Insight Focus

Imports of liquid sugar and premix powder hit a new high in May. Due to changes in import management policies, white sugar imports for processing into liquid sugar and premixes have fallen.

Imports Of Liquid Sugar and Premix Powder Hit A Record High

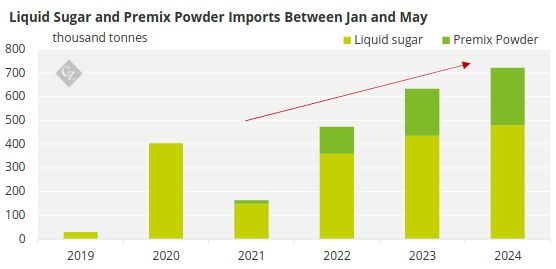

In 2023, China imported 634k tonnes of white sugar, 1.21 million tonnes of liquid sugar, and 598k tonnes of premix powder. The latter two products converted into dry weight of 1.336 million tonnes of white sugar equivalent. They have become the dominant “white sugar” imports for China.

May 2024 was a bright month for imports of liquid sugar and premix, both of which hit record highs for the month, reaching 144,100 tonnes and 68,800 tonnes respectively. This brings the cumulative imports from January to May 2024 to 723,000 tonnes, compared to 634,000 tonnes in the same period last year.

There seems to be nothing to stop their import momentum now, other than policy risk.

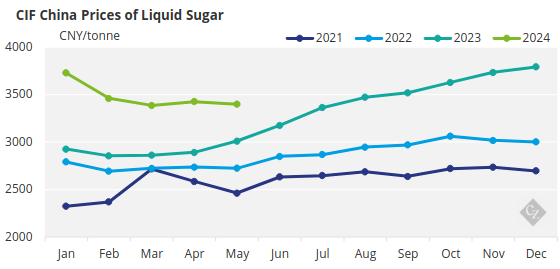

Margins are clearly the most important factor in stimulating imports. After reaching a peak of 3,792 yuan/tonne in December last year, the liquid sugar CIF price has fallen in 2024 along with the world market sugar price, and the import CIF price in May was 3,399 yuan/tonne, 10.4% down from the peak.

This converts into a dry weight after tax price of 5,733 yuan/tonne, 667 yuan lower than the current domestic white sugar price of about 6,400 yuan/tonne.

Policy Changes Have Put Pressure on Direct Imports of White Sugar

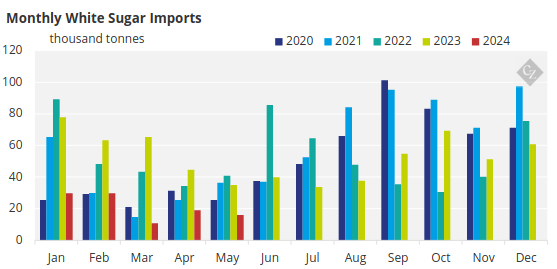

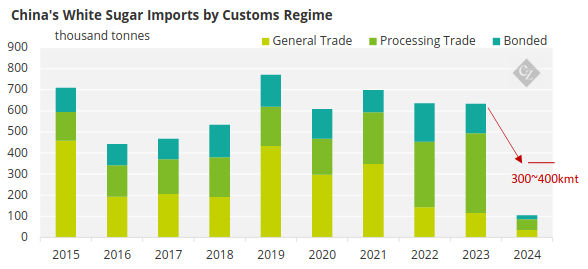

White sugar imports in May were in line with expectations and remained at a low level. Since 2022, imports of general trade (quotas and AILs) have shrunk significantly, while imports from processing trade and bonded areas have increased significantly.

The white sugar imported under the latter two trade methods is usually used for the processing of premix powder or liquid sugar in a comprehensive bonded zone (CBZ). As discussed in our report last month, this route is no longer in line with the new measures implemented by the Customs on the import of sugar from the CBZ.

As a result, China’s direct white sugar imports have fallen sharply due to the combination of high world market sugar prices and policy changes, and it is difficult to rebound this year. China’s sugar imports in 2024 are likely to fall by at least 200k tonnes from last year, ranging from 300k to 400k tonnes.

Note: 2024 is updated until end of May