- COVID controls constrained PET resin export flows in March.

- Taiwanese Q1 exports to the US increased 40% from Q4 ‘21, 58% year-on-year.

- Low inventory and strong demand keep US imports at multi-year highs.

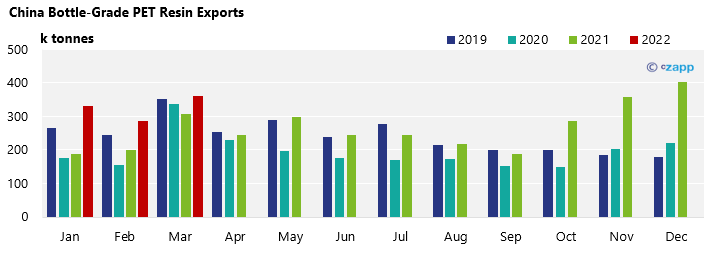

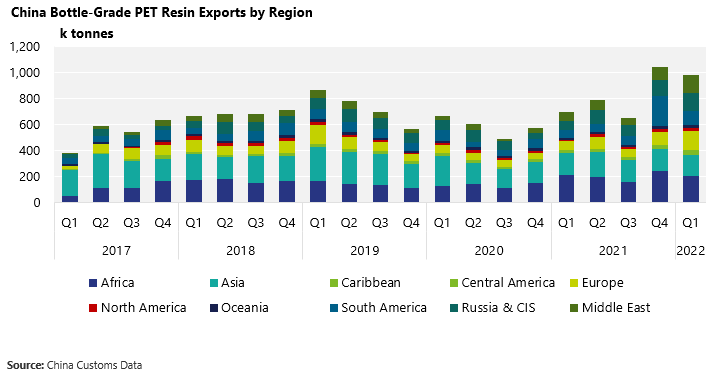

China’s Bottle-Grade PET Resin Market

Monthly Exports

- Chinese bottle-grade PET exports reached over 361k tonnes in March, up 26% on the month, and 17.3% on the year.

- Whilst rising steeply from February, March exports were lower than expected, given the large volume of orders in hand following Chinese New Year.

- Export flows from China have been hit by domestic lockdowns and COVID controls, which have resulted in disruption to logistics and PET resin production over the last couple of months.

- Flows to Russia slowed in March, down 15% on the month and 18% on the year, although volumes to Ukraine leapt 52% due to larger breakbulk cargoes.

- Whilst originally destined for Ukraine these cargoes are likely to have been rerouted to other regional distribution hubs.

- Except for Colombia, other Latin American destinations that had been prominent over the last few months fell in the March rankings.

- Given the enormous increases to both these regions over the last quarter, in part due to an increase in breakbulk shipments and the return of regional production in Brazil, lower volumes to Latin American destinations were in line with expectations.

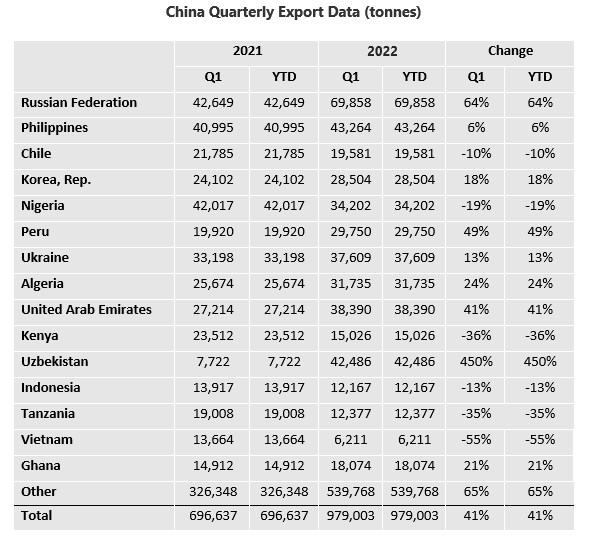

Quarterly Exports

- Chinese bottle-grade PET resin exports totalled 979k tonnes in Q, down 6.3% from Q4 ’21, yet up 46.7% from a year earlier.

- By region, Europe and the Middle East experienced the largest increases in Chinese Q1 exports, with volumes to South American and African destinations falling 52% and 15%, respectively.

- Q1 exports to Peru and Chile fell 41% and 66.8%, respectively, from the previous quarter despite continuing regional shortages.

- Volumes to Uzbekistan, Algeria, and the Philippines showed some of the strongest gains, with quarterly increases of 155%, 72% and 20% respectively.

- Strict COVID controls within China are expected to continue to slow shipments and hamper efforts to deliver existing orders over the coming months.

- The war in Ukraine will also have a pronounced impact on future orders for Chinese PET resin to these destinations, with Russian consumer spending hit hard over the

last month and an exodus of global brands.

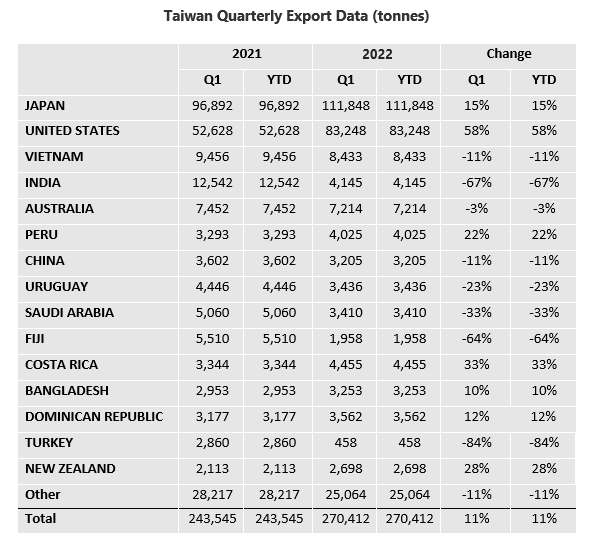

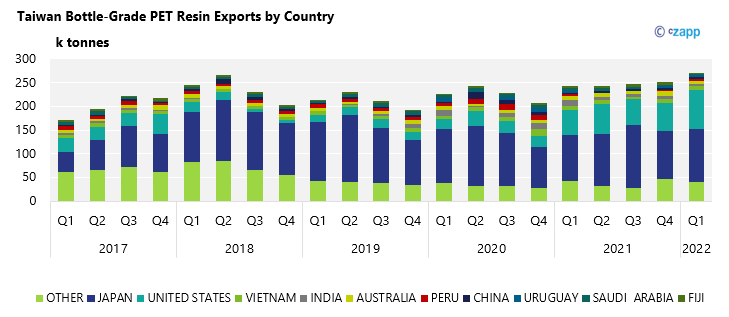

Taiwan Bottle-Grade PET Resin Market

Quarterly Exports

- Taiwanese PET resin exports totalled 270k tonnes in Q1, up 7.3% on the previous quarter and 11% year on year.

- Exports to the US continued to take a larger share in Q1, with volumes increasing 40% from the previous quarter and 58% year on year.

- Exports to some nations, however, experienced sizable decreases.

- For example, exports to India and Australia fell 40% and 28%, respectively; volumes to Turkey and Bangladesh slumped 73% and 43%, respectively, albeit on smaller volumes.

- The US and Japan made up over 72% of Taiwan’s total PET resin exports in Q1.

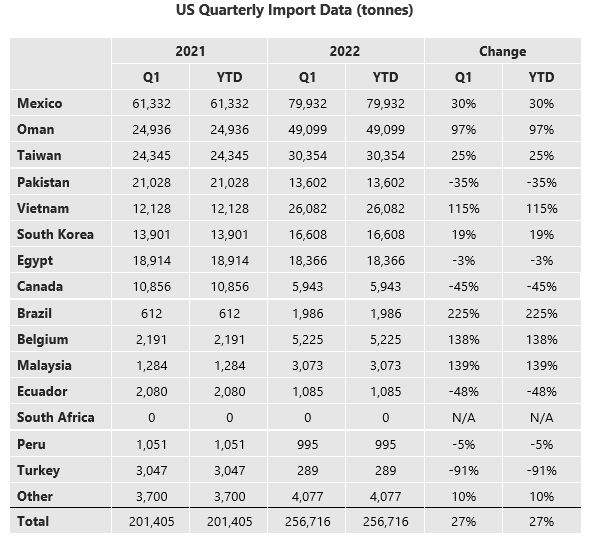

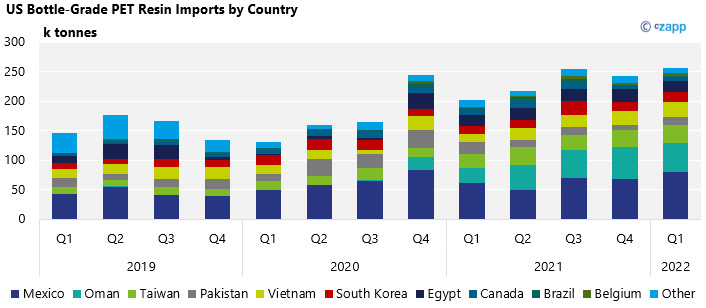

US Bottle-Grade PET Resin Market

Quarterly Imports

- US bottle-grade PET imports totalled 257k tonnes in Q1, up 5.8% on the previous quarter and 27% year on year.

- Although production across the Americas has recovered from last year’s outages, low inventory and strong demand are keeping US imports at multi-year highs.

- Origins with the greatest volumes in Q1, include Mexico, Oman, Taiwan, Vietnam, and Egypt.

- Oman was the second-largest source of imports behind traditional flows from Mexico, accounting for over 49k tonnes, down 9.4% on the previous quarter but up 97%

year on year. - Imports from Vietnam have also more than doubled over the last year to just over 26k tonnes in Q1.

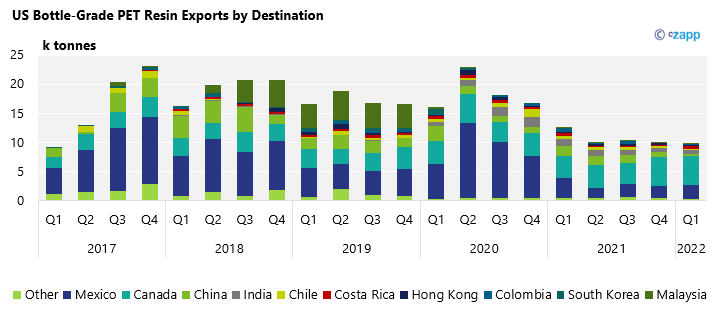

Quarterly Exports

- US bottle-grade PET exports totalled just 9.8k tonnes in Q1, down 2.1% on the previous quarter and down 23% year on year.

- As is traditional, over 76% of the total export volume remained with North America. Canada was the largest destination, followed by Mexico, with 5.1k tonnes and 2.4k tonnes in Q1, respectively.

- Given the continued supply constraints and strong demand going into peak season, exports should remain subdued into the next quarter.

Data Appendix