- The freight market usually quietens down in August, but not this year!

- A new wave of COVID cases in China is pushing freight higher.

- Port congestion is building, and freight rates are on for another record month.

Freight Market Rises with COVID Surge in China

In years gone by, the freight market has quietened down a little in August, but this doesn’t seem to be the case in 2021.

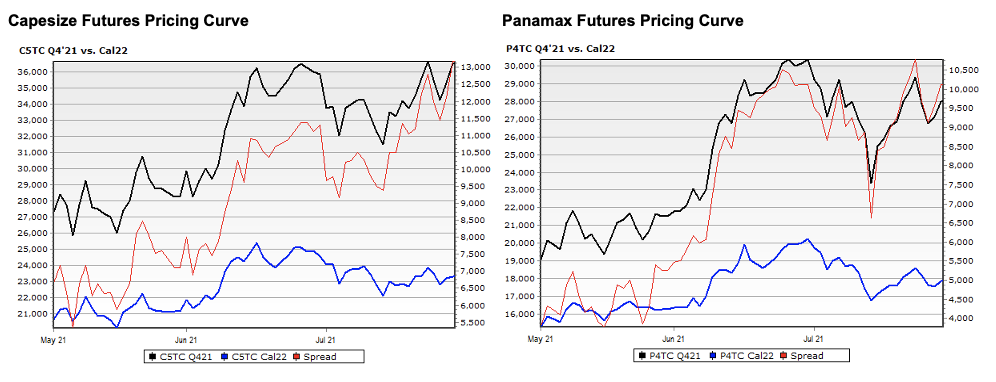

If the first two weeks is anything to go by, August will be another record month for freight rates. What’s more unusual is that freight is reaching new highs in the Forward Freight Agreement (FFA) market for the rest of 2021, and is a moving higher still in 2022.

The start of August saw the Baltic Freight Index (BDI) at 3,292 points, with yesterday’s close at 3,606, marking a new record for 2021.

The Panamax market, which started August at 28,358 USD/day closed at 30,917 USD/day yesterday. The Supramax market also jumped from 32,395 USD/day to 34,309 USD/mt in the same period.

However, the real action has been in 2022 sentiment, with the Panamax moving from $18,100 on 1st August to $20,350 in the 2022 FFA contract. The Supramax vessel class is also up from $17,125 to $20,600 for 2022.

These increases would create a very busy market, and to see these hikes in the 2022 forward market is quite phenomenal, especially in August. What the rest of the year will bring from here is anyone’s guess…

The reason for this strong upturn has been the seasonal shift in vessel demand from the Pacific Ocean to the Atlantic, as a wind down in the North Pacific grain activity and Australian grain season heads over to South America and the Black Sea. These longer voyages will drain the vessel supply and occupy the world dry bulk fleet on lenghtier sea legs.

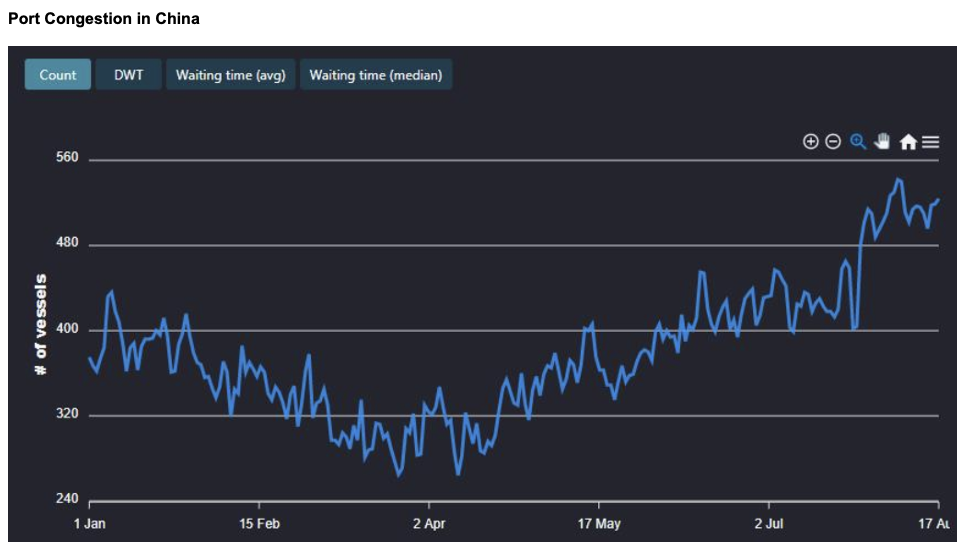

However, this seasonality is really only part of the story. The spread of the Delta variant in China has brought normal vessel operations in many of the China’s key ports to a halt. Suddenly, we’re dealing with mass vessel congestion in Chinese ports.

Over the past two weeks, the lines of dry bulk vessels anchored off Chinese ports have grown explosively due to congestion and new COVID restrictions. According to AIS data obtained by dry bulk operator Lauritzens Bulkers, 7.5% of the global fleet of smaller dry bulk vessels, including Handysize and Supramax segments, are currently anchored off Chinese ports.

We’ve previously expressed our outlook for a strong freight market for the balance of 2021 and 2022, based on healthy raw material demand versus vessel supply. However, this recent delta outbreak reminds us that disruption to normal operations at sea ports will only support freight rates as it disrupts and delays timely vessel and supply chain execution.

Quoting shipbroker Braemar ACM’s Research Head, Nick Ristic, “the dry market has been on a roll for the last six months, with rates hitting their highest levels in over a decade. While our outlook remains positive for the remainder of the year, and we’re constructive on the longer-term fundamentals for the dry market, there are several COVID-related factors that we see currently keeping rates high. The unwinding of these effects presents a risk to freight. These can be split into fleet inefficiencies directly caused by the pandemic, such as lengthy quarantine requirements and diversions for crew changes, and trades which have indirectly received a boost from the disruption caused by the virus.”

Other Opinions You May Be Interested In…

Explainers You May Be Interested In…