Insight Focus

- China’s zero-COVID policy is resulting in a wave of new city-wide lockdowns.

- PET resin producers attempt to keep production steady, whilst logistics deteriorate.

- Slower deliveries should compound the lack of availability in the short-term.

China Reaffirms Zero-COVID Strategy Amid New Lockdowns

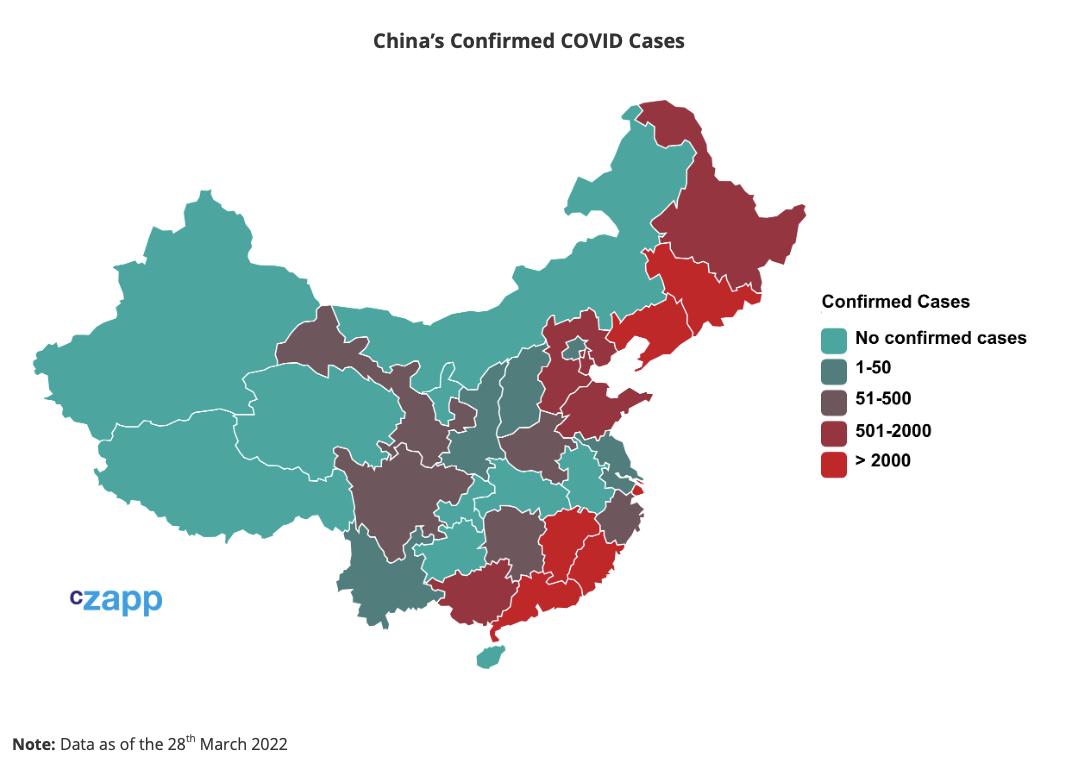

A new COVID wave has been sweeping across China, resulting in strict control measures impacting supply chains and delivery schedules.

Whilst new case numbers remain comparably low with an average of less than 1,500 daily cases being reported, versus over 30,000 in the US, China’s resolve towards its zero-COVID strategy seems unwavering.

President Xi Jinping affirmed just last week that China would stick to its zero-COVID policy, and although he also emphasised that pandemic measures should not cause economic pain, it’s unclear how compatible these two philosophies can be.

According to an economist at the Chinese University of Hong Kong, “China’s COVID lockdowns are likely costing the country at least $46 billion a month, or 3.1% of GDP, in lost economic output, and the impact could double if more cities tighten restrictions”.

Recent lockdowns in the southern Chinese manufacturing and technology hubs of Shenzhen and Dongguan shut down many factories and disrupted already overstretched global supply chains. Last week, the northern Chinese steelmaking city of Tangshan, with a population of 7.7 million people, also imposed a partial lockdown.

Although Shenzen and Dongguan have now reopened for business, Shanghai, and its population of over 25 million, has now also fallen foul of China’s zero-COVID approach.

On Monday the 28th March, Shanghai entered one of the most extensive lockdowns seen in the country since the virus was first detected over two years ago. The closure will be split into two phases – the city’s eastern side will lockdown until Friday and then the western side will close from 1-5 April.

And as the nation looks set to continue its pursuit a zero-COVID strategy, new lockdowns in other Chinese cities are inevitable in the coming weeks.

PET Producers Attempt to Ride Out Lockdown

Far Eastern New Century is the only PET resin producer to have operations in Shanghai itself (558 k tonnes/year) and to confirm impact by the shutdown.

Other major producers in regions surrounding Shanghai, such as China Resources, Sanfame, and Wankai remain largely unaffected.

Some manufacturers, including China Resources, have attempted to keep operations running despite the restrictions by creating social bubbles for workers and have them remain on site.

Changzhou city, where China Resources (1,000 k tonnes/year) is located, had previously locked down during 19-24 March.

Nevertheless, cargo transport in Shanghai should grind to a halt this week. Major trucking bottlenecks have already developed in Shanghai and other cities.

To leave Shanghai, truck drivers are required to provide a PCR test within 48 hours and again to re-enter the city. However, testing kits are reportedly becoming more difficult to obtain as mass public testing is prioritised, exacerbating the logistics slowdown.

PET producers in Shanghai are therefore likely to face difficulties in delivering resin as well as receiving feedstock for operations over the next week.

Port Congestion Builds

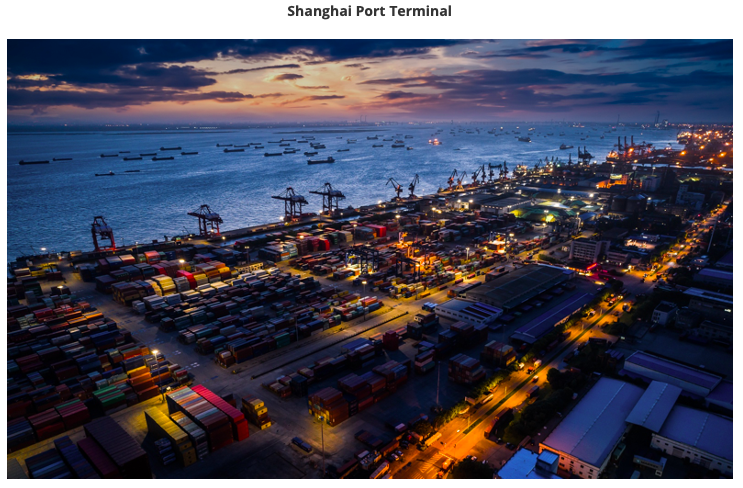

Shanghai Port still operates as normal with daily container operations of more than 140,000 TEU. However, warehouse closures, the drop in manufacturing, and reduced land-side trucking capacity should cause a significant dip in the availability of goods and port output.

As a result, some logistics firms are telling customers not to ship in or lift cargoes from their warehouses during the lockdown period.

Others are recommending that clients use Ningbo Port to the south of Shanghai, although major ocean carriers haven’t announced plans

to skip Shanghai’s ports yet.

Most main ports across China were already experiencing increased congestion following the previous Shenzhen lockdown, though. Other ports in Jiangsu Province are also under short-term lockdown due to COVID outbreaks.

Many ocean carriers have already announced changes to schedules, in essence withdrawing and restricting supply.

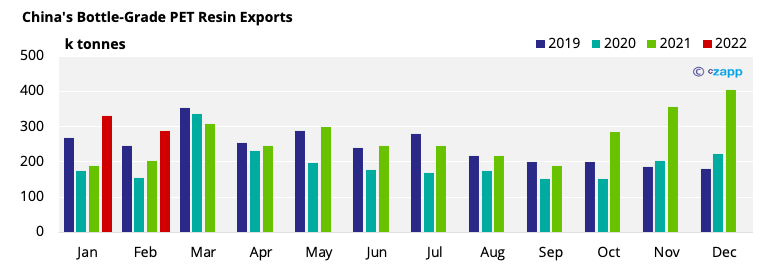

Although Chinese PET producers had received record export orders over last six months, actual delivery has become fraught with difficulty. Many large European buyers are now expecting a deterioration in delivery times as well as container availability.

Whilst lockdowns have typically been short and sharp, restrictive measures prior to lockdown, and recovery time afterwards, means a short 5-7-day lockdown can still result in over a month’s worth of disruption.

For example, whilst only experiencing a 7-day lockdown, throughput at the port of Yantian plunged by over 40% in March. A similar scenario is also now expected in Shanghai.

Although producers would have hoped for a swift recovery in export volumes following Lunar New Year, March exports should now be lower than previously anticipated.

Export Premiums Should Remain High in the Short-Term

Material for export was already in short supply, with most major Chinese PET resin producers already sold-out for April and May.

Slower delivery, as well as a scramble for safety stocks by some domestic bottlers, will simply compound the lack of availability in the short-term.

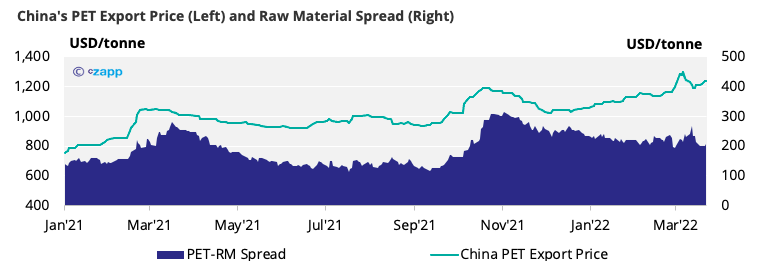

As a result, PET resin export premiums should remain high in the short-term, supported by low inventory and large order volumes in hand.

However, it must be noted that whilst premiums are high, PET resin producers are facing tremendous cost pressures due to increased energy costs, working capital interest, and added transportation costs.

Market Outlook & Concluding Thoughts

Whilst a lack of availability will dominate in the short-term, several factors could precipitate lower PET export premiums beyond May/June.

Firstly, the impact of COVID restrictions on Chinese domestic consumption. Although beverage bottlers are currently operating at typical levels, further restrictions could lead to lower beverage consumption and increase overall PET resin availability.

Seasonality trends are unavoidable, and with new orders now offering June/July shipment, the window for summer arrival in European markets is all but shut.

Adding to this, there’s risk of delays and disruption at every stage of the journey, from the producer gates in Asia through to the export market converter. Buyers needing to cover supply will increasingly focus on securing resin domestically.

And finally, loss of Chinese export demand from key markets Russia and Ukraine should pressure sales for some producers.

Other Insights That May Be of Interest…

European PET Market Rocked by War in Ukraine

PET Resin Trade Flows: Europe Awaits Asian Shipments