Insight Focus

Cocoa prices hit record highs amid crop challenges. Forecasts for the 2024/25 season are divided, while regulatory hurdles like the EU Deforestation Regulation (EUDR) add further uncertainty. These factors create a volatile outlook for the cocoa market’s future.

2024/25 Cocoa Stocks in Deficit

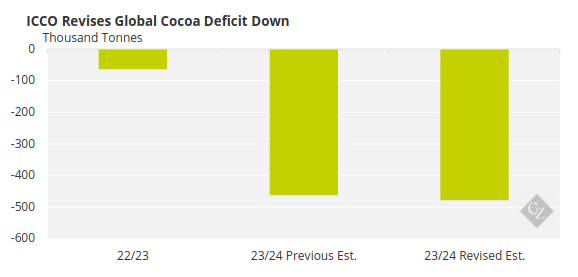

The ICCO recently reported that it has adjusted its cocoa deficit figures for 2023/24 to negative 478,000 tonnes from 462,000 tonnes. Global ICE Monitored cocoa stocks are now at 21-year lows.

Source: ICCO

Even more concerning, the forecasts for the 2024/25 crop season were initially looking at a surplus but more recently have been predicted to be up to a 150,000-tonne deficit.

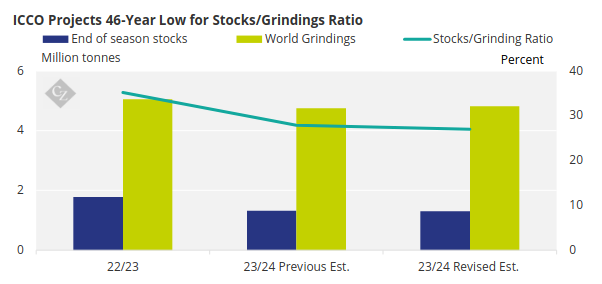

All these numbers start to look like a further reduction in the stock to grind ratio which will be concerning for industry players. The last reported number was between 25% and 27%, which is ringing alarm bells since it marks a 46-year low.

Source: ICCO

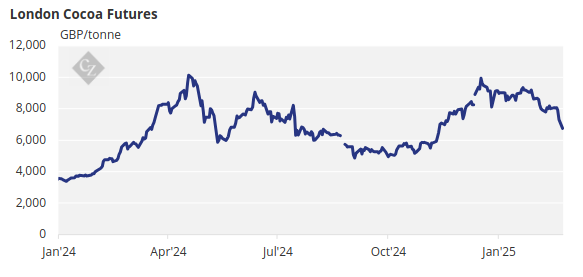

This is just one reason contributing to the recent volatility in the cocoa market. The cocoa market has had an exciting 18 months, achieving its highest levels in recorded history in April last year, a level in London of GBP 9,980.

The rally in the price was driven by a collapse in the 2023/24 crops in Ivory Coast and Ghana in particular, but also poor crops across all the growing regions.

The market primarily blamed El Niño, but other factors were at play, including disease, particularly cocoa swollen shoot virus (CSSV), illegal gold mining in Ghana, and the long-term effects of low farmgate prices.

Damaged Cocoa Fruit

As we began to enter the period where forecasts for the 2024/25 crops could reasonably be predicted, participants started to become divided, with some predicting that the crops would rebound to previous levels with a mild La Nina weather pattern countering the effects of the previous crops El Nino impact.

Others predicted that there would not be a full recovery because there were more factors contributing than just the weather phenomenon.

So, what is in store for the Cocoa Industry in 2025?

Weather Impacts Crop Development

The harvest in the main cocoa producer Ivory Coast initially looked good, up 35% in December against prior year (even though still not as high as the 2022/23 crop). However, these numbers have since receded to 20% up on prior year.

There are still concerns that the mid crops in Ivory Coast and Ghana will be worse than forecast because of weather conditions impacting the mid-crop developments. The entire industry is now trying to understand whether there are structural supply issues or whether the downturn in crop production in the two main cocoa growing origins was a temporary blip caused by El Nino.

So far, the evidence does not look good, with the finger pointed at very high incidence of cocoa swollen shoot virus (CSSV), illegal gold mining in Ghana and overall lack of investment in maintenance and rejuvenation across cocoa farms in West Africa over the last 30 years.

Physical Differentials Opaque

The physical differentials have been very strong and very volatile, with a high for Ghana around GBP 1,500 over. There are big gaps between quoted levels and actual trades, which makes it difficult to track the real physical value of cocoa.

Grading has recently occurred in the ICE markets, implying that for origins other than Ghana and Ivory Coast, the physical differential is at a level that is considered suitable for grading.

EUDR Requirements Weigh

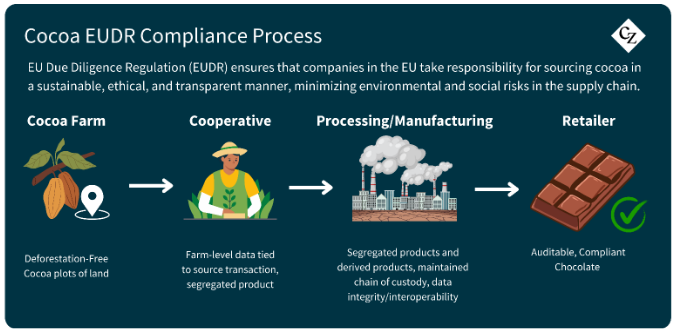

The postponement of the EUDR has eased concerns about physical supply to Europe, but this is temporary, with the regulation now entering into application on December 30, 2025.

The challenge for the industry is that approximately 50% of supply is directly sourced by the supply chain companies through cooperatives and aggregators where there are programs or certification.

The other 50% comes from third-party shippers with traditionally very little transparency and accountability in their supply chains. About 25% of the supply into Europe will need to come from these third-party shippers.

That supply will need to be compliant to EUDR by December 30, 2025 and this is a concern for the industry.

Global Demand Wanes

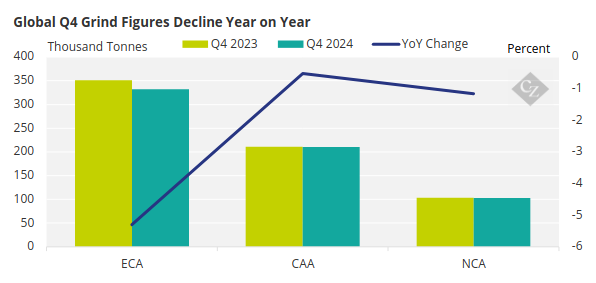

According to global Q4 grinding numbers from European Cocoa Association (ECA), there has been a like-for-like decline of 5.3% in consumption. Data from the Cocoa Association of Asia (CAA) shows a decline of 0.5% and the US numbers from the National Confectioners Association (NCA) are down 1.2%.

These numbers are backed up by stories from Mondelez and Hershey reporting a decline in demand with refences to significant increase in chocolate prices and chocolate makers being forced to reformulate recipes by replacing cocoa with other ingredients.

A supermarket consumer report in the UK indicated that chocolate prices rose by 12.4% to the end of November 2024. There have been price increases across the board, but the big question is whether demand can ride the wave and remain resilient.

Still, the market is closely following the crop developments and consumption numbers. If we have another deficit with little prospect of a recovery of the 2025/26 crop to 2022/23 levels, then there will need to be a big downturn in consumption for the price to break back towards the depressed levels of the last 30 years.

It looks like we might be in a new higher range for the foreseeable future.