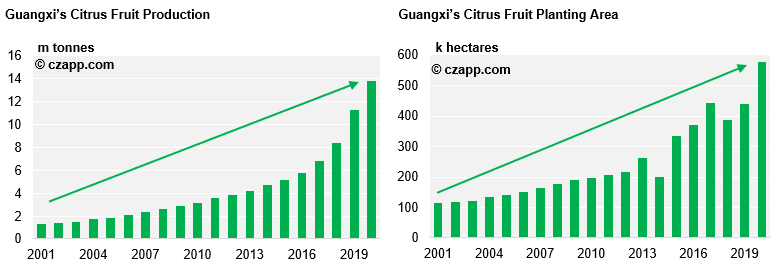

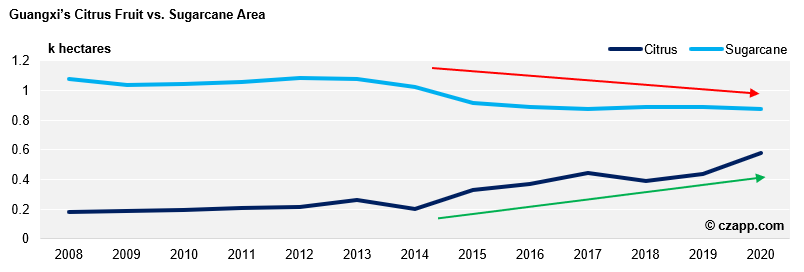

- Guangxi’s citrus fruit area has increased by 461k hectares in 12 years.

- Its cane area has dropped 201k hectares in the same period.

- As consumers turn more health conscious, might more Chinese farmers turn to citrus production?

China’s Citrus Fruit Production Continues to Flourish

- China produced 51.2m tonnes of citrus fruit in 2020, 13.8m tonnes of which came from Guangxi.

- Today, Guangxi is China’s largest citrus fruit region, with its total area spanning 577k hectares.

- The same cannot be said for Guangxi’s cane production.

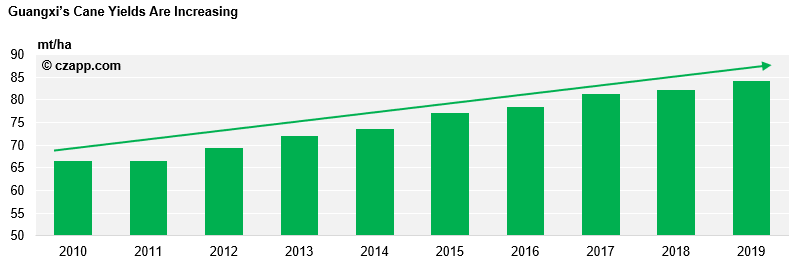

- It’s China’s largest cane region, harvesting close to 74m tonnes each year, but its area has dropped by 201k hectares over the last 12 years.

- Guangxi’s citrus fruit area has increased by 461k hectares in the same period.

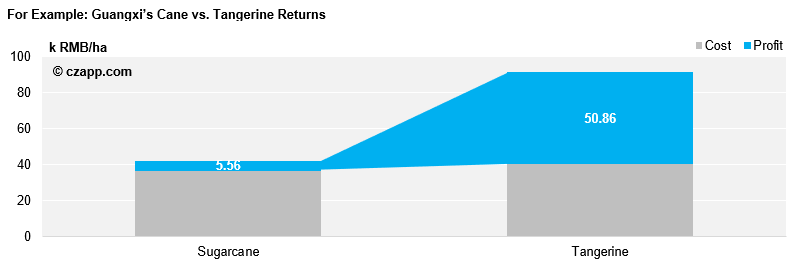

- This is likely because China’s farmers get paid a lot more money for planting citrus fruit, meaning those that are able to successfully cultivate it will likely do so.

Why Aren’t More Chinese Farmers Turning to Citrus Fruit?

- Many farmers still favour cane as it’s an easy crop to manage and the price is fixed prior to planting, meaning it offers a reliable source of income.

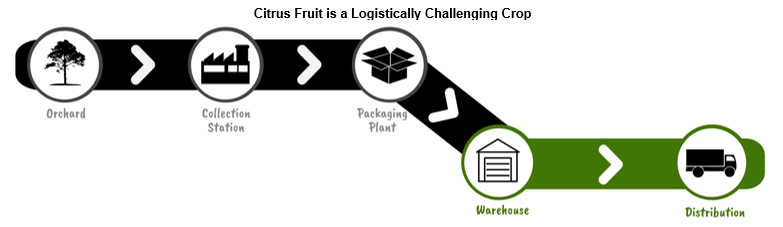

- Citrus fruit is less easy to manage as, once handpicked at the orchard, it must be delivered to the collection station, taken to the packaging plant and then onto the warehouse for storage prior to distribution.

- In other situations, it must be taken from the packaging plant to the sales region or port by truck, train, or ship, creating further hassle.

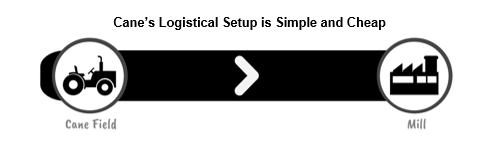

- For cane, the logistical setup is simpler and cheaper as it’s merely delivered from the cane field to the sugar mill by truck.

- Logistics aside, citrus fruit orchards are more prone to disease outbreaks too, notably citrus greening.

- Citrus greening restricts fruit development and can lead to devastating crop losses.

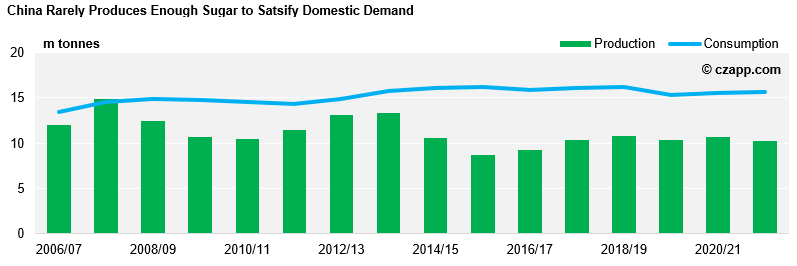

- And finally, China’s Government offers more generous subsidies to cane farmers; it currently offers 5,250 RMB/ha (350 RMB/mu) if a farmer plants a higher-yielding cane variety, and it pays farmers 8,250 RMB/ha (550 RMB/mu) if they turn to plant cane over another crop.

- This is primarily because China doesn’t produce enough sugar to satisfy domestic demand, and food security is a top priority for the Government.

What Does the Future Hold for Citrus Fruit vs. Cane Production?

- The Agricultural Department thinks China will produce 347m tonnes of fruit in 2030, up 68m tonnes from 2020.

- It also thinks cane area should remain stable, with the industry striving for improved yields, rather than increased area.

- 98% of the fruit China produces is consumed in-country.

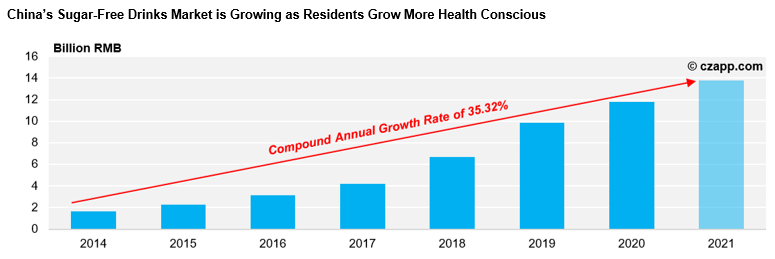

- As China’s population become more aware of the link between excess sugar consumption and poor health, fruit consumption could thrive.

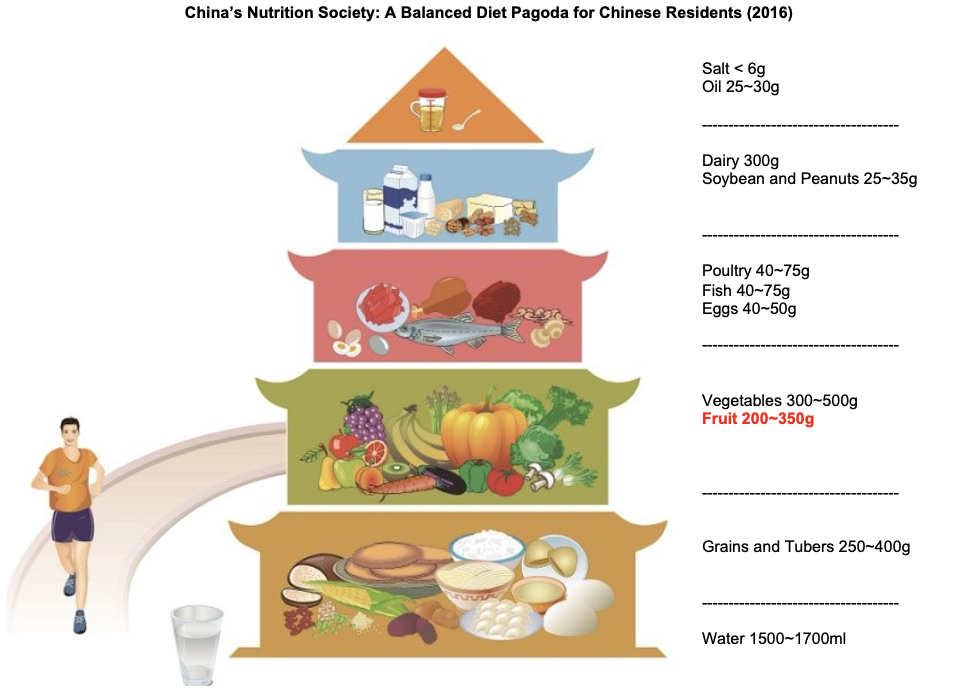

- China’s Dietary Guidelines are currently encouraging residents to increase their fruit intake and reduce their sugar intake to less than 25g a day.

- The recommended amount may decrease over time; they’ve already lowered this from 50g per day.

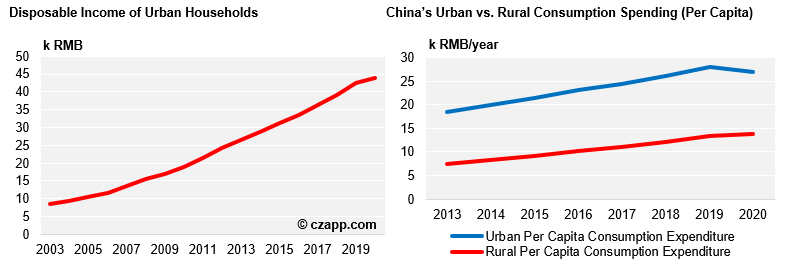

- Aside from this, we believe those with larger disposable incomes will spend more freely on fruit products, as is the case with sugary products.

- So, as China’s average income increases, the countries urbanises, and residents turn more health conscious, we could see more people spending on fruit-based products.

- However, in terms of production, we don’t think a large amount of China’s cane farmers will turn to plant citrus fruit in the short term.

- It already pays a lot more than cane, meaning those that can cultiviate it are likely already doing so; the limitations discussed above mean the switch isn’t easy for many.

Other Opinions You May Be Interested In…

Explainers You May Be Interested In…