Insight Focus

- In 2023, China imported 1.21 million tonnes of liquid sugar and 600k tonnes of premix powder.

- This is equivalent to 1.34 million tonnes of white sugar.

- Strengthening the regulations of the sugar industry to be proposed in 2024 ‘Two Sessions’.

Massive Growth in Chinese Liquid Sugar Imports

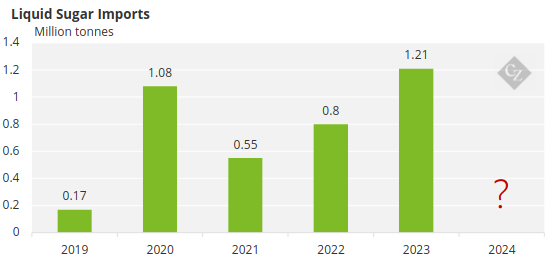

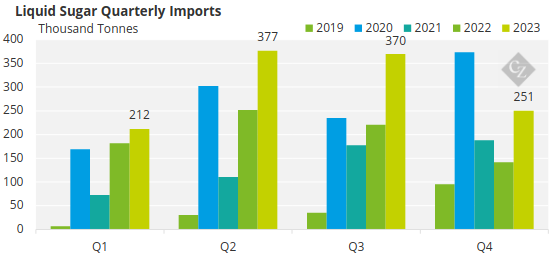

Liquid sugar imports in 2023 ended up at 1.21 million tonnes, up 410k tonnes from 2022. 1.21 million tonnes of liquid sugar is equivalent to 810k tonnes of white sugar.

Source: China Customs

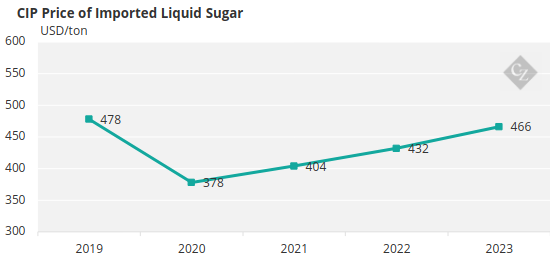

The average import price in 2023 was $466/mt, up 8% from 2022. This translates to $695/tonne of white sugar.

Source: China Customs

Last time we mentioned that the Ministry of Industry and Information Technology issued a new industry standard for liquid sugar, and the China Sugar Association held a preparatory meeting for the Rock Sugar Committee. These moves stimulated the market’s imagination that the import of liquid sugar will be controlled, but we have not yet heard any new developments.

Therefore, we expect liquid sugar imports in January and February to continue, perhaps at similar levels to Q1’23’s record 212k tonnes imported.

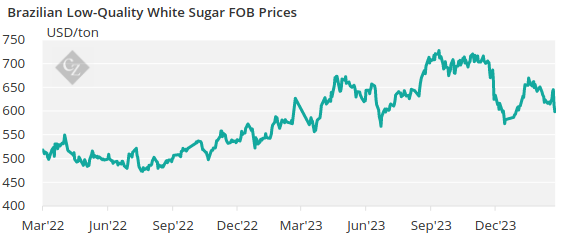

Source: China Customs

The Import of Premix Has Increased Sixfold

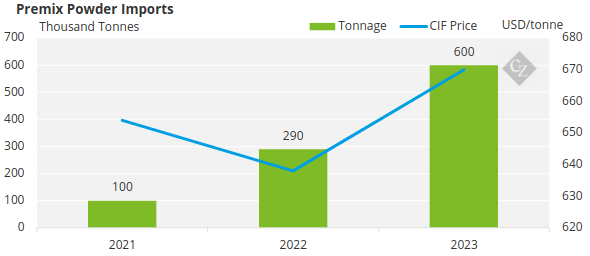

Premix powder is a mixture of sugar and other food ingredients. It is usually a mixture of 88% white sugar and 12% glucose. The import of this product is also eye-catching. In 2023, imports of premix powder reached 600k tonnes, more than double the import volume in 2022.

This is equivalent to 528k tonnes of white granulated sugar.

Source: China Customs

For end users, the application of liquid sugar may be more flexible. Currently the main consumer is the rock sugar factory, and it is also suitable for the beverage production.

The application of premix powder may be limited by the product formulation, but judging from the rapid growth of the quantity, it has also been widely accepted.

Together, these two products had a market share of about 1.34 million tonnes of white sugar equivalent in 2023.

Deputy to Propose Regulations on Liquid Sugar and Premix in Two Sessions

The Chinese People’s Congress and the Chinese People’s Political Consultative Conference are traditionally held in March every year, and are collectively known as the “Two Sessions” because of their close connection and far-reaching impact on national governance. The 2024 Two Sessions are scheduled to kick off on March 4, and conclude on March 11.

As a deputy in Two Sessions, and the owner of Zhanjiang Jinling Sugar Group (both refinery and sugar mill), Mr. Lin plans to propose to strengthen the import management of liquid sugar and premix powder, and promote the high-quality development of China’s sugar industry.

This may not be “news”, because it has been the main appeal of the sugar industry in the past few years. Policy changes are difficult to predict, and until then, we expect liquid sugars and premixes to continue to flow in, as long as flows remain profitable.

Supply Could Be A Problem

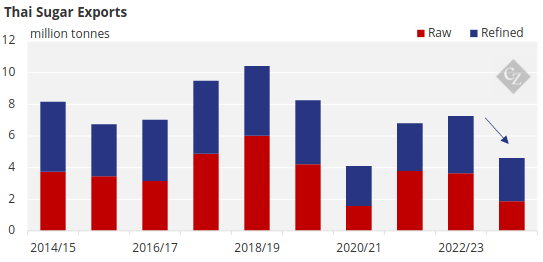

Thailand and India have been the key sources of feedstocks for liquid sugar and premix powder. But their sugar output will fall in 2023/24.

Can Brazilian sugar replace Thai and Indian sugar? Last year we did see some Brazilian sugar flowing into liquid sugar and premix production, but in small quantities. There may be operational difficulties, such as transporting sugar long distances to a liquid sugar factory in Thailand for processing and then shipping to China.

Price wise, the current FOB price of Brazilian white sugar is $590/tonne. The import cost could be around 5600 yuan/tonne, comparing to today’s domestic white sugar price of 6460 yuan/tonne. That means there should still be a profit window.