Price Action

Forecast

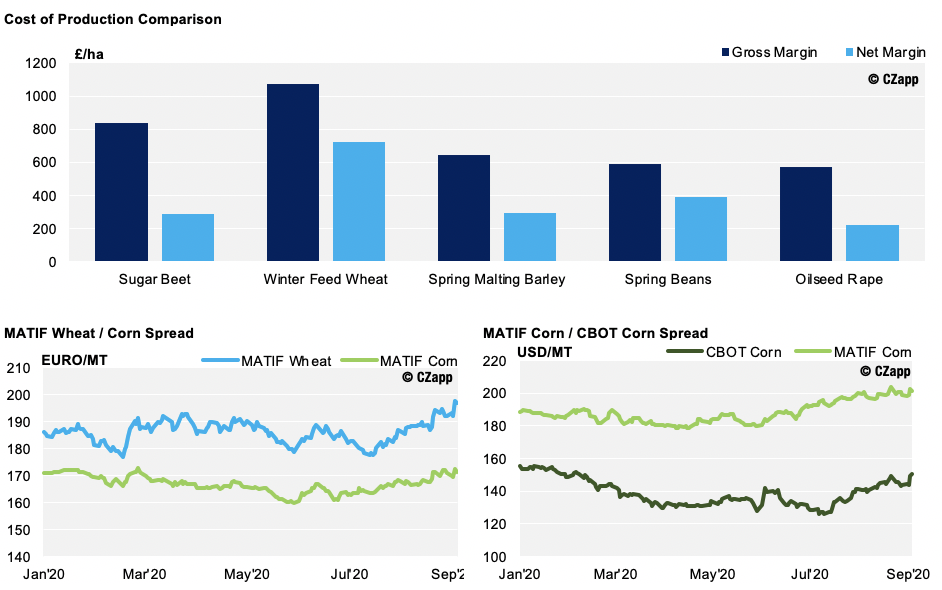

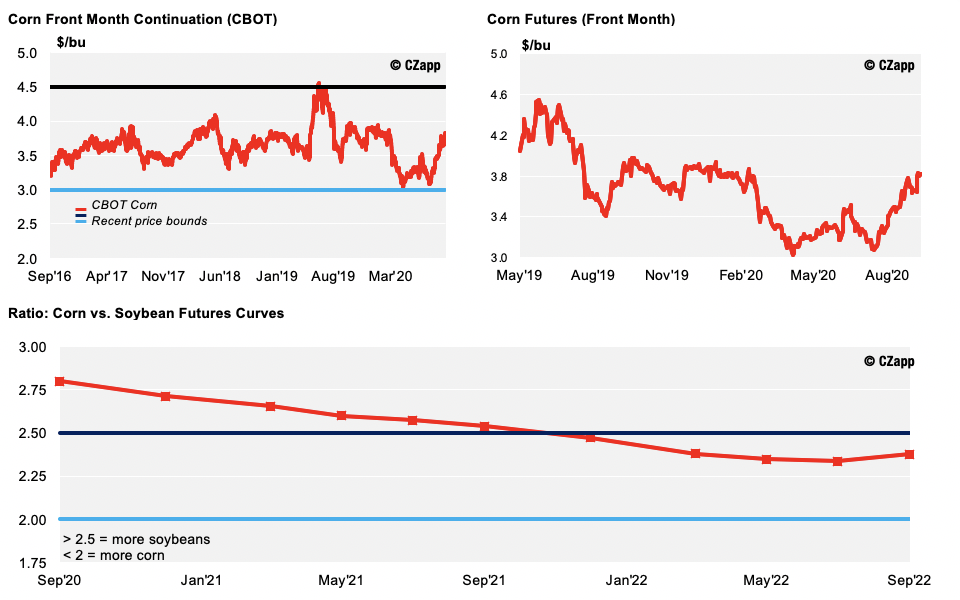

There are no changes to our 2020/21 (Sep/Oct) average price being in a range of 3.25-3.75 USD/bu, but it will likely be revised upwards after the October WASDE is published this Friday. The average price since the beginning of the crop has been running at 3.64 USD/bu.

Market Commentary

Grains rallied in all geographies after the USDA surprised us all in their quarterly stocks report. This week’s WASDE will show a tighter picture for supply and demand, with Corn stocks higher year-on-year.

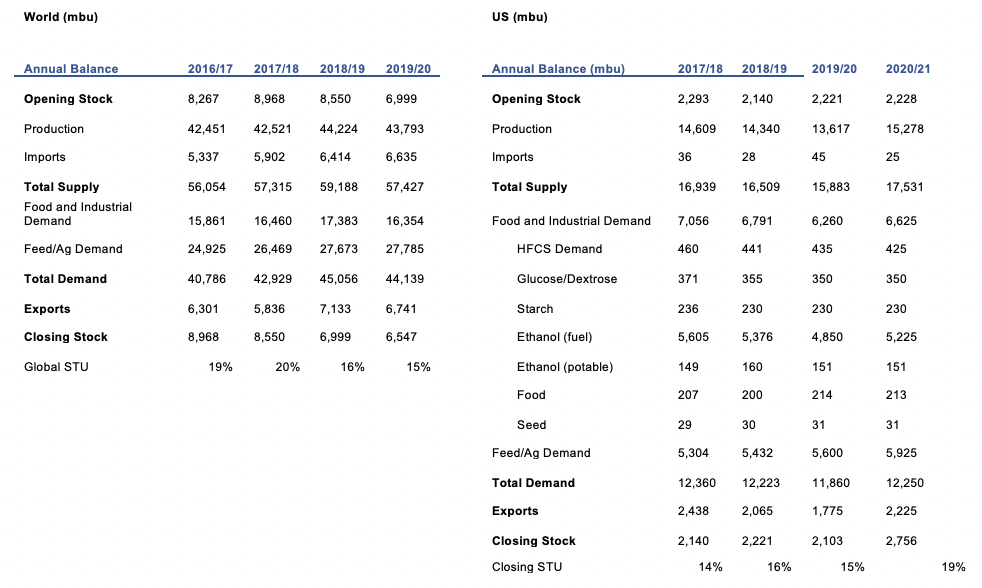

Last week, the USDA published its quarterly stocks report. This is usually neutral, but this time was a big surprise. Stocks by the 1st September came in at 1.99 billion bushels for Corn, compared to the anticipated 2.25. Wheat came in at 2.16 billion bushels, compared to the expected 2.24. Soybeans came in at 0.52 billion bushels, compared to the 0.58 predicted.

The anomaly came as the USDA corrected the June 30 Corn stocks, lowering them by 205 million bushels, due to feed/residual consumption being increased by 252 million bushels. This takes feed/residual demand to 5.9 billion bushels in 2019/20, compared 5.6 before. Ending stocks are now down to 2 billion bushels, compared to 2.3 before. Likewise, the 2020/21 feed/residual consumption will probably be upgraded and surpass the 6 billion bushels, compared to the 5.8 published in the last WASDE release. 2020/21’s ending stocks should move closer to 2-2.2 billion bushels, compared to the 2.5 predicted in last month’s WASDE.

On the production side, the consensus is for a reduction in yields, which would further reduce the ending stocks figure.

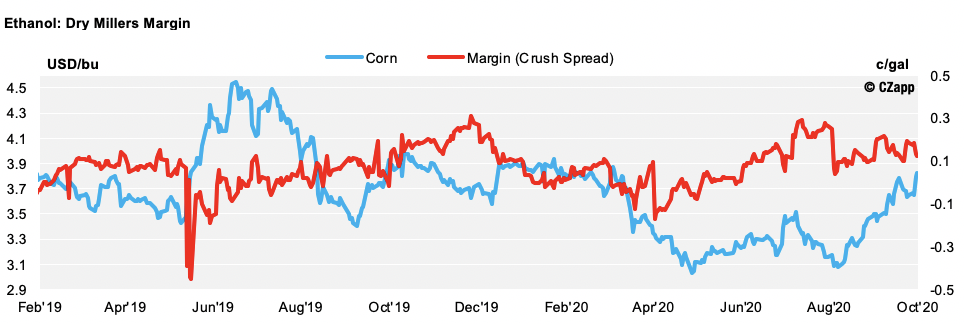

We think Corn for Ethanol usage in 2019/20 might be increased if the Energy Information Administration’s ethanol production number is correct, using a conversion of 2.85 gallons per bushel.

Less than two months ago, the August WASDE showed 2.8 billion bushels of Corn ending stocks in 2020/21. So, if yields are reduced in this week’s WASDE and 2019/20’s Ethanol usage is increased, we could see a massive reduction of to 800 million bushels in just two months. We’ll have to wait until Friday.

Corn, Soybeans and Wheat rallied after the report, but they all corrected some of the gains during the second part of last week.

In summary, the USDA’s quarterly report showed there is less Corn, Wheat and Soybean than initially expected, but in any case, supply is still above that of last year.

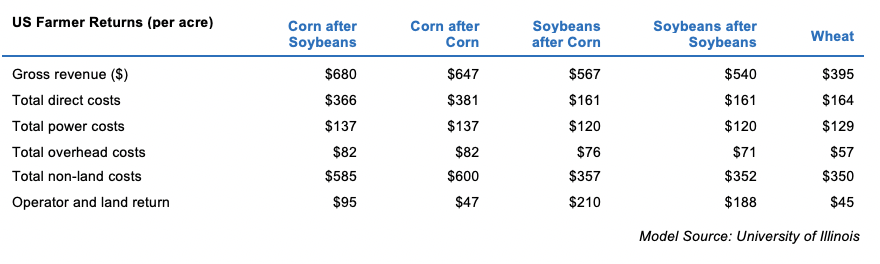

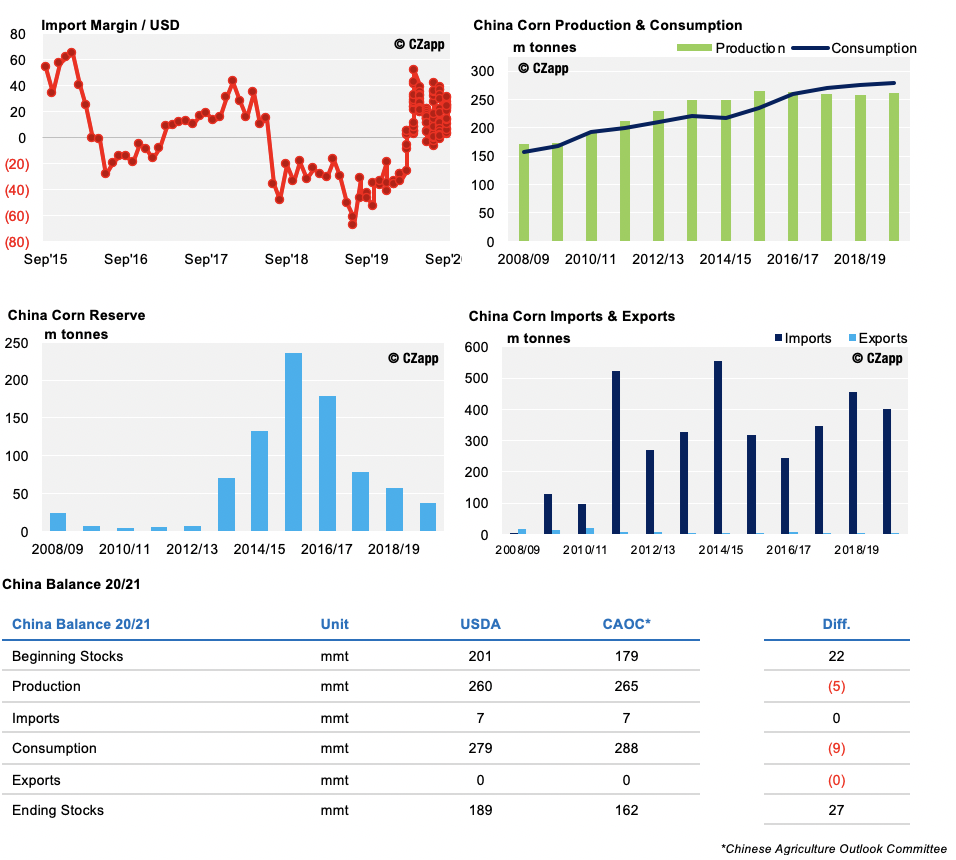

In terms of exports, China’s Phase One Trade Agreement is still a tough one to fulfill. From the 36.5 billion USD committed in 2020, only 11 billion USD has been realised. It will certainly be a challenge to fulfill this in the last quarter of the year, and it will no doubt be bullish if China goes for it.

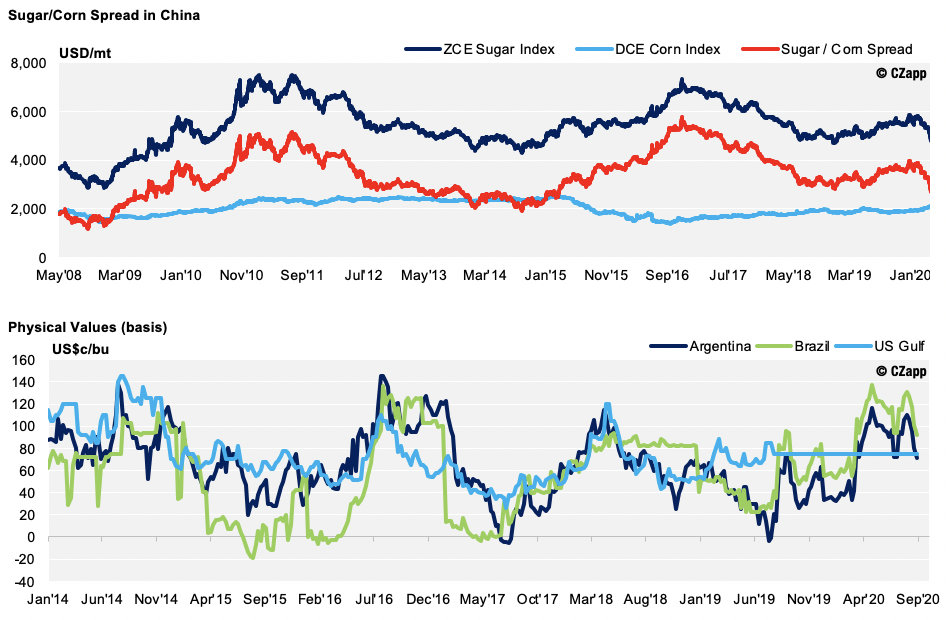

China has placed food security as a priority and does not want to run the risk of having shortages due to logistical constraints if COVID-19 has an impact on Brazilian or US ports. China needs to replenish its strategic Corn stocks, which is another incentive for the strong buying to continue. The damage typhoons caused to its Corn crop still leaves a question mark, with private analysts calculating a fall of 10m tonnes, while the Government is denying any significant damage.

Finally, China’s hog herd is increasing fast, after the African Swine Fever of the last 1.5 years reduced it by almost half. With this, demand for protein is increasing rapidly. Two weeks ago, China announced an import quota of 7.2m tonnes, which suggests it’ll continue to increase its hog population.

Last week’s US Corn net sales were 2m tonnes, surpassing the expected range of 805k tonnes to 1.15m tonnes. Wheat sales were also higher than expected, totalling 506.3k tonnes, slightly higher than the anticipated range of 200-500k tonnes.

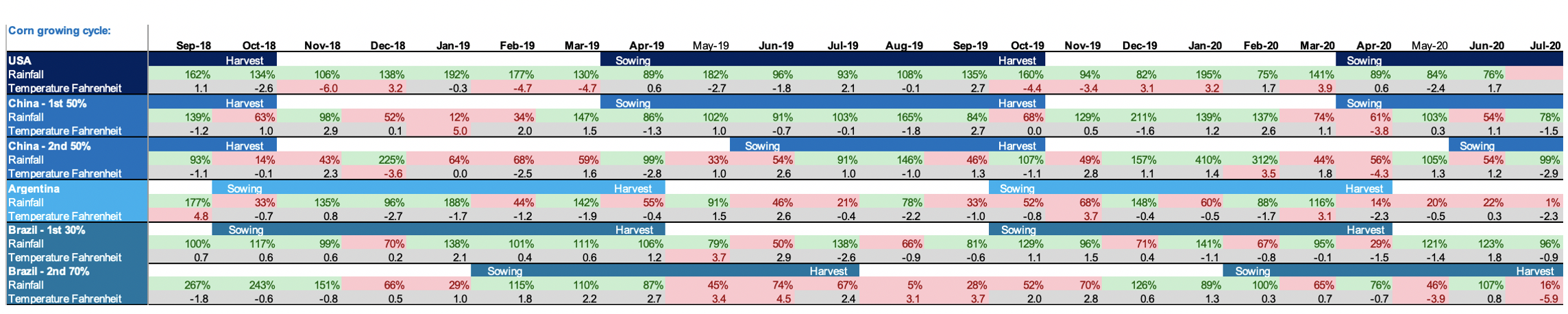

The US’ Corn condition was unchanged last week, at61% good-to-excellent. There was good progress in harvesting, which advanced by 7%. It’s now at 15%, compared to 10% this time last year. The five-year average for this point in the year is 16%.

Russian Wheat production should increase to 82m tonnes, up 7.5m tonnes year-on-year. The harvest is 95% complete.

In summary, we have seen major changes in the supply and demand balance sheet, especially in Corn. We have moved from August’s expected ending stocks of 2.8 billion bushels in the US (2020/21) to an expected of 2 to 2.2 billion bushels. Still, supply is higher than last year.

On the consumption side, we have China having to fulfill its trade agreement, having to restock and having to feed its increasing hog herd.

Expect some volatility this week as traders position themselves ahead of the WASDE. In any case, we think there should be limited downside risk.

Supply

WASDE Projections

Weather in Main Corn Growing Regions

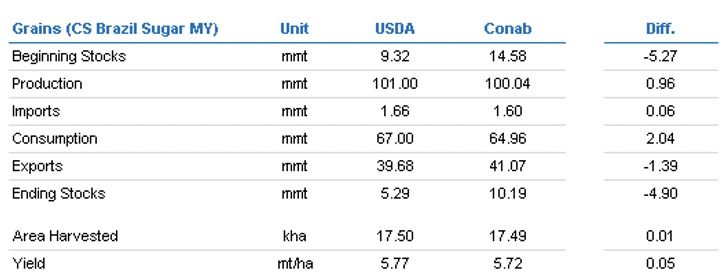

Brazil Balance

China

Demand

EU