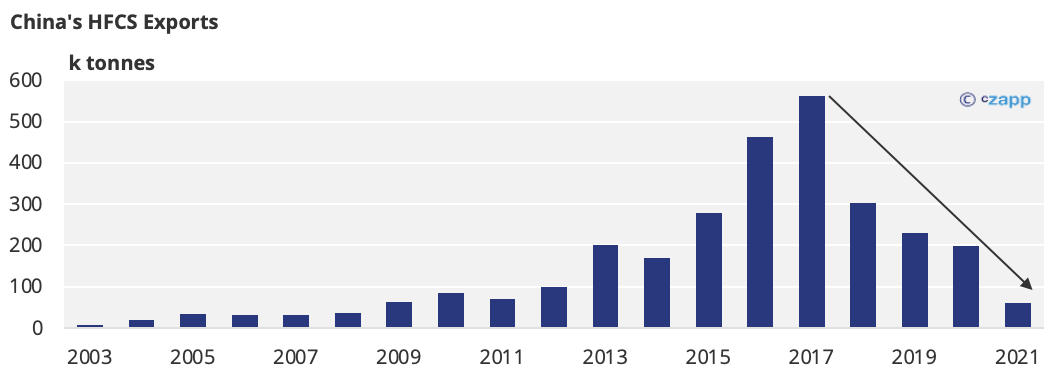

- China’s HFCS exports could hit a 13-year low this year.

- This is because Vietnam implemented anti-dumping duties on Chinese HFCS.

- These duties have since been removed, so flows should rebound in 2022.

China’s HFCS Exports Hit a 13-Year Low

- We think China’s High Fructose Corn Syrup (HFCS) exports will hit a 13-year low in 2021 (60kmt).

- This is largely because Vietnam, the main buyer, implemented anti-dumping duties on the product in June last year.

- Rallying corn prices have also made HFCS more expensive for importers.

- China’s corn price rallied from 1,800 RMB/mt to over 2,800 RMB/mt in 2020.

- With this, China’s HFCS price jumped to 3,650 RMB/mt in Jan’21, up 950 RMB/mt year-on-year.

- The average FOB for HFCS climbed alongside this, from 369 USD/mt in 2020 to 587 USD/mt.

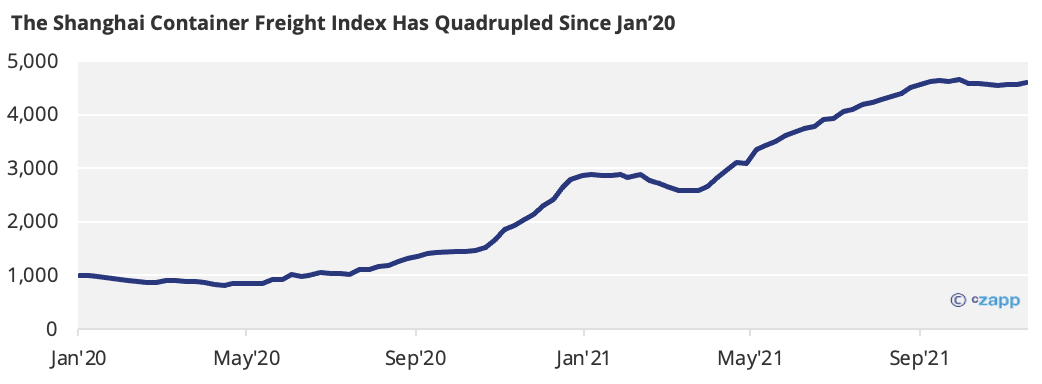

- Freight’s rally has not helped, with import costs heavily impacted by any movement here.

- China therefore exported just 51k tonnes of HFCS between January and October this year, down 134k tonnes year-on-year.

What Does the Future Hold for China’s HFCS Exports?

- Vietnam should import around 100k tonnes of Chinese HFCS next year.

- Its Ministry of Industry and Trade terminated the anti-dumping investigation in October, as the adjudicators didn’t believe strong HFCS imports were harming the sugar industry.

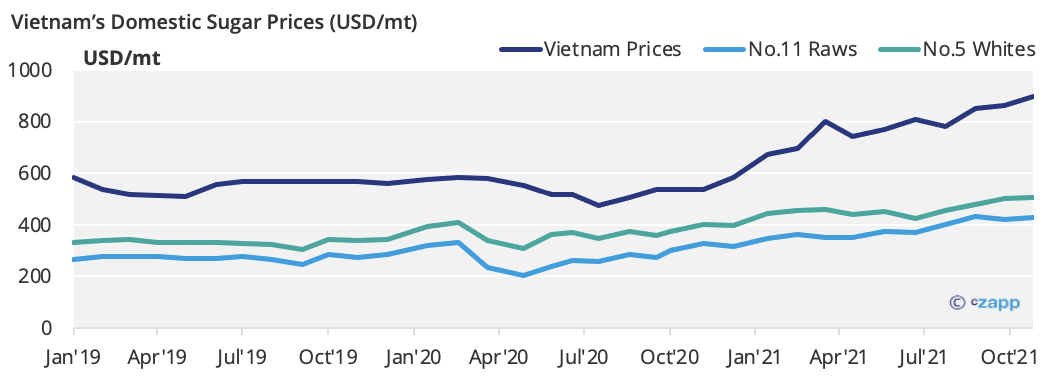

- Its sugar prices are also at a nine-year high (911 USD/mt) as production could sit 900k tonnes below consumption in 2021/22.

- This means it’s 108 USD/mt cheaper for Vietnamese industrials to buy Chinese HFCS than it is to buy domestic sugar.

- They would have previously turned to Thailand for cheaper sugar, but the Government has now placed heavy duties on Thai sugar, which could be in place for at least five years.

- Tight border control through COVID also means smuggling from Cambodia is not an option.

Other Insights That May Be of Interest…

Vietnam Keeps Anti-Dumping Duties on Thai Sugar

Explainers That May Be of Interest…