Insight Focus

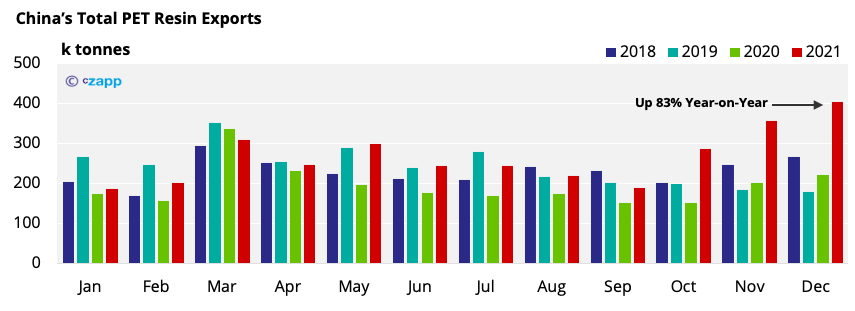

- China’s PET resin export orders hit record levels in Q4’21.

- However, logistical troubles have deepened in China.

- Can these orders be fulfilled alongside fresh port closures and COVID restrictions?

China’s PET Resin Export Orders Reach Record High

- China received around 1.1m tonnes of PET resin export orders in Q4’21, its highest quarterly figure on record.

- New orders surged between Sep-Oct 2021, prompting an uplift in shipments in the months that followed.

- Whilst order intake quietened through November, export orders surged once again in December, with an additional 380k tonnes booked.

- Continued shortages in overseas supply, coupled with the expected increase in ocean freight in 2022, has driven this new wave of demand.

- Buyers were also voicing a greater risk appetite for container shipments in the pre-Christmas period.

- Whilst January orders should be lower, many of the December orders will target post-Lunar New Year shipment.

Will Buyers Receive Such Large Volumes on Time?

- Many had hoped that global supply chains would start to normalise in 2022 as we move into a post-pandemic age of recovery.

- However, over the last month, logistical woes have worsened in China, challenging the reliability of shipping schedules once again.

- With China committing to a zero-COVID policy, even a single case being detected has led to severe restrictions that have impacted port operations and internal logistics.

- Most recently, we’ve seen restrictions and partial closures at several ports including Dalian, Ningbo, Shanghai, Tianjin, and Yantian.

- As Omicron continues to spread, further restrictions seem highly likely in the coming months, especially following heightened social mixing over the Lunar New Year.

- Even when ports remain open, COVID cases detected in surrounding areas are causing havoc with local, internal logistics.

- Restrictions placed on truckers and warehouses have led to disruption in the flow of goods to Tianjin and Ningbo.

- Zhejiang (Ningbo province) has placed severe restrictions on truckers entering and transiting through the province, which led to increased traffic at nearby ports including Shanghai.

- Yantian Port in Shenzhen has also suffered a knock-on effect of closures in other ports.

- An operator in Yantian stated that, on average, vessel schedules were delayed by 170 hours with just 20% of vessels arriving on time.

- However, COVID is just half the picture when it comes to port congestion in China.

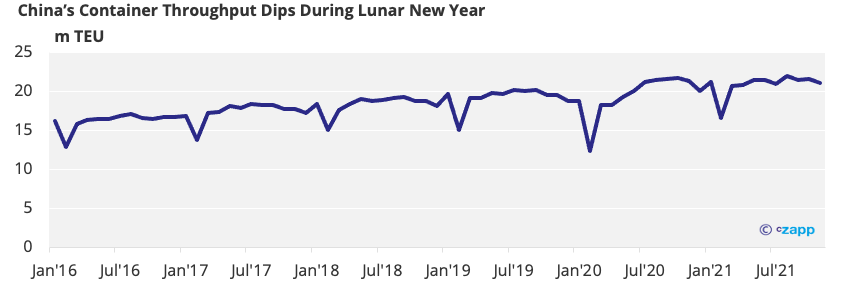

- Lunar New Year traditionally leads to a slump in Chinese exports and port activity.

- This Lunar New Year will likely have a particularly pronounced impact, as several Chinese shipping companies suspended work early to allow workers enough time to quarantine before heading home.

- As a result, supply chains face even greater backlogs following the Lunar New Year.

- Although Ningbo and Dalian have both reopened, it’s unlikely either will completely deal with their congestion before Lunar New Year closures.

Could This Impact PET Production in China?

- Whilst port disruption is seemingly widespread, the immediate impact on PET production is limited.

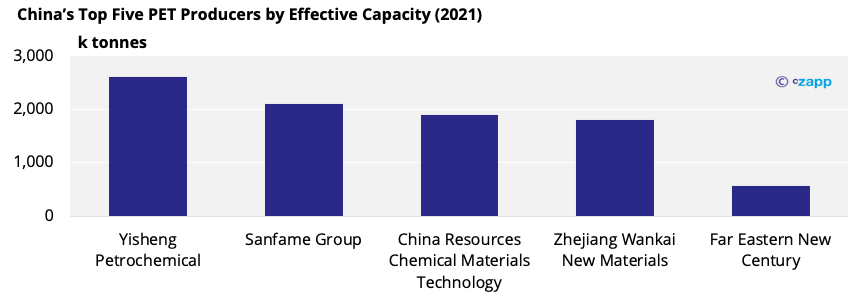

- Fortunately, most of the affected ports are not major terminals for PET resin exports.

- Major ports used for PET resin exports include Shanghai, Xiamen, Zhangjiagang, Zhapu, and Changzhou.

- However, congestion may nevertheless spread to other unaffected ports as shipping lines seek alternative options.

Market Outlook

- Although China’s major PET resin exporters have managed to avoid any direct impact relating to port closures, one of the biggest threats to delivery is the potential increased disruption to internal logistics following the Lunar New Year.

- With the Winter Olympics beginning on the 4th February, attempts to detect and contain COVID cases will intensify, with new restrictions expected, particularly in the Beijing area.

- Any increased quarantine restrictions could slow deliveries further.

- If further deterioration in logistics is avoided, exports may rise sharply again following the Lunar New Year, given the jump in order intake in December.

- Monthly exports of 250-300k tonnes could be achieved through Q2, despite the current issues.

Other Insights That May Be of Interest…

Europe’s PET Supply Worries Ease as Omicron Hits Consumer Demand

European PET Prices Jump with Supply Shortages

Chinese PET Exports Rebound Following Logistical Mayhem European PET Prices Jump with Supply Shortages