- The July WASDE tightened old crop closing stocks for corn and wheat.

- Grains rallied in response to this.

- With yields already looking poor, there’s little room for further weather trouble.

Nixal’s Forecast

Our 2020/21 average price forecast for Chicago corn (Sep/Oct) remains unchanged in a range of 5.1 to 5.5 USD/bu.

The average price since the beginning of the old crop (Sep/Aug) is running at 5.28 USD/bu.

Our initial outlook for the new 2021/22 crop (Sep/Oct) is unchanged, with Chicago corn averaging 4.5 USD/bu.

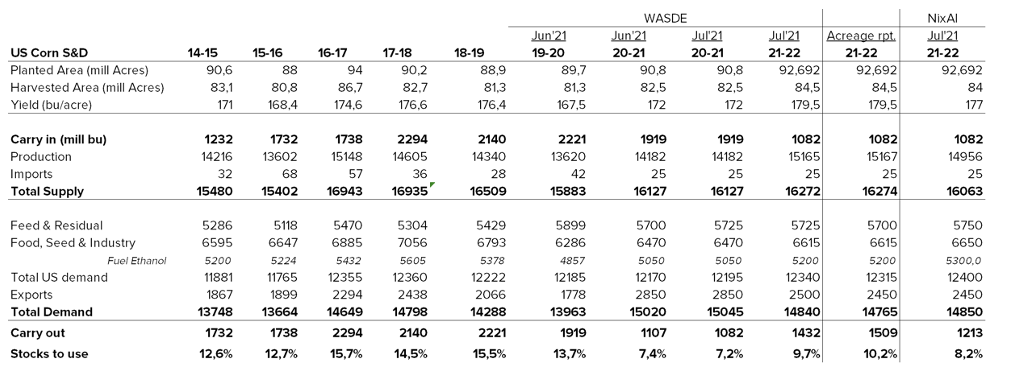

A lot could change with the weather going forward, but we feel the USDA’s yield estimate is too optimistic and could be more towards 177 bushels per acre (bpa), which would increase our forecast towards 5 USD/bu.

Market Commentary

It’s been a bumpy week for grains.

Chicago corn’s July futures contracts expired at 6.83 USD/bu on Wednesday 14th, and the September futures closed at 5.56 USD/bu on Friday 16th, up 5% week-on-week. Chicago wheat’s July contract also expired, and the September futures rallied 13%.

The July WASDE tightened old crop closing stocks for wheat and corn. Old crop closing stocks for US Corn were reduced by 25m bu, on the back of higher feed use leaving stocks-to-use at 7.2%. European corn and wheat had expressive rallies as a result.

The USDA updated new crop acreage and left new crop yields unchanged at 179.5 bpa. This was somewhat expected; they don’t usually make changes to their yield projections in July. Nevertheless, we still think there’s downside risk to their yield forecasts (final yields could be more like 177 bpa). We also still think there’s room to increase feed usage, exports and ethanol usage, as shown in the table at the bottom of the piece.

Despite new crop changes being immaterial to the market, tighter old crop stocks sparked a rally last week.

Elsewhere in the world, Brazil’s production was reduced to 93m tonnes, down from 95.5. However, as mentioned previously, we think Brazil will have a sub 90m tonne crop, meaning the August WASDE should lower their number again.

For Argentina, production was increased to 48.5m tonnes, up from 47 before.

The US’ corn condition climbed 1% and now sits at 65% good-to-excellent, up 4% year-on-year. For France, the corn condition held stable at 89% good-to-excellent, up 7% year-on-year.

Moving away from corn, it was wheat that endured the most expressive rally last week. Again, this rally was fueled by the bullish WASDE, which reduced old crop production by a sizable 152m bu as yields were lowered to 45.8 bpa (from 50.7 before). Despite this, ending stocks were down by just 105m bu thanks to higher imports and lower feed consumption.

European wheat rallied also, with France suffering a huge delay to their harvest due to heavy rain. As it stands, their harvest is just 4% complete, compared to 42% this time last year. France’s wheat condition dropped 3% too, meaning it now sits at 76% good-to-excellent. Luckily, this remains far better than last year’s 55% ranking.

The US wheat harvest is 59% complete, down 7% year-on-year.

Going forward, we think the market will close the gap between the July Expiry and actual prices. Weather and crop condition reports will remain a key influence of price behavior as we think there’s only downside risk to new crop corn yields, leaving little room for unfavorable weather.

Nixal’s Data Source

Other Opinions You Might Be Interested In…