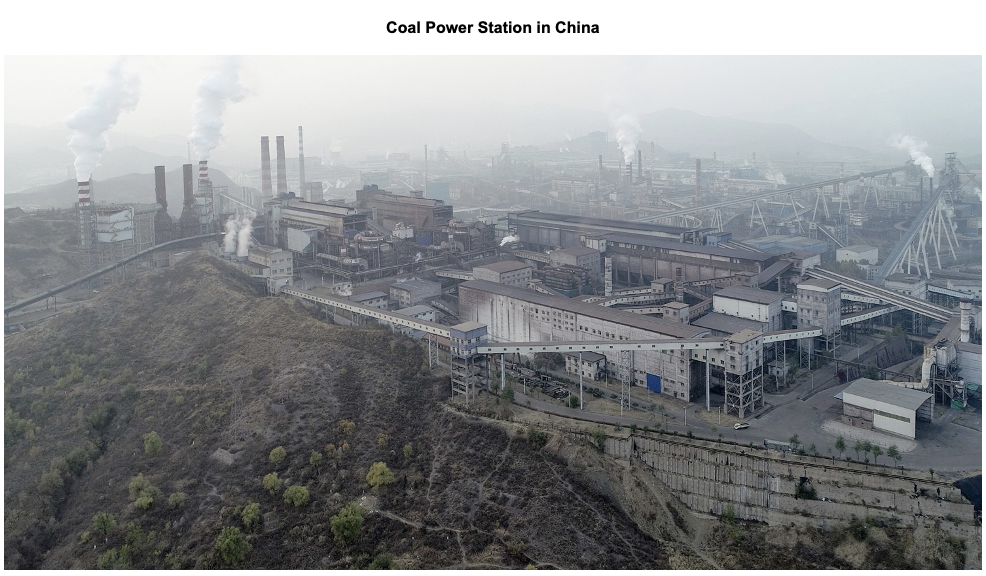

China’s Provinces Are Failing to Meet Energy Targets

- According to the NDRC, two-thirds of China’s provinces and territories are failing to meet energy targets, with nine regions, including Guangdong, Guangxi, Yunnan, and Jiangsu, increasing their energy consumption on an annual basis in the first half of the year.

- The worst offenders were the eastern provinces of Qinghai, Ningxia, Guangxi, Guangdong, Fujian, Yunnan, and Jiangsu, which received red ratings for both consumption and intensity targets.

- Xinjiang and Shaanxi provinces received red ratings for these intensity targets and yellow for their consumption.

- Eleven other regions fell short of at least one target.

- Underperforming regions started to apply power rationing in September as an energy consumption control measure to tackle the immediate crisis and meet climate goals.

Energy Curbs Have Direct Impact on Petrochemicals

- Companies in fertiliser, basic chemical materials, coal processing and ferroalloy sectors in regions with energy intensity above industrial average levels have recently been asked to curtail production.

- The NDRC has also stopped reviewing proposals in those regions for new high energy consuming projects that don’t have the support of the National Government for the rest of the year.

- China’s Central Government is also considering increasing industrial power prices to reduce consumption and ease the immediate energy supply crunch.

- PET producers have reduced operating rates as a direct result of curbs, with rates falling to intra-year lows within certain provinces.

- If energy rationing continues, China’s energy crisis has the potential to impact around 6.9m tonnes of PET resin production, with over half of China’s PET capacity located within regions that have received red ratings for both consumption and intensity targets.

Market Outlook

- China is the world’s largest consumer and producer of PET resin.

- The country’s current energy situation and future environmental goals will therefore have an immediate and potentially lasting impact on global PET markets.

- With Beijing now ordering industrials to secure energy at any cost, the most severe energy rationing within China is expected to be short-lived, although some curbs on industrial output and electricity consumption may remain in Northern provinces, especially with the 2022 Winter Olympics on the horizon.

- China’s removal of an energy price cap is likely to create a global bidding war on energy, compounding the current energy crisis in Europe and resulting in higher costs for PET producers.

- · In the longer term, China faces an economic slowdown, which has in part been exacerbated by its planned rapid energy transition; this will slow future global demand growth for PET resin.

Other Opinions You Might Be Interested In…

Explainers You Might Be Interested In…