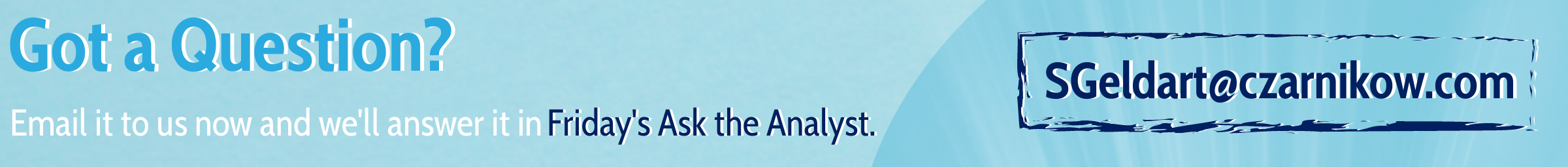

- We think India could fail to fulfil this season’s 6m tonne sugar export quota due to the ongoing container shortage.

- The shortage could also lead to more sugar being exported in bulk, rather than container.

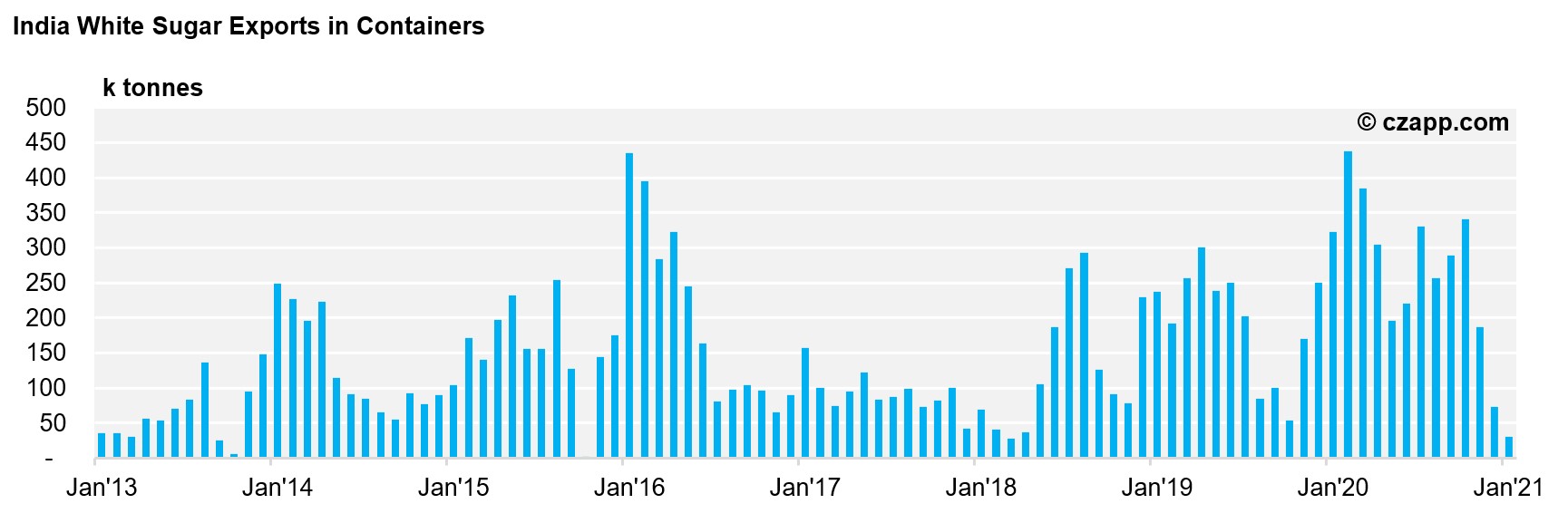

- The first half of the year is the prime time for India to export, as the monsoon makes logistics harder in Q3.

Will the Container Shortage Weaken India’s Sugar Exports?

- There’s been a shortage of shipping containers at Indian ports for the last five months.

- During this time, freight rates for India’s sugar exports have tripled (from $500 to US$1,800 for Chennai to Hamburg, for example).

- The limited container availability means regular vessel calls have been rescheduled; this has driven freight costs even higher as the container sailing slot availability has reduced.

- With this, India could fail to fulfil its 6m tonne sugar export quota.

How has this happened?

- In the second half of 2020, India’s all container exports increased by 18% as global demand recovered as COVID lockdowns were lifted.

- In the same period, India’s imports were down, meaning its usual ability to re-use those containers for export was limited.

- This meant India used up its 10-15% buffer, which is usually reserved for exports of any commodity including sugar.

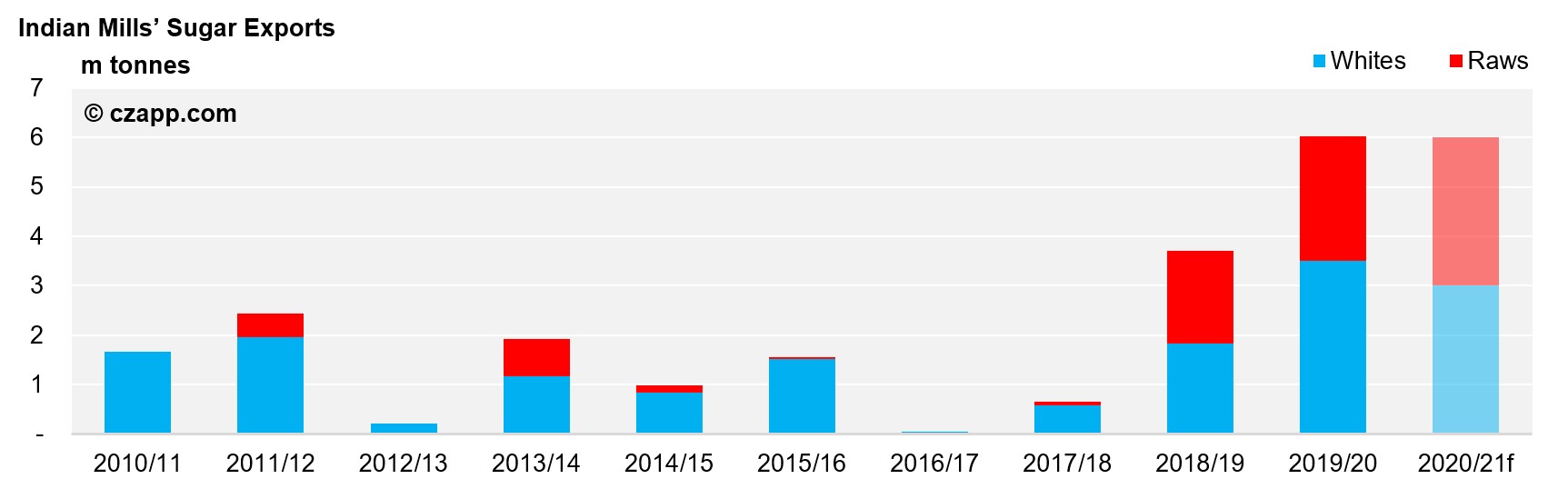

- Most of India’s white sugar is exported in containers; in 2020, 81% of a total 3m tonnes of mill white sugar were exported this way.

- If February exports do not rebound, we think India may only achieve between 4 to 5m tonnes exports.

- The containers shortage is likely to primarily impact white sugar availability as this is the main method for shipping whites.

- In the last season, India mills had supplied Sri Lanka (723k), Afghanistan (684k) and China (108k) of white sugar in boxes.

- These destinations haven’t taken Indian sugar in bulk vessels unlike East Africa (Somalia, Sudan and Djibouti).

What Do the Container Shortages Mean for India’s Longer-Term Supply?

- We think the global container supply will become more normal sometime in Q2’21, halfway through India’s peak export window.

- For the past nine years, India’s Q3 sugar exports have been around 23% lower than those of Q2 as the monsoon makes logistics harder.

- In recent years we have seen flooding on highwasy, truck queues at ports and strong winds hampering port operations.

- This all ultimately impacts vessel berthing schedules, which means sailing (arrival and departure) schedules ultimately could get pushed back.

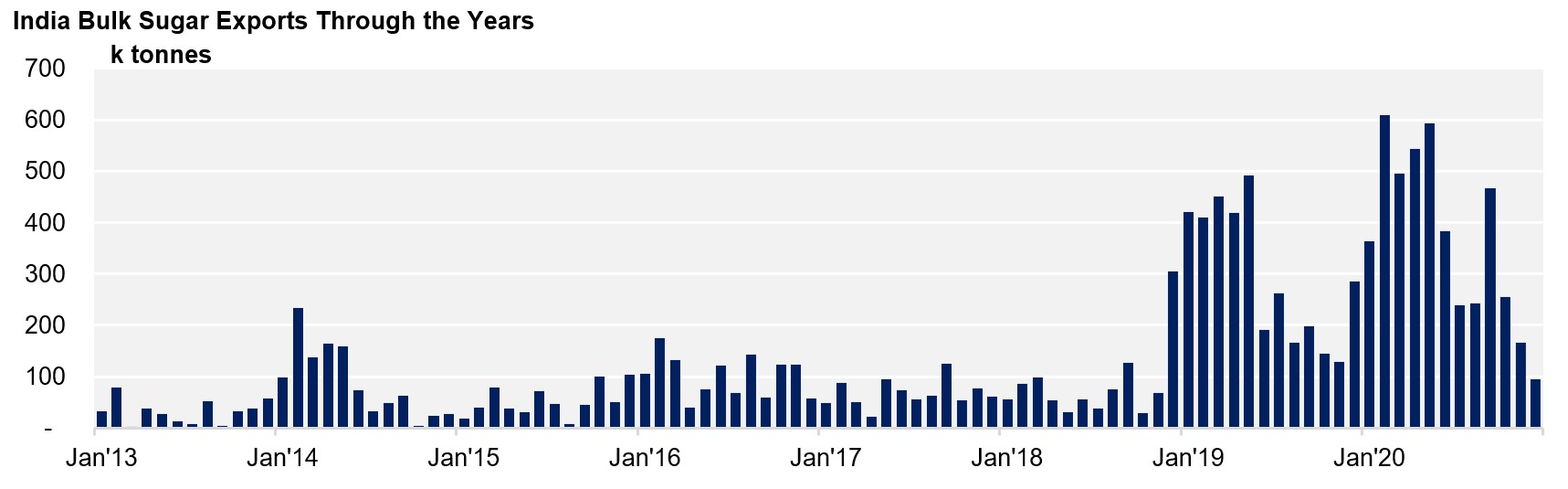

- Therefore we could see more Indian exports via bulk shipment in the short term to get around the container shortage.

- Last year, 4.5m tonnes of India’s sugar was exported in bulk.

- In the longer term, India plans to expand its container availability by manufacturing its own; the feasibility of this is currently being explored.

Here’s Another Opinion You Might Be Interested In…

- Indonesia: The World’s Largest Raw Sugar Importer in 2021

- India Ups Ethanol Production at Sugar’s Expense