Insight Focus

- China’s premix imports could hit 400k tonnes in 2022.

- This flow might be depressing raw sugar import margins.

- New customs codes for pre-mixes may not act as a deterrent.

Following strong imports of liquid sugar and sugar blends from 2020, China’s sugar industry has been calling on the government to restrict this flow. They’ve asked for liquid sugar and premixes to be treated in the same way as sugar imports.

Last week, the General Administration of Customs (GAC) issued Order No. 78 of 2022, the Announcement of the Decision on the Classification of Commodities in 2022.

To the disappointment of the local industry, the order only further categorizes customs codes for some premixes; it doesn’t tighten import regulations.

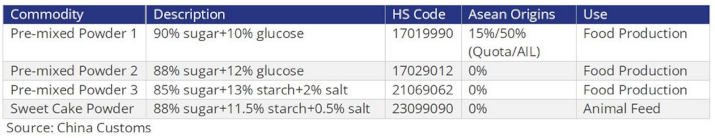

Premixes containing more than 90% sugar are now classified as white sugar under HS code 17019990. All other premixes are unchanged, which means imports from ASEAN are duty-free. Most pre-mix imports to China are below 90% sugar and so are unaffected by the rules.

Second Attempt: Industry’s First Attempt in 2021

It’s the domestic sugar industry’s second attempt to curb the import flow of pre-mixed powder and liquid sugar.

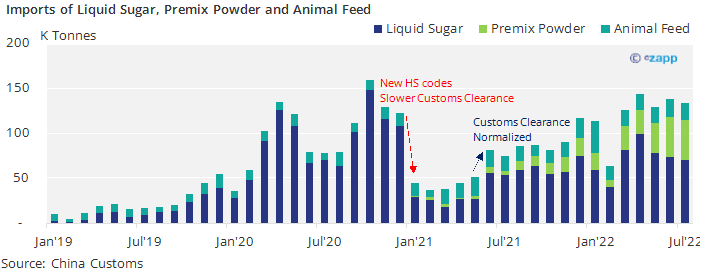

- Before 2021, imports of liquid sugar and pre-mixed powder were categorized as others.

- In response of sugar industry’s complaint of unknown sugar imports, GAC set new HS codes in 2021.

- And this legalised the imports of these products.

- The imports of premix powder between Jan and Jul 2022 were 8 times the volume in same time last year.

Onshoring of Premix Powder Production

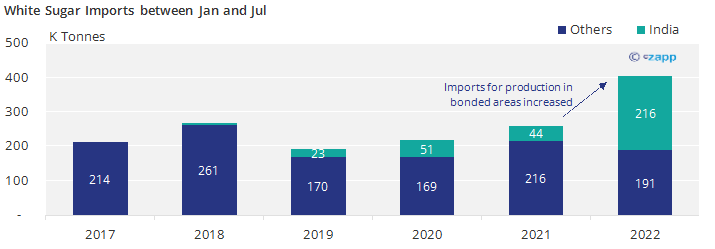

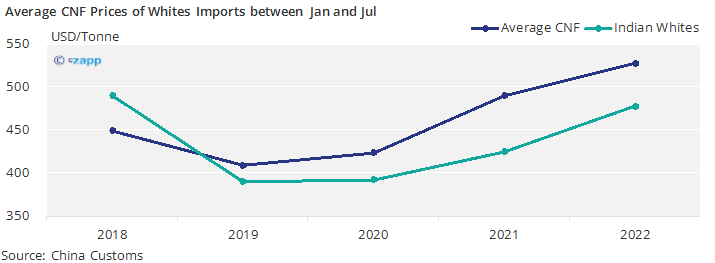

- The whites import in Jan-Jul’22 amounted to 406k tonnes, 146k tonnes higher than same time last year.

- The increment is probably for premix powder or liquid sugar production in bonded areas.

- We think India could be the main source for this flow.

- The record Indian crop in 21/22 makes cheap sugar sourcing viable.

Concluding Thoughts: Demand Switching Positions

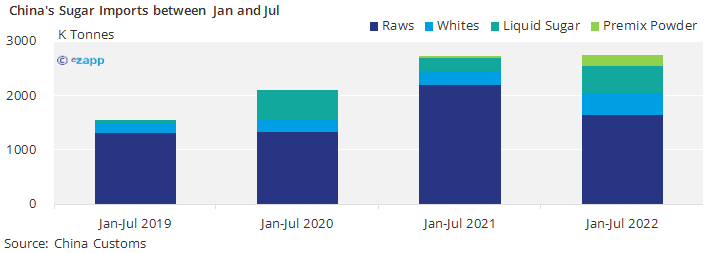

- Unlike what people think, Chinese sugar demand so far amounted to 2.6m tonnes, same as last year.

- The reduction of raws demand was compensated by the increase of whites, liquid sugar, and premix.

- The raws import parity could continue to be suppressed by the flow.

- On the contrary, If the order is a harbinger of government regulation on premix powder, those demands could shift back to raw sugar in the future.