Insight Focus

- China’s zero-COVID policy and rolling lockdowns look set to continue.

- Consumer sales and beverage production in China feeling impact of loss of mobility.

- An extended period of weak domestic demand could weigh on overall PET resin sales.

China continues its pursuit of zero-COVID

Currently an estimated 46 cities are in full or partial lockdown in China, affecting the lives of nearly 350 million people; Shanghai, a city of over 26 million, has been in lockdown for over a month.

Concerns continue to grow in other parts of China, where growing numbers of asymptomatic cases are being detected, including dozens of new cases in Liaoning, Zhejiang, Jiangxi, and Xinjiang.

Beijing, China’s sprawling capital of over 21 million, is also attempting to contain its own outbreak. Although city officials look to have potentially avoided a full lockdown.

China’s zero-COVID policy meant that many had a quiet May Day holiday this year.

Across many cities, including Beijing, in-restaurant dining, entertainment venues, and schools were closed. Travel was also heavily restricted, in what would otherwise be traditionally one of China’s busiest tourist period.

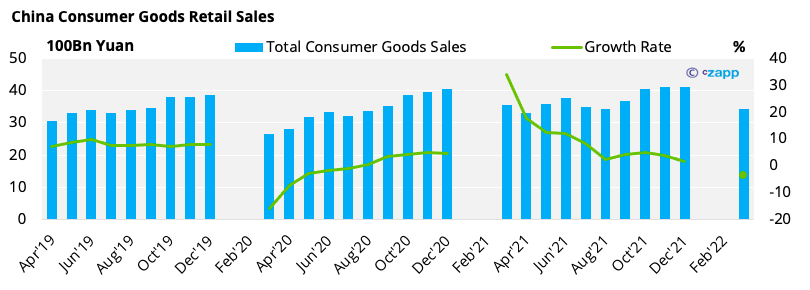

Retail Sales and Beverage Consumption Impacted by Lockdowns

Latest Chinese national data shows that retail sales for March fell 3.53% year on year, the first drop in 20 months.

Several major brands and multi-nationals have also announced corporate results over the last few weeks, hinting at the impact COVID restrictions are already having on the food and beverage industry, a key consumer of PET resin for bottles and packaging.

Coca-Cola highlighted its initial strong start in China in the run up to the Lunar New Year, but strict COVID lockdowns and reduced consumer mobility reversed this momentum, giving way to lower beverage sales in February and March and ending the quarter negative.

Pepsi also discussed how lockdowns in Shanghai and other cities were affecting consumer behaviour. Whilst lower mobility was hitting on-the-go beverage consumption, at-home consumption and stocking has been strong.

Starbucks’, which itself is heavily reliant on consumer mobility to get to its stores, sales plunged 23% in Q1 compared with Q4’21, due to China’s tough COVID-19 curbs.

Whilst too early for Q1 reporting from some of China’s largest beverage brands, including Nongfu Spring. Targeted campaigns at boosting in-home consumption over the last two years, including promoting the use of bottled water for the safe preparation soups and rice, may help cushion losses from the out-of-home market.

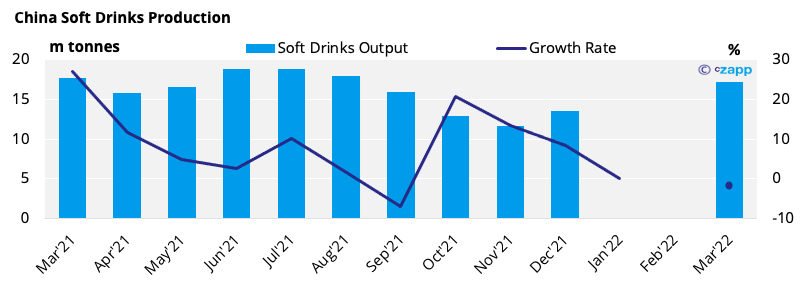

China Beverage Output Declines in March

According to the China Beverage Industry Association, the domestic beverage industry’s production in March fell by 1.6% from a year earlier, and was down 7.97% from March 2019. Production volumes for packaged drinking water were down 10.44% compared with March 2019.

A combination of better preparedness on the part of the beverage industry, and efforts by the Chinese government to buoy economic growth through incentives such as food vouchers, is likely to mean that the impact will be far less and shorter-lived than that experienced in 2020.

What does this mean for PET resin prices?

That said, logistics disruption and the consumer demand erosion caused by China’s COVID restrictions has already had a noticeable impact on PET resin pricing.

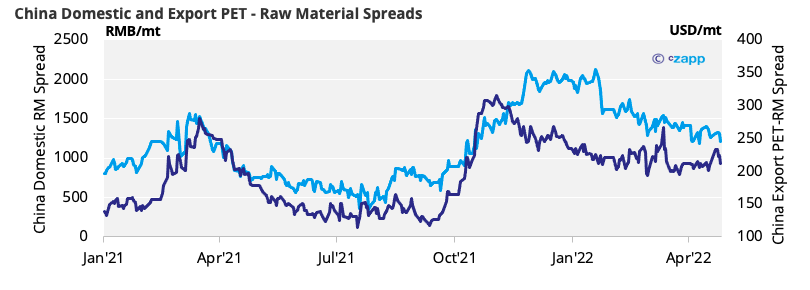

Since returning from the Chinese New Year holiday the domestic PET resin – raw material spread has been on a steady downward trajectory.

At the same time, producers have faced tremendous cost pressure so although raw material spreads are higher than historical levels, overall domestic PET margins are under pressure.

On the flip side, the raw material spread for Chinese PET resin exports has remained firm, and is now showing an upswing, due to low stock and high orders in-hand.

Logistics disruption resulting from lockdowns has also created delays for exports, further tightening the market.

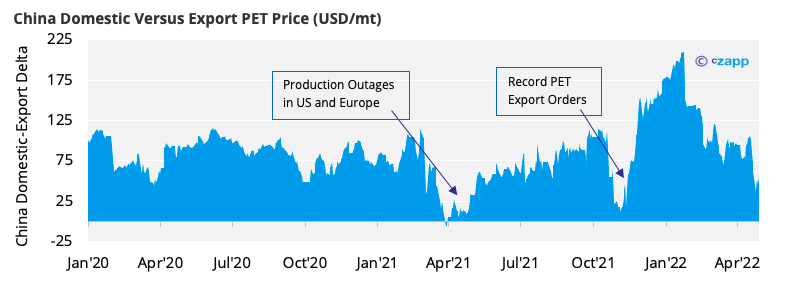

The difference between Chinese domestic and export prices also highlights some interesting trends.

The current domestic-export delta has dropped sharply in recent weeks, highlighting weakness in domestic sales versus export.

Last year, the same pattern also emerged during two periods of high export demand, largely resulting from global shortages due to regional production outages.

These peak and trough are indicative of over-bought and over-sold positions for PET resin exports.

Market Outlook & Concluding Thoughts

COVID controls are expected to take a heavy toll on China’s economic growth. The IMF’s latest World Economic Outlook has revised China’s 2022 GDP growth forecast down 1.2 percentage points over the last 6 months, to 4.4%.

COVID case numbers are likely to ebb and flow over the coming months. Whilst much of the rest of the world begins “living with COVID”, the Chinese government is not expected to change its Zero-COVID policy fundamentally in 2022.

Further restrictions and lockdowns are highly likely, affecting both production and domestic demand in the near term.

Whilst the existing PET resin export order book will remain strong through the rest of H1 2020, an extended period of weak domestic demand could weigh on overall sales.

Although export offers and margins currently remain firm through to August, weaker Q3 export orders, coupled with lower domestic demand, could cause inventories grow and export margins shrink.

Other Insights That May Be of Interest…

European Buyers Under Pressure as PET Prices Hit New Highs

PET Resin Trade Flows: China’s COVID Response Slows Exports

Chinese PET Industry Faces Biggest COVID Outbreak Since 2020