Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading undertaken based on the analysis or suggestions provided herein. This information is intended solely for the personal and confidential use of the reader and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis as principal of TechCom. Copyright © 2023 Technical Commentary.

Featuring 8 key futures markets that combined add up to more than 50% of the entire weighting of the Bloomberg Commodity Index (23 markets total) and augmented by analysis of the Bloomberg Index and the US Dollar Index, this report offers the preeminent heavyweight commodity sector portfolio.

For more information please contact Michael here.

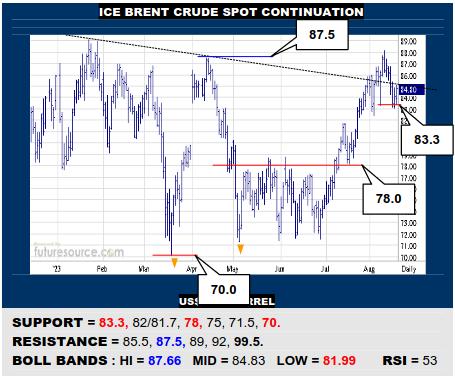

ICE BRENT CRUDE OIL SPOT

An Aug foray across a neckline exit to a large inverse H&S still couldn’t provide a confirming escape over the preceding 87.5 apex and Brent has slipped back through its mid band. Thus now needing a prior trough at 83.3 to intercept or else it would look a more convincing crest and a correction back towards the 78 rim of the May-Jun base would threaten.

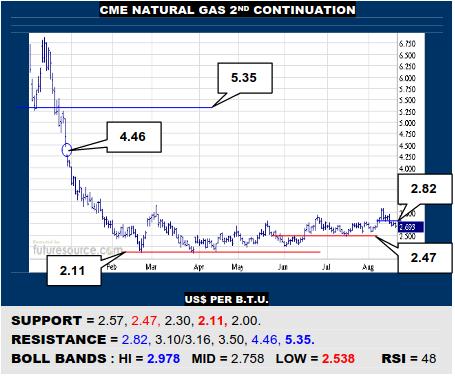

NYMEX NATURAL GAS 2ND CONTINUATION

A very quick rejection from the 3’s has led to a tiny top shape above 2.82 and erosion of the mid band so further repercussions look likely. Must thus make way for a dunk back towards the 2.47 shelf before chances to regroup would improve again. Nat Gas must otherwise bust back over 2.82 and hold there to retrieve the recent stumble.

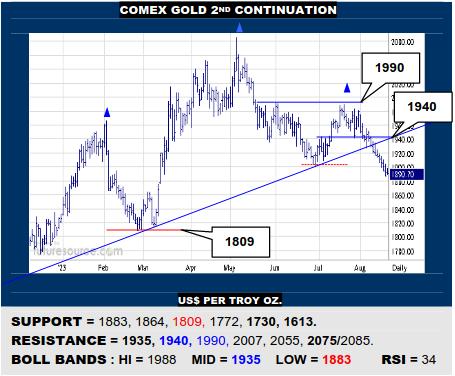

COMEX GOLD 2ND CONTINUATION

Gold has dropped away from a ’23 H&S with a recent confirming slip out of the 1900’s. Even so, in lately pressing against the lower Bollinger band (1883), a correction may be due but would have to react back over 1940 to make any serious impact on the top. Otherwise a full top height projection ultimately measures on down through 1809 to the low 1700’s.

LME COPPER 3-MONTHS

The Jun-Jly recovery never troubled the prior H&S neckline (8970) and Copper has veered south in Aug to suggest that a two-month corrective effort has crested. Thursdays’ outside day puts up a nearby fight but would have to stir a rebound clear of 8500 to make any useful repairs. Alternatively, stay wary of further losses to threaten 7850 once more.

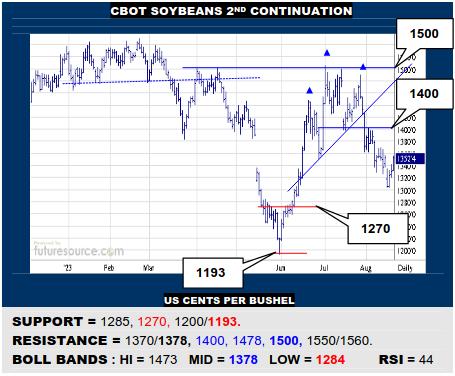

CBOT SOYBEANS 2ND CONTINUATION

After a steep mid-year H&S resolved with loss of 1400, Beans have taken some mild steps lower in Aug, rather like tame bear flags. Not severe momentum then but the H&S technically projects to 1285 and there isn’t much notable bracing until 1270. Must duly make more room underfoot while only clearance of 1400 would really steady the ship.

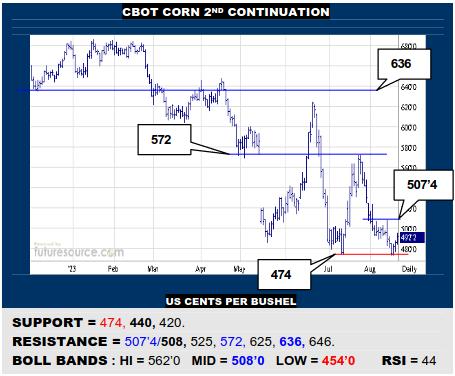

CBOT CORN 2ND CONTINUATION

Corn has tagged the Jly trough of 474 again in Aug but managed to hold and bounce once more. If this reaction could jolt clear of the recent 507’4 apex and arriving mid band (508), it would look a better catch and there would be scope up to 572 for a generally improving landscape. If blocked at 507’4 though, stay wary of space down to 440 beneath 474.

CME LIVE CATTLE 2ND CONTINUATION

The first real challenge for the summer escape to new millennium highs in Cattle as the advance has faded in the past month and 178 support now marks a tipping point to resolve a new Q3 top. If cleanly breached, beware testing the prior millennium peak at 172.7 and risk on back to 166. Must hold 178 and pop the mid band (180.5) to stabilize instead.

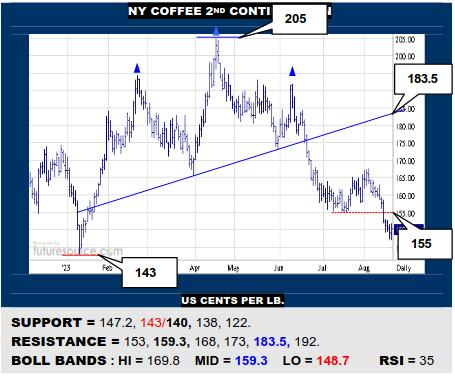

NY COFFEE 2ND CONTINUATION

Coffee has pressed to new depths below 155 this week and a small new top now projects to 142 while the large first half H&S measures just through the main weekly support (140) to 138. Even so, an outside day to end the week warns to mind 153 as a possible trigger for a temporary correction to try the mid band (159.3) before diverting lower once more.

B-BERG / US DOLLAR RATIO

The Jly rally out of a ’23 inverse H&S was still intercepted by the preceding peak of 1.067 to divert the Ratio back through nearby 1.027 support where it is now looming over the base neckline (0.993), a Fib retracement sitting just behind at 0.989. Would duly want to see the retreat mopped up in that 0.993 to 0.989 span in order to regain stability and composure, success then turning focus back up towards the mid band (1.035) as an escape hatch towards a key third encounter with 1.067. If instead the decay just chewed on through the 0.99’s while the Dollar forged ahead beyond 103.5, the base here would be diluted and losses could continue towards 0.94.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading undertaken based on the analysis or suggestions provided herein. This information is intended solely for the personal and confidential use of the reader and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis as principal of TechCom. Copyright © 2023 Technical Commentary.