Insight Focus

PTA Futures strengthen on a rising cost base, and crude and PX pricing firms. The Mar’25 PET futures contract expired, and May’25 is now the main month with the highest liquidity. Asian PET resin export prices are projected to remain flat in near-term based on forward curve.

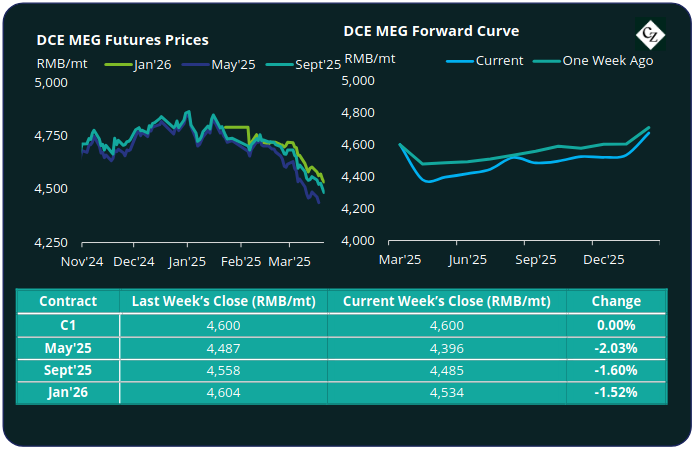

PTA Futures and Forward Curve

PTA Futures ebbed higher, with main contract months rising around 1.5% on stronger upstream pricing.

Crude oil prices posted a weekly gain, driven higher by fresh US sanctions on Iran’s energy industry and OPEC+ efforts to rein in production. Brent crude ended the week over USD 72/bbl.

The PX-N CFR average weekly spread widened by around USD 8/tonne to USD 182/tonne, as scheduled plant turnarounds reduced inventory positions. The PTA-PX CFR spread strengthened to an average of USD 79/tonne last week, up USD 4/tonne on the previous week.

Polyester operating rates remain high, with a steady improvement in PTA supply and demand fundamentals, leading to inventory drawdowns despite several PTA plant restarts.

The PTA forward curve continued to hold a slight carry, with the May’25 contract holding just a RMB 10/tonne premium over the current month’s contract. Sept’25 flattened to a RMB 22/tonne premium.

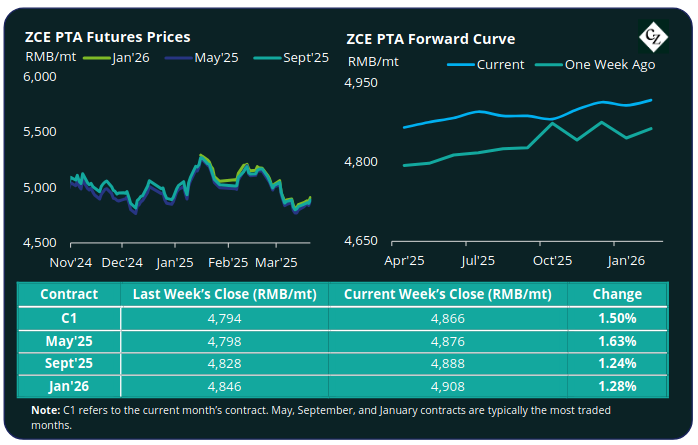

MEG Futures and Forward Curve

Conversely MEG Futures continued their slump, with the main May’25 contract dropping a further 2%, with prices down nearly 10% since Chinese New Year.

East China main port inventories increased by 2.8% to around 676,000 tonnes as port arrivals intensified, despite improved daily offtake.

Despite high polyester production supporting demand, domestic MEG operating rates remained high, constraining prices. Looking forward, increased scheduled maintenance in April is expected to alleviate some of this pressure.

MEG Futures forward curve remains flat, although forward contract prices remain below the current month, with the May’25 contract at a RMB 204/tonne discount over current month. The Sept’25 contract is at a RMB 89/tonne premium over May’25.

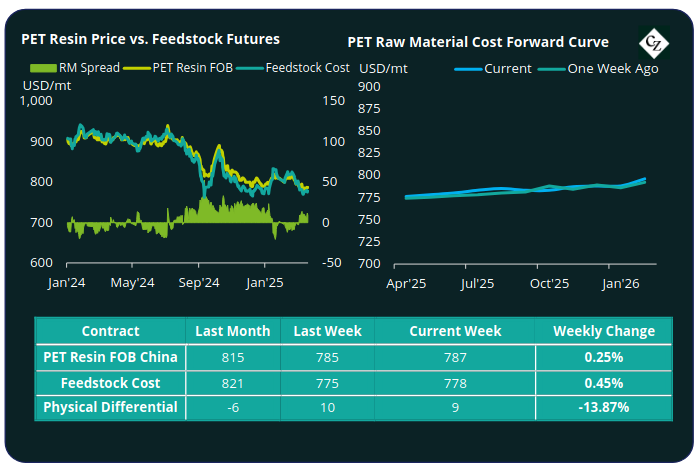

PET Resin Export – Raw Material Spread and Forward Curve

Chinese PET resin export prices increase very slightly, up by USD 2/tonne to average USD 787/tonne by Friday.

The average weekly PET resin physical differential against raw material future costs softened to a weekly average of positive USD8/tonne last week, down by USD 3/tonne. By Friday, the daily differential was positive USD 9/tonne.

The raw material cost forward curve remains flat, with May’25 at just USD 2/tonne premium over the current month, and Sept’25 holding just a USD 7/tonne premium.

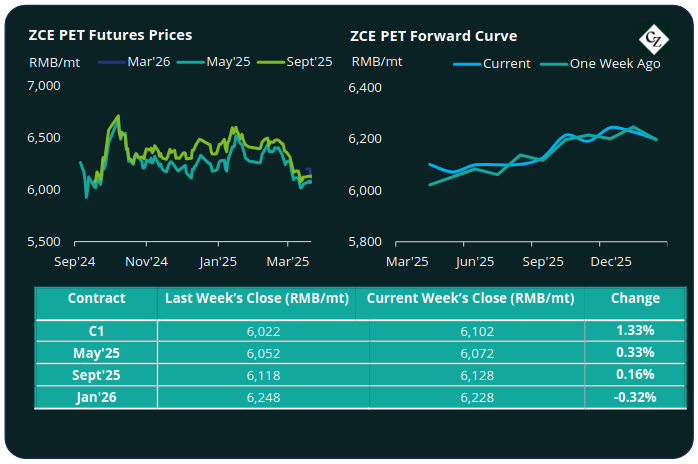

PET Resin Futures and Forward Curve

PET Resin Futures halted their decline with main month contracts adding less than 0.5%.

With the Mar’25 contract having now expired, May’25 is now the next main month with the highest liquidity. The May’25 contracts increased to RMB 6,072/tonne (USD 838/tonne).

The average weekly premium of the May’25 PET futures over May’25 Raw Material futures decreased to USD 23/tonne, down USD 2/tonne. By Friday, the daily premium was USD 21/tonne.

The PET Resin futures forward curve kept relatively unchanged in shape. Sept’25 held just a RMB 56/tonne (USD 8/tonne) premium over May’25.

Concluding Thoughts

In general, Chinese PET export pricing increased in line with raw material prices, with the physical differential changing little amid relatively subdued demand.

PET resin operating rates weakened slightly, although are expected to continue their upward move through the next month. Stock levels also averaged down marginally to just over a fortnight.

Any further improvement in the physical differential to raw material futures is likely to be constrained by the structural over-capacity, as shutdowns and new capacity returns to the market over the coming weeks.

Expect Asian PET resin export prices to closely follow upstream costs through April, with forward curves indicating now indicating flat pricing going into peak season.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.