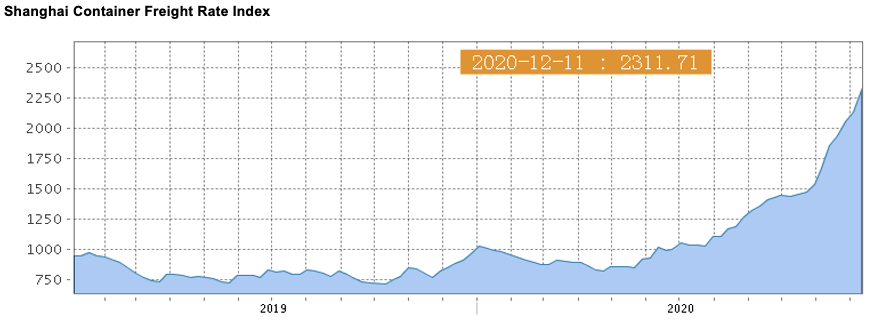

- A global container shortage is disrupting supply chains.

- If white sugar availability is hit, regional premiums and the white premium could strengthen.

- Meanwhile, global raw sugar demand could reduce if refiners are unable to ship their sugar.

Why Are Container Shortages Threatening Global Trade?

- Like everything in 2020, blame COVID, specifically the lockdowns used in the first half of the year to combat the virus.

- China moved into lockdown the earliest as factories shut down there had fewer goods to ship in containers.

- The rest of the world soon followed, meaning demand for goods also fell in H1’20.

- As a result, container lines cancelled vessel sailings; by mid-April almost 40% of capacity from Asia to Northern Europe had been removed.

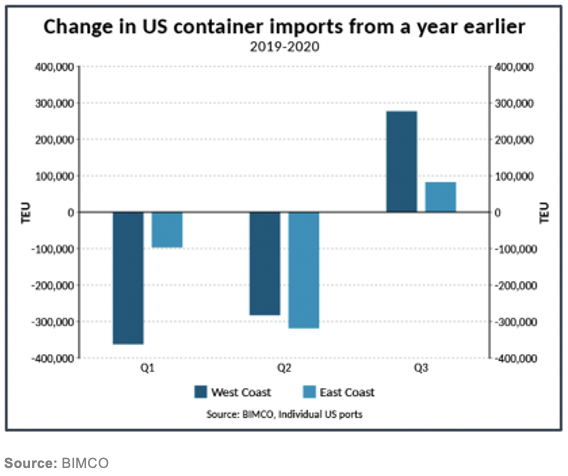

- As the world emerged from lockdowns at the end of Q2’20 and into Q3, pent-up demand for goods meant there was a surge in demand for container shipments.

- This created problems for shipping lines: the global container industry runs on a hub and spoke model which is less resilient to disruption than a network model.

- Many major ports were operating under COVID conditions, including social distancing and other countermeasures, reducing efficiency of operations.

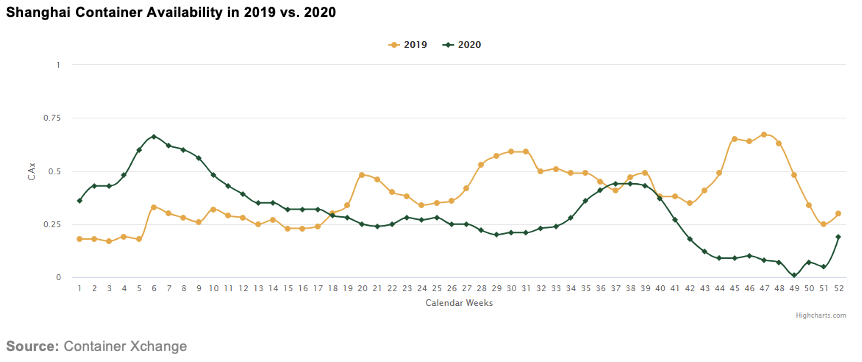

- Meanwhile key export ports in China faced container shortages as equipment was stuck either laden on vessels, at trans-shipment ports or empty and waiting to return on the backhaul.

- In short, many of the world’s containers were (and still are) stranded where they are not needed, and it’s been difficult to recirculate them back to East Asia.

- Shipping lines have tried to respond, but service levels have fallen as a result.

- Main routes are being operated preferentially, feeder routes are being sacrificed and container offers are short-term and expensive.

- This has led to delays and constant schedule changes as vessels sit waiting for days outside ports.

- Container availability in China has now started to improve as operators move boxes to the most profitable locations.

- However, other countries are still feeling the strain as boxes have been diverted to fill the shortfall in China.

What Does This Mean for Sugar?

- This has serious implications for supply chains, especially those that run on a “just in time” basis like white sugar.

- Sugar is not a high priority product for shipping lines.

- Firstly, it accounts for a very low proportion of global trade.

- Secondly, it’s a heavy but low value product.

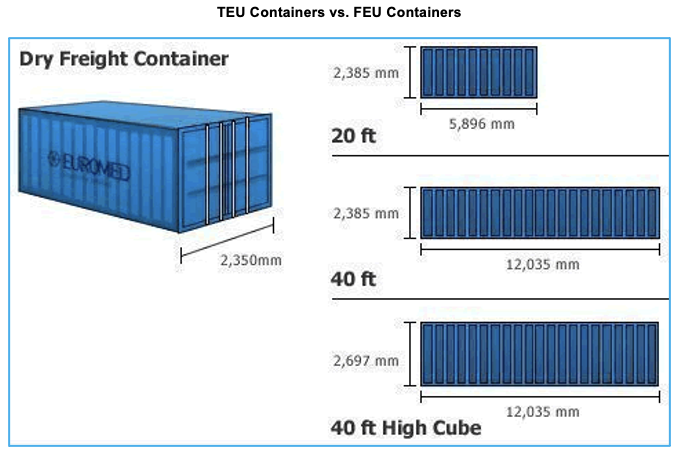

- Its weight means it can only be shipped in twenty-foot equivalent unit (TEU) containers, not forty-foot equivalent units (FEU).

- Retail goods with a lower volume-to-mass ratio, on the other hand, can completely fill the larger FEU.

- Shippers prefer the larger containers as they offer more capacity for the same handling costs.

- It’s therefore become increasingly difficult to source containers for sugar shipments, notably in the Indian Ocean region.

- More than 60% of the world’s white sugar trade is shipped in containers.

- If containers cannot be easily sourced, we risk localized stockouts as a worst-case scenario.

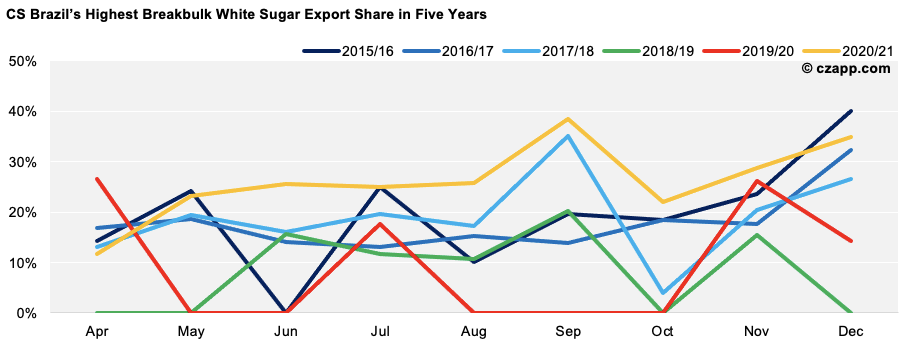

- Traders could attempt to aggregate demand to ship white sugar in breakbulk vessels (typically >10k tonnes each).

- In Brazil, breakbulk shipments have taken the highest share of whites exports in the last five years.

- However, this would rely on being able to aggregate different customers’ sugar with different contractual demands.

- Many ports are also not well-equipped to handle breakbulk vessels, and the larger consignment size could be harder to finance.

- This means that in some regions, physical values for white sugar could strengthen because of the logistical stress.

- If the problem becomes more widespread, the 2021 white premiums may also strengthen.

- Those sugar refineries who are struggling to source containers may also need to reduce melt rates if their whites silos fill, possibly reducing their raw sugar needs.

How Could the Problem Resolve?

- Most people in the market are hoping that global trade smooths as vaccines against COVID roll-out in 2021 and life returns to something approaching normality.

- A common refrain in the container market is that the problems will be “over by Chinese New Year”.

- However, it’s interesting to see that the problem has become so important that shipping lines are attracting political pressure.

- In the UK, a Honda car factory had to stop operations due to a shortage of parts thanks to congestion at Felixstowe.

- While this was partly blamed on Brexit, it’s possible the container market problems had a contributing role.

- Meanwhile, in the USA the Federal Maritime Commission is investigating whether container lines have broken the Shipping Act by restricting US grain merchants’ access to export markets, therefore depressing grains prices.

- Perhaps politicians can succeed where the market has failed and encourage the shipping lines to further improve their operations…?

Here’s Another Opinion You Might Be Interested In…