Insight Focus

- Steep Rise in New Zealand Exports to Japan

- EU Exports to China Plunge

- US Exports Strong on Competitive Prices

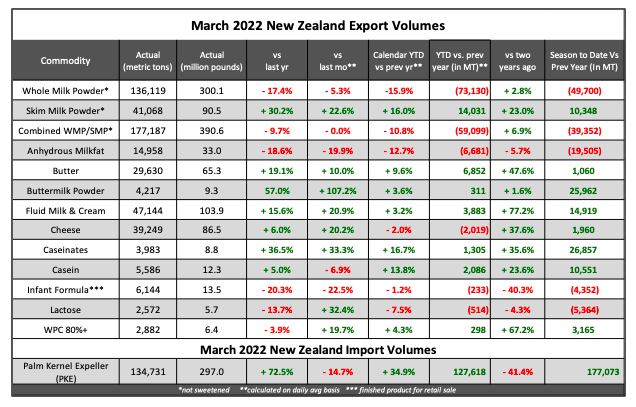

New Zealand

Whole milk powder (WMP) led export volume losses, though March’s export values were UP 26% from prior year as buyers were still willing to pay a premium to secure the commodity. China’s demand is the biggest concern as economic concerns and widespread lockdowns create nervousness around dairy consumption. Opposite WMP weakness, there was a solid push for many other key dairy products from New Zealand borders though with skim milk powder (SMP) shipments reaching 16-month highs. Cheese exports reached an all-time high, even as volume dropped into China, the number one destination. There was a strong increase into Japan, UP 55% from prior year to 8,844MT, the highest on record into the country. Caseinate exports jumped with market chatter consisting of very tight supplies from the EU, increasing reliance on NZ. Exports to South Korea and China recorded the largest gains over prior year. The increase in buttermilk powder was a result of strong demand needs from Southeast Asia, which was likely booked in February before prices escalated further.

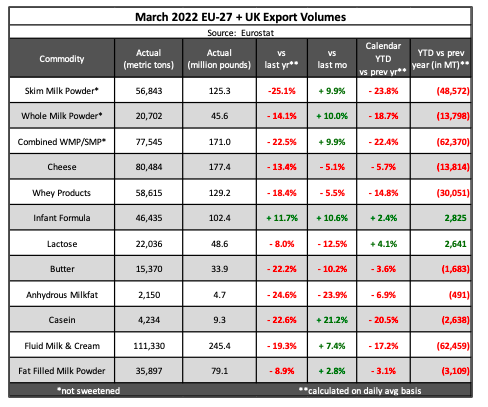

EU27 + UK

There was an incredible drop in dairy shipments heading to China in March, led by fluid milk & cream (53,391MT, -21,251MT YoY) and whey (12,420MT, -15,791MT YoY). Losses were also notable in the form skim milk powder (6,271MT, -4,751MT YoY) and lactose (2,070MT, -2,220MT YoY). The slowdown into China had been anticipated as large swaths of the population has been locked down for two months now, resulting in a temporary erosion in demand. Cheese exports were unable to keep pace with the strong shipments last year with the biggest drop observed into Ukraine, DOWN 4,179MT YoY to just 717MT, the lowest since May 2017 given the existing turmoil within the country. Shipments to the number one destination, the US, eked out gains (11,322MT, +566MT) but losses into Japan (8,541MT, -1,544MT YoY) also helped to offset gains seen elsewhere. After 14 months of weaker exports, infant formula shipments gained over prior year with volumes to China jumping to 16-month highs of 18,937MT, UP 1,115MT over prior year. While relatively small in comparison to shipments to China, record volumes sailed to the US in the amount of 1,200MT versus 282MT last year as nation-wide shortagessweep headlines; much of the volume came from Ireland.

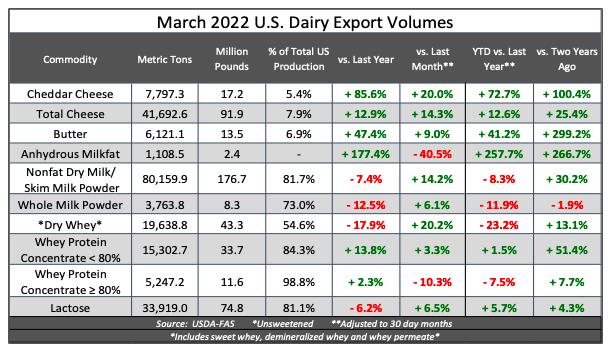

USA

March export figures were strong and an overall result of competitive commodity prices, most notably on cheese and butter, from the US throughout the second half of 2021 that promoted foreign demand. So far this year, shipments are nearly unchanged from prior year’s record export volumes, which are expected to have remained strong into the beginning of Q2 as well. There were some stark regional changes to note given global economic concerns; while shipments to our North American trade partners as well as Central America, reached an all-time high in March, shipments to Middle East-North Africa (MENA) fell to Dec 2020 lows. Exports to Mexico improved to seven-month highs on increased demand for cheese and nonfat dry milk. The MENA region has been bringing in higher amounts of dairy imports from South America to mitigate paying higher prices and from Turkey due to proximity and price. Mexico announced this week that they will increase production of staple foods to control consumer inflation (corn, beans and rice), is also eliminating import tariffs on ‘basic foods,’ and has worked with private sector producers to curtail increases in food prices. Support from the government will create more opportunity for the US to move milksolids into Mexico, especially as it remains difficult to forecast deliveries into the rest of the world due to logistical constraints.

For additional dairy market analysis, request a free trial at highgrounddairy.com/free-trial