- Chinese PET producers have struggled to make domestic and export sales recently.

- COVID-induced port closures have caused severe logistical disruption.

- High freight rates have also made China a less favourable origin.

A Barrage of Challenges for Chinese PET Producers

- A combination of severe weather events, port closures and the relentless rise in ocean freight rates have weighed on China’s domestic and export PET sales.

- A resurgence in COVID cases has also limited mobility within China and led to further lockdowns in key South-East Asian export markets.

- Chinese producers are increasingly worried about how much PET they’ll be able to export in 2022; many think high freight rates will continue to plague sales well into next year.

- Many Asian suppliers are only offering FOB (Free On Board) prices on transpacific routes at present, unwilling to take on the freight risk to Latin American destinations by offering CIF (Cost, Insurance and Freight) prices.

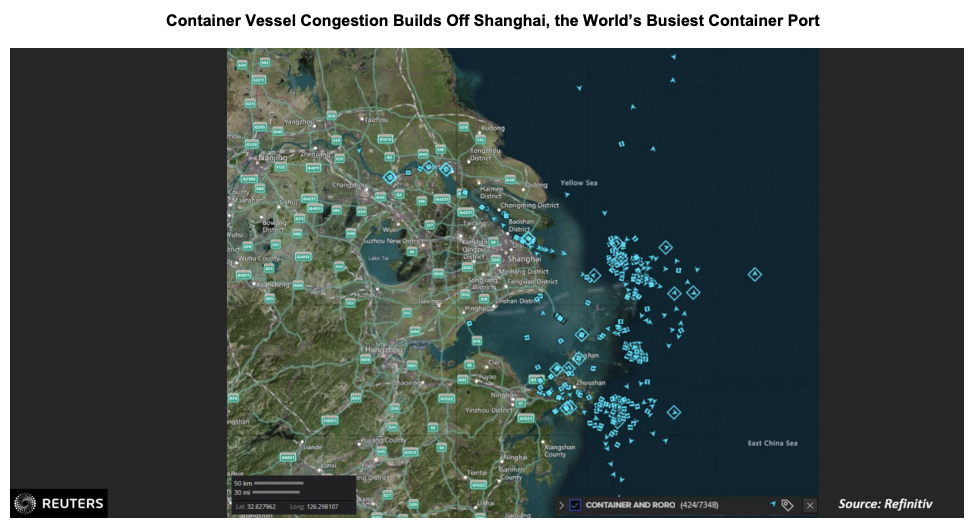

- Reports that ships have skipped port calls due to congestion and long wait times have caused logistical nightmares for buyers.

- Some Latin American buyers have been hesitant to place new orders, even as preparations for the summer begin, although the recent outage at Indorama in Brazil has brought about a new scramble for supply that may bring buyers back to the table.

- Elsewhere, within the Northern Hemisphere, key export markets such as Europe are now moving into the off-season, as the weather becomes cooler and beverage consumption declines.

- European buyers are currently preferring to source locally to avoid any import risk whilst demand tapers.

- Chinese producers have also faced a number of port closures in recent months.

- The latest saw the Meishan terminal of Ningbo-Zhoushan Port in East China’s Zhejiang Province shut after a dock worker tested positive for COVID-19.

- The Meishan terminal is responsible for around 25% of port handling and had been shut since the 11th August.

- Although the terminal is now back up and running, the backlog and congestion surrounding the port could take over a month to clear.

- Fortunately, Ningbo is not a major terminal for PET resin exports, however, at least one local producer faces additional logistics costs to ship from an alternate port.

Trade Flows Alter Course as Lockdowns and Anti-Dumping Take Toll

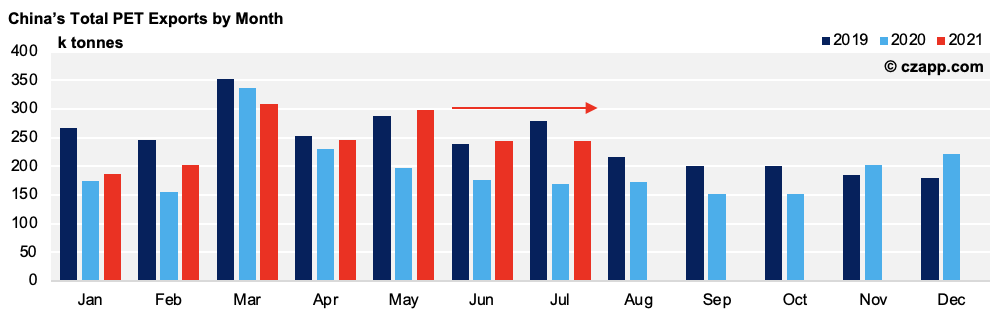

- China’s PET export volumes in July were relatively flat versus the previous month, up by just 0.4% month-on-month.

- Year-to-date (YTD) export volumes for the first seven months of 2021 were up 20% year-on-year, but down 10% from pre-COVID levels through the same period in 2019.

- Q3 exports will likely comprise of delayed shipments from earlier in the year, potentially masking actual demand levels.

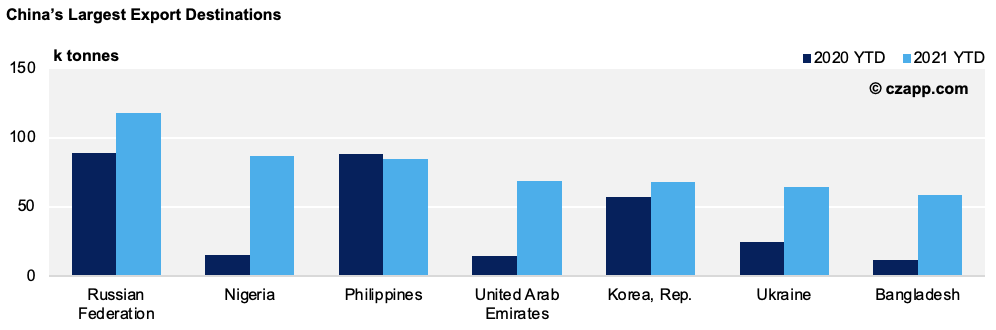

- Russia and the Philippines remain key export markets, with volumes to Russia up 32% year-on-year, and up 27% from 2019.

- Recent transportation issues moving resin from the North of China into Russia may temporarily challenge future August numbers.

- Exports to the Philippines have seen a modest decline YTD because of freight disruption, combined with strict COVID restrictions within the Philippines.

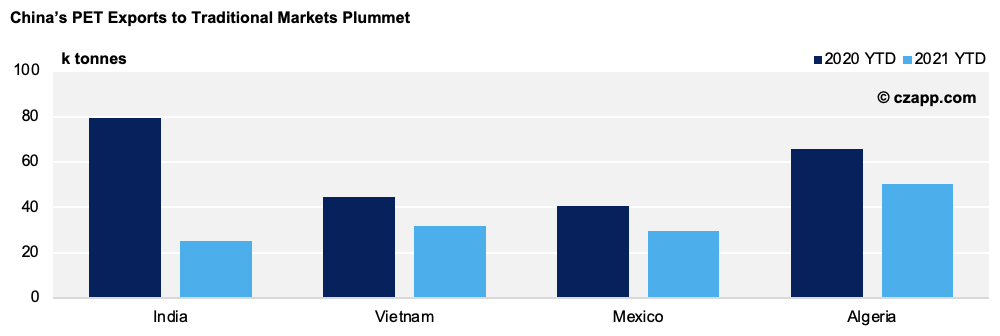

- Some of the largest traditional markets for Chinese PET, including Algeria, Chile, and India have fallen down the rankings.

- Whilst volumes to Algeria and Chile have largely been the victim of increased ocean freight costs and disruption, Indian trade has fallen sharply due to recent anti-dumping action against Chinese PET resin.

- Indian anti-dumping against Chinese PET was confirmed in December 2020 and is set to last five years.

- As a result, exports to India have fallen by 68% YTD, and by as much as 80% compared to pre-COVID levels.

- However, much of the loss in volume to India has been offset by increases in trade elsewhere.

- Nigeria and the UAE have seen some of the largest increases in Chinese trade over the last seven months but are not alone in triple digit increases.

- Chinese PET exports to Bangladesh and Ukraine have also experienced large increases.

Market Outlook

- Chinese export demand should weaken through the second half of the year, following the typical seasonal downturn in many Northern Hemisphere markets.

- Any improvement in demand may hinge on the easing of COVID restrictions in key markets within South-East Asia.

- High freight rates and poor schedule reliability may continue to dampen demand for transpacific container flows into Latin America.

- Interest in bulk PET shipments will likely increase across a number of geographies, sidestepping the container market and affording lower freight rates to buyers.

- A flurry a large bulk shipments may also begin to move the market given lower production and tighter availability in China.

Other Opinions You Might Be Interested In…

Explainers You Might Be Interested In…