Opinions Focus

- China is including sugarcane in subsidized agricultural insurance cover to protect farmer incomes.

- China could produce 10.35m tonnes of sugar in the 2022-23 season.

- This means it would still need to import over 5m tonnes of sugar.

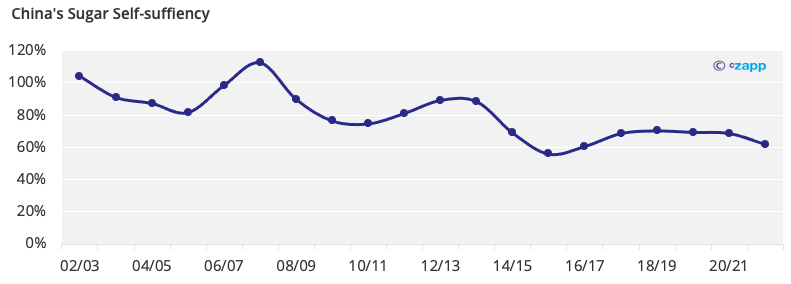

China Struggles on Sugar Self-sufficiency

- China produced around 9.7m tonnes of sugar in the 2021-22 season, 1m tonnes less than a year earlier.

- This equates to a self-sufficiency rate of 62%, in the bottom three of the past 20 seasons.

- China no longer seems to be aiming for sugar self-sufficient but to maintain sugar production at around 10m tonnes.

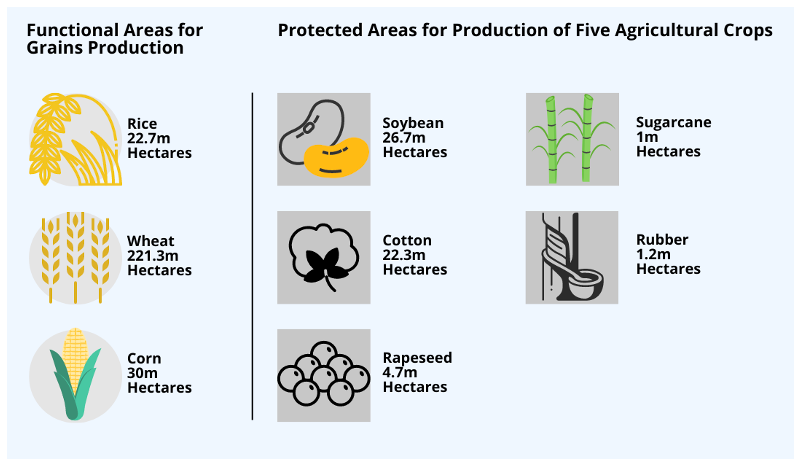

- China set the goal of dedicating advantageous areas to grains and important agricultural crops in 2017.

- This includes 1 million hectares of sugarcane in the Guangxi Autonomous Region (767k ha) and Yunnan Province (233k ha).

- However, some protected cane areas were being used to grow fruit and eucalyptus because of higher returns.

- China expanded the scope of its High Sucrose & Yield Cane Base to cover all protected cane areas in 2019.

- Guangxi has built up 336k ha of High Sucrose & Yield Cane Base, with an average sucrose content of 15.6% and an average cane yield of 103.35 tonnes/ha.

- Under ideal conditions the protected area can produce up to 13m tonnes of sugar, yet it only produced 8.1m tonnes this season.

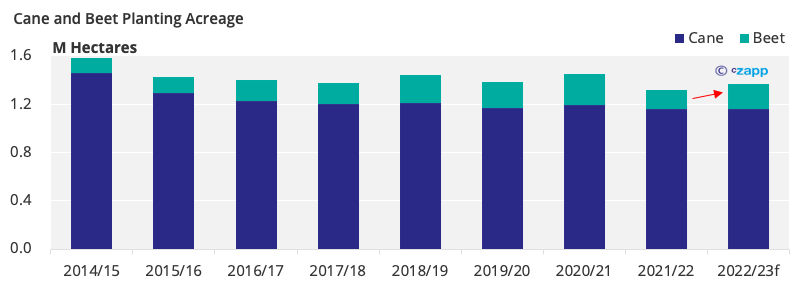

22/23 Crop to Recover with Record Beet Price

- Chinese 2022-23 sugar production could rebound 650k tonnes on the year to 10.35m tonnes.

- This is down to a recovery in the beet area due to a record high beet price and more favourable weather.

- Xinjiang, the second largest beet region, raised its beet price to RMB 560 (USD 83.69) from RMB 440/tonne for 2022-23.

- The cane area is expected to increase slightly in the 2022-23 season, which would already be a success.

- Guangxi government plans to boost sugar production by 5.0-5.5% in 2022-23, by removing areas of banana, eucalyptus, and fruit.

- However, this increase in the cane area was largely offset by losing land to rice and construction.

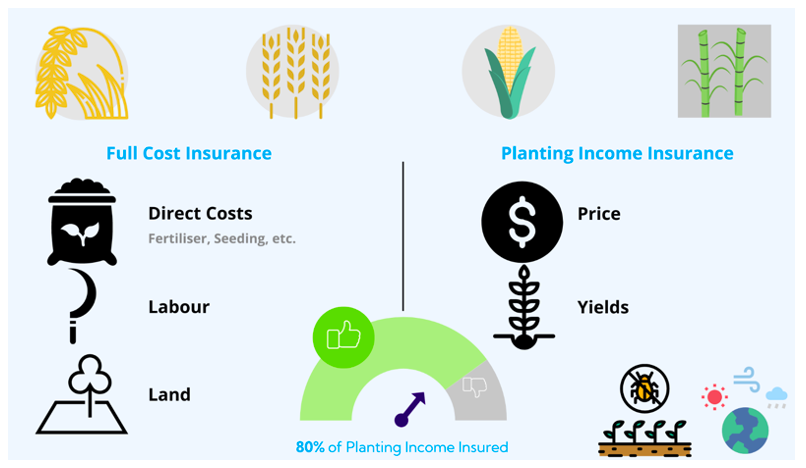

New Approach to Encourage Cane Planting

- China included sugarcane cost-in-full and income insurance coverage in 2022, along with three grain crops.

- It protects 80% of farmers’ income against natural disasters, pests, disease and price fluctuations.

- The central and provincial governments will pay 70% of the insurance cost.

- The rest will be shared between county governments and farmers.

- The new plan covers 3 times the value of previous direct cost and price insurance in 2020-21 and 2021-22.

Will It Work?

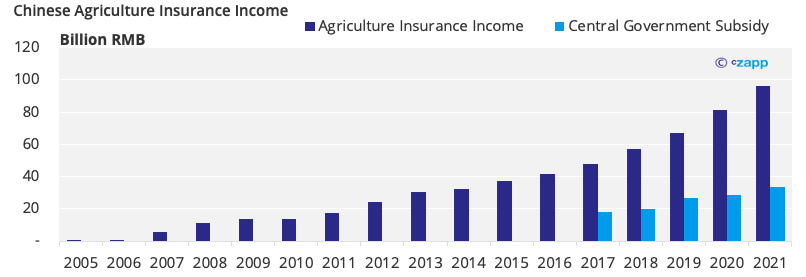

- The Chinese government is encouraging farmers to continue growing grains and cane by protecting their income through insurance and subsidies.

- The central government s spent RMB 231m on subsidising sugarcane insurance in Guangxi in 2021, 53% more than in 2020.

- It protected 591.2k farmers and increased farmer income by 7.7%.

- China also spent RMB 17.78b on the Guangxi sugar industry between 2016 and 2020.

- As a result, Guangxi’s cane acreage has remained around 760k ha between 2016-17 and 2021-22.

- Guangxi’s cane area shrank to 747k ha in 2016-17 from 865k in 2014-15.

Concluding Thoughts

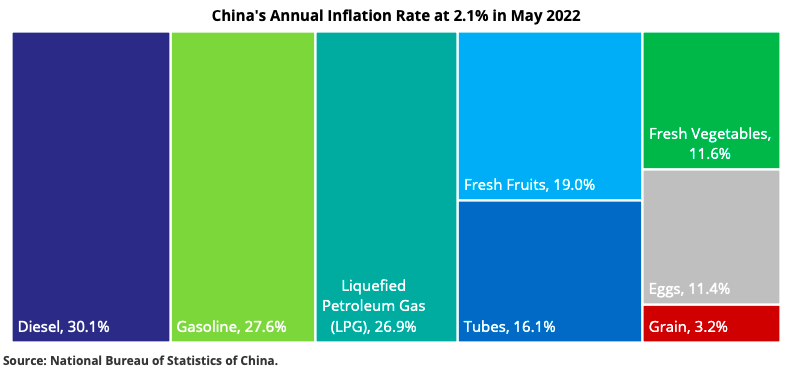

- China is using insurance and subsidies to encourage the planting of sugarcane and grains.

- The aim is to enhance food security and curb inflation with ample supply.

- We don’t expect a significant increase in sugarcane acreage despite all these government efforts.

- This means China’s sugar self-sufficiency rate could swing between 60% and 70%.

- China will need to import 4.7m-6.2m tonnes of sugar a year.

If you have any questions, please get in touch with us at Jack@czapp.com

Other Insights that may be of interest

What the Energy Crisis Means for Inflation & Commodities

What Is Fuelling Chinese Demand For Liquid Sugar?

Interactive Data Reports that may be of interest …

Consecana Panel

CS Brazil Weather Update