Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading undertaken based on the analysis or suggestions provided herein. This information is intended solely for the personal and confidential use of the reader and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis as principal of TechCom. Copyright © 2023 Technical Commentary.

Featuring 8 key futures markets that combined add up to more than 50% of the entire weighting of the Bloomberg Commodity Index (23 markets total) and augmented by analysis of the Bloomberg Index and the US Dollar Index, this report offers the preeminent heavyweight commodity sector portfolio.

For more information please contact Michael here.

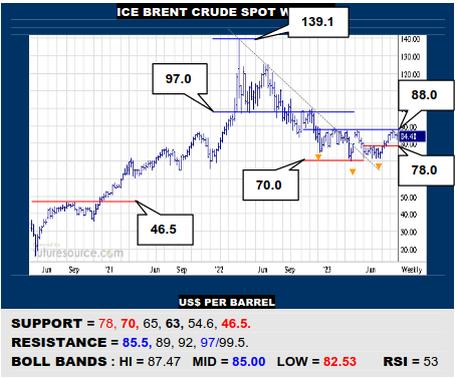

ICE BRENT CRUDE OIL SPOT WEEKLY

Balancing quite precariously on immediate 82 support, Brent still has a look at the mid band (85) that marks a likely trigger for another try at 88, the confirming escape hatch for a large 9-month inverse H&S that could really beef up this chart. Alas, if still denied by the mid band, beware breaking 82 and withdrawing to the prior smaller Q2 base rim at 78.

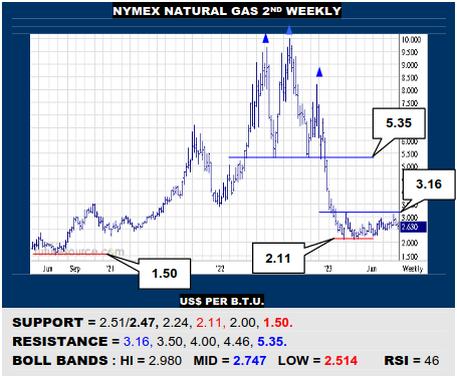

NYMEX NATURAL GAS 2ND WEEKLY

As in Mch, an Aug glance into the 3’s was fleeting and Nat Gas has backed away towards the lower end of the Bollinger corridor (2.51). Watching this and a 2.47 ledge just behind if this backlash is to be gathered in fairly promptly and a fresh try made for the 3’s. Otherwise loss of 2.47 would imply a correction cresting to take aim at 2.11 again.

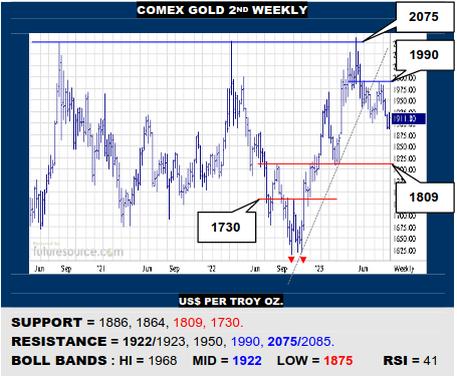

COMEX GOLD 2ND WEEKLY

The mid band is blunting Golds’ attempt to bounce but an outside week was still achieved so keep eying 1922/1923 as a portal to score a more persuasive turn up to 1950 and maybe create scope towards 1990. However, if the Dollar drove clear of 105.6, so 1922 will become far tougher, in that case implying risk down through 1886 to 1809.

LME COPPER 3-MONTHS WEEKLY

Previously blocked shy of a prior H&S neckline (now 9100), Copper has stumbled in Aug but fought back a bit this week. Alas, to sharpen this upturn effort will demand piercing 8465 (then maybe having a shot to the low 9K’s) but a Dollar hunting the 105’s isn’t making that easy so keep watch on 8140 as well as the trapdoor back down to 7850 instead.

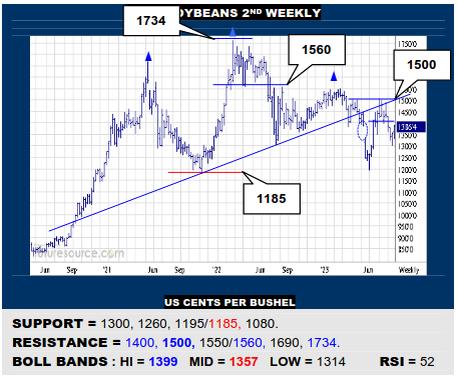

CBOT SOYBEANS 2ND WEEKLY

Jly failures at 1500 marked the intervention of the big ‘20’s H&S neckline and Beans fell back in Aug to install a small mid-year top above 1400. The current attempt to revive will have to hurdle that 1400 level to make an impression then and return sights to 1500 yet again. If denied by 1400, stay wary of a new swat down to the 1200-1185 region.

CBOT CORN 2ND WEEKLY

The 474 support has survived renewed scrutiny of late but Corn would have to hop back over 507 to form a small daily inverse H&S that could shore up the footing here and open the door towards the 570’s again. If is a precarious perch meanwhile and breaking below 474 would instead warn of a further delve into the better monthly buffer at 440-420.

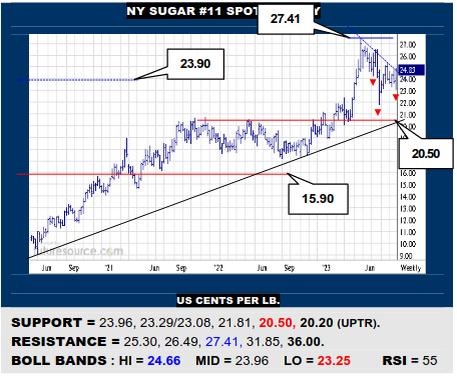

NY SUGAR #11 SPOT WEEKLY

Successful retrievals in the low 23’s during Aug have now delivered an outside week higher across 24.60 to propose the mid-year period as an inverse H&S base and suggest Sugar getting back on track aiming for 26.50 and even 27.40. An oppositional Dollar won’t make it easy though so always mind the mid band (23.96) as a pivot back into trouble.

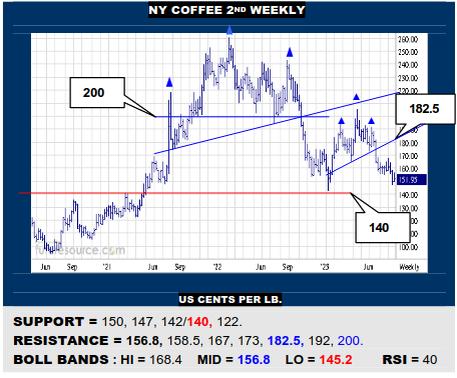

NY COFFEE 2ND WEEKLY

Coffee has been trying to fight off the Aug dip and scored an inside week but this must still dislodge the mid band (156.8) to give the turn more of a cutting edge that could at least stir a bounce to 167, even if too soon to look towards the 180’s. If denied by the mid band though, watch 150 as a tripwire to resume lower to actually test the 140 shelf.

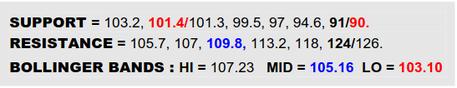

BLOOMBERG COMMODITY INDEX WEEKLY

It isn’t that the B-Berg is doing so badly as it has kept restraint on its Aug setback whereby the neckline of the ’23 inverse H&S currently remains safe (101.4) near a 101.3 Fib retracement and this was an inside week hinting at a bid to turn north again. Alas, since the Dollar is putting on an even better display, the rules are pretty rigid as to what gets applause and what doesn’t. So ultimately the commodity index must defeat the broad 109.8 frontier still to pull this year together as an even better inverse H&S and so open the door significantly higher to 125. Meantime if floundering shy of 109.8 and diverted back through the 101’s defenses, it would look prone on down towards 90.

US DOLLAR INDEX WEEKLY

The Dollar still has the edge over the B-Berg in Q3 as it was quick to snatch back a delve into the 99’s that narrowly missed a major Fib retracement of the previous big ‘21/’22 advance so Jly plays as a false breakdown. If the greenback can now go on to polarize this catch by popping 105.6 resistance, it would be tough to argue against it and there would then be relatively plain sailing up to 110, almost certainly bringing pressure enough to bear on the B-Berg to tear through its 101’s base defenses. Otherwise needing to see this recovery intercepted shy of 105.6 and at least a diversion back under 102.7 to show an Achilles’ heel that commodities might yet be able to exploit.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading undertaken based on the analysis or suggestions provided herein. This information is intended solely for the personal and confidential use of the reader and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis as principal of TechCom. Copyright © 2023 Technical Commentary.