Insight Focus

The cocoa market has faced record-high prices. This is due to supply deficits and speculation, with uncertain demand trends reflected in mixed grind data. Persistent supply challenges and low stock-to-grindings ratios below 30% support prices, keeping industry coverage steady.

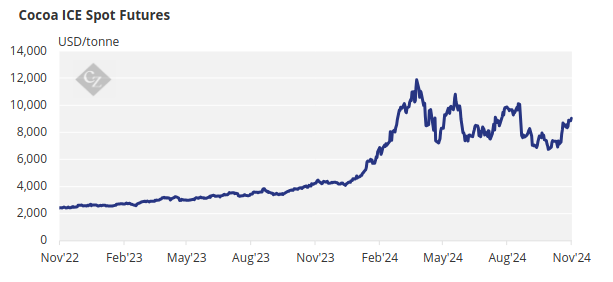

The cocoa market has started to settle into new price levels below the all-time highs of mid-April but a tier above the last 50 years. The big question is whether demand will be resilient to the higher levels or will weaken as it is supressed by consumers seeking snacking alternatives or brands pushing lower cocoa content in chocolate consumer products.

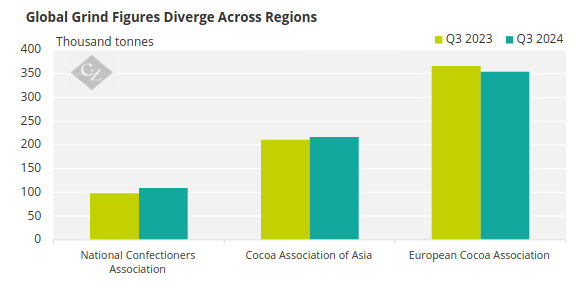

The final indicator will be the quarterly grind numbers over the next 12 months coming from Europe, the US and Asia – the industry barometer for demand.

Stock-to-Grindings Ratio Impacts Market

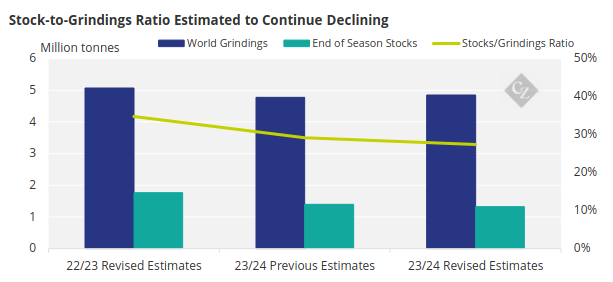

So, why are stock-to-grinding ratios important? Well, stocks are an indicator of supply and grinding is an indicator of demand. If the ratio goes down, that indicates there is more demand than supply – a bullish factor for prices.

ICE monitored stocks in the US have been declining for nearly two years and are currently at a 19-year low. Recently the International Cocoa Association (ICCO) revised its estimate of the stock-to-grindings ratio downward to 27.4% with the market participants generally reporting stock to grindings ratios between 25% and 30%.

Source: ICCO

It is generally accepted that if the stock to grindings ratio is below 30% then the brands will not be likely to reduce cover. This means the market remains supported with six to 12 months of chocolate maker cover but with them keeping an eye on the opportunity to extend cover if the ratio goes even lower.

Uncertainty Persists in Cocoa Supply

Over the last 18 months, the cocoa market has seen unprecedented trading levels sparked by disastrous crops across all the growing areas but particularly in Ivory Coast and Ghana. A global deficit of over 450,000 tonnes pushed the stock-to-consumption ratio to below 30%, immediately igniting supply concerns. Industry participants pushed their cover further forward.

Speculators jumped in and the market hit all-time highs on April 19. The market has since backed off but is still considerably higher than the average of the last 10 years. The big question now is whether the high prices will suppress demand.

The huge reduction in the Ivory Coast and Ghana 2023/24 crop of around 590,000 tonnes was caused by a combination of factors, including El Nino weather phenomenon, Cocoa Swollen Shoot Virus (CSSV), illegal gold mining, tree age and historical low prices.

Expectations for a recovery for the 2024/25 crop vary between market participants depending on whether they attribute last year’s decline purely to El Nino or if any blame is attributed to the more structural issues such as disease, tree age and land conversion to gold mining.

The latest global demand numbers are currently confusing, with the National Confectioners Association in the US recently reporting that Q3 grind figures rose 12% year on year. The Cocoa Association of Asia also reported an increase — though less marked at 2.6%. At the same time the European Cocoa Association reported a decline in grindings in Europe of 3.3% year on year. The Q4 grind numbers will give a better indication of whether the high prices of the last 12 months have started to bite.

There have been huge variations in supply and demand estimates for the 2024/25 crop year. As already highlighted, the anticipated crop recovery in Ivory Coast and Ghana generated some supply and demand projections in excess of 250,000 tonnes surplus, with most reporters originally posting around 150,000 tonnes.

However, recent heavy rains in Ivory Coast flooded parts of the growing area bringing greater risk of disease. Conversely, dry weather in Ghana and Nigeria has generated concern for the late main crop and mid crops. Many market participants have therefore now reduced their estimates of surpluses to either nominal or even flat.