877 words / 4 minute reading time

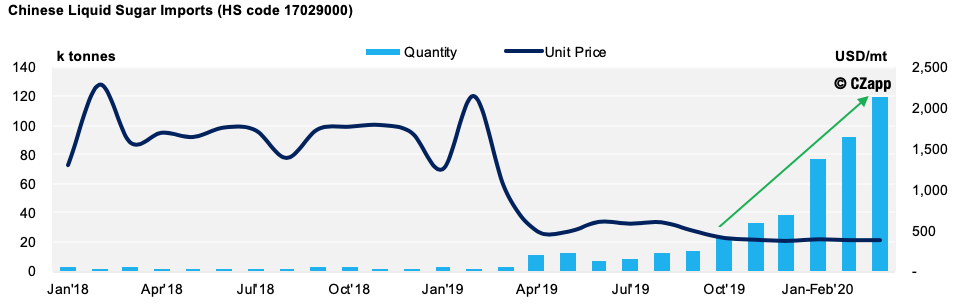

- China imported 290k tonnes of liquid sugar between January and April 2020; this is 13 times the size of 2018’s import number.

- The strong offtake occurred because liquid sugar imports are currently duty-free when coming from ASEAN origins.

- This flow could reduce in 2H’20, however, because there is limited Thai sugar availability and because the Chinese government could impose control measures that restrict liquid sugar imports.

What is Liquid Sugar?

- Liquid sugar is a blanket term for saturated aqueous solutions of sugar (sucrose), such as glucose and fructose.

- There are two basic types of liquid sugar derived from sucrose.

- Liquid Sucrose – This is almost all sucrose, containing 67% of solid sucrose.

- MIS (Medium Invert Syrup) – This contains 76-78% of dry material, 50% of which is sucrose.

Chinese Imports of Liquid Sugar Surge

- Liquid sugar imports totalled 168k tonnes in 2019; this is almost eight times the size of 2018’s import number.

- Despite this, China’s liquid sugar imports in Q1’20 have already exceeded 2019’s imports number!

- At this rate, we could see China import 1m tonnes of liquid sugar this year, if no restrictions are imposed.

Why? Because the Margins are Great for the Buyer and the Seller!

- Both the buyers and sellers are keen to keep this flow going, as long as there’s availability and imports remain duty free.

- For the seller, the average price of liquid sugar (CIF China) in Q1’20 was $388/mt. This was $580/mt in the dry weight and $167/mt higher than the CIF price of Thai refined to China during the same period.

- For the buyer, liquid sugar is still profitable at such a high price as it is currently duty-free.

Why is Liquid Sugar Exempt from China’s Customs Restrictions?

1. ASEAN–China Free Trade Agreement

- The ‘ASEAN – China Free Trade Agreement’ is an FTA between the ASEAN regions and the People’s Republic of China.

- On 1st January 2010, the average tariff rate on ASEAN goods sold in China decreased from 9.8% to 0.1%.

- Imports of liquid sugar from ASEAN countries are still duty-free under this agreement.

2. Liquid Sugar Falls into a Unique Import Category

- Unlike sugar in solid form, liquid sugar is imported under the sugar syrup category (HS Code: 17029000).

- This means liquid sugar can bypass the strict restrictions placed on solid sugar imports, including quota allocation, Additional Import Licenses (AILs) and Safeguard Duties.

- It is, therefore, duty-free.

Potential Restrictions for the Liquid Sugar Flow: The Supply Side

Thailand’s Limited Sugar Availability

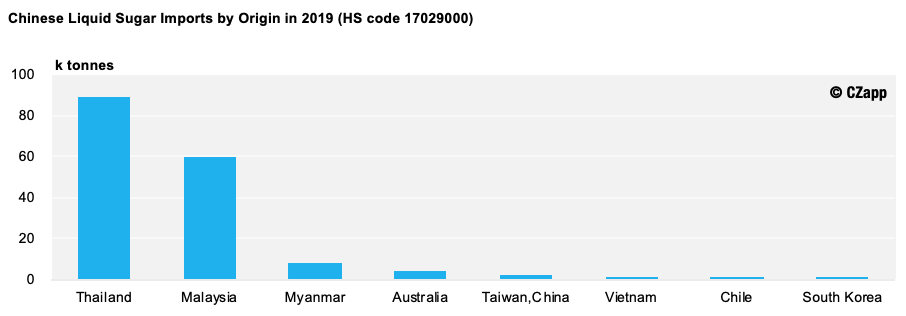

- Thailand is China’s supplier of liquid sugar, accounting for over 50% of the supply.

- However, Thailand’s raw and white sugar supply has reduced significantly after their poor cane crop.

- They will, therefore, struggle to maintain their liquid sugar output, as a result of their decreased production capacity and higher spot prices.

- However, some Thai factories could import white sugar from India in order to produce liquid sugar for export, so we may not see the flow reduce completely.

Malaysia, Vietnam and Indonesia are Facing Logistical Issues

Other origins of liquid sugar include Malaysia, Vietnam and Indonesia. But they are facing problems too…

- Vietnam mainly imports raw sugar from Thailand, so their supply could be limited in 2H’20 for the reasons stated above.

- Malaysia has other sources of raw sugar, such as Brazil and India, so the feedstock should not be a problem. However, their loading capacity is less than 5k tonnes per month…

- Indonesia will be a new source from 2H’20, but we don’t expect a strong flow there.

In short, the flow of liquid sugar could be cut in half once the Thai mills run out of sugar…

Potential Restrictions for the Liquid Sugar Flow: The Demand Side

Control Measures May Be Implemented to Protect the Domestic Sugar Industry

- China’s sugar industry is highly regulated, so we could see control measures enforced on liquid sugar imports now its loopholes have now caught the attention of Officials.

- This is because the Chinese Sugar Association claimed liquid sugar is hurting China’s domestic sugar industry, given that its imports are exempt from the very measures that were put in place to protect it (e.g. AILS, Safeguard Duty, etc).

The Positive: Liquid Sugar Import Surge Eases Pressure on Smuggling Flows

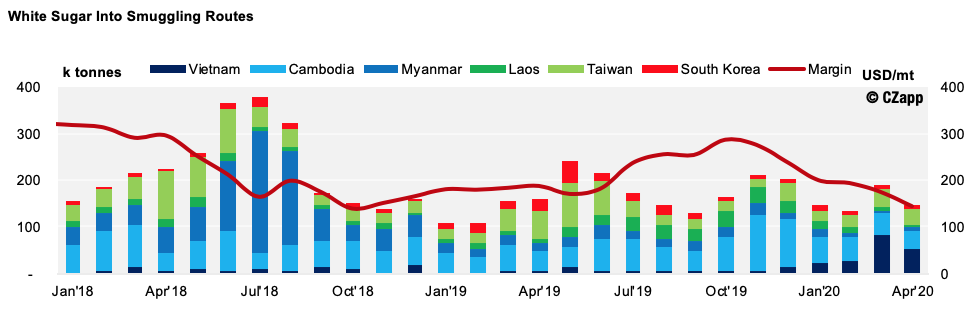

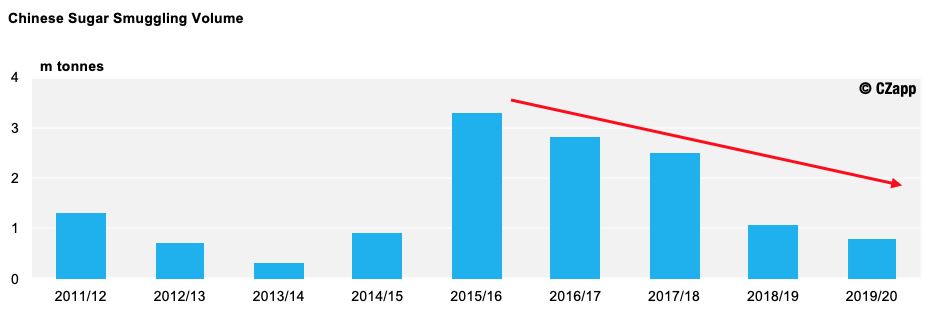

- China’s smuggling flow will be down 200k tonnes in the 19/20 season.

- This is because strict border control measures have been implemented, logistical interruption has been caused by the coronavirus, and the smuggling margin has worsened.

- However, the increase of liquid sugar imports should compensate for this and make up for the loss in smuggling.

- China’s growing demand for liquid sugar should be a good news to both the raw and white sugar market.

- The six main smuggling routes have now to reduced to three; Vietnam, Cambodia and Taiwan.

- Vietnam’s white sugar demand surged in 2020, due to the quota removal and the larger sugar deficit.

- That means we could see a lower demand from Cambodia in 2H’20 as they used to smuggle sugar into Vietnam.

- Other than that, the smuggling margin is narrowing due to the high spot values of Thai sugar.