Insight Focus

- At current prices corn will lose acres to soybeans in many producing regions.

- The US corn stock to use ratio will be the highest since 2016/17 this year.

- Russian wheat exports are weighing on the market.

The weakness in the grains market continued last week with corn in Chicago closing below USD 4/bushel for the first time in three years. Wheat was able to close the week positive thanks to fresh sanctions on Russia. Although ample supply should continue to weigh on prices, we think the downside should be limited now.

There is continued doubt over where is the floor of the market is and we think it should be close, given that, at current levels, we are set to lose corn acres in all major producing regions given other crops (namely soybeans) are more profitable.

There is no change to our Chicago corn forecast for the 2023/24 (September/August) crop, which is averaging in the range of USD 4.15/bushel to USD 4.40/bushel. The average price since September 1 is running at USD 4.65/bushel.

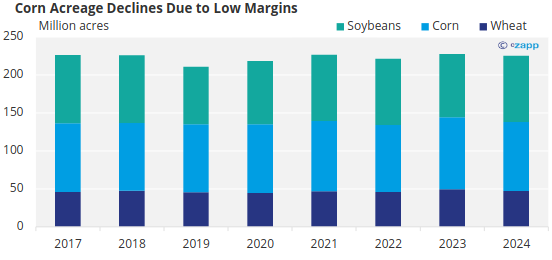

Low Margins Causes Corn Acreage Reduction

Chicago corn settled last Friday at USD 3.99/bushel, slightly above the week’s low of USD 3.98/bushel. There were enough positive signals last week to give some support after the continued deterioration since the end of the US harvest.

In the short-term US ethanol production remains at very high level but Argentina reduced its production forecast. In the longer term, the USDA Outlook Forum forecast lower acreage for the new crop, arguing poor margins. But ample supply both in the US and globally pressed corn lower last week.

Source: USDA

Ample supply continues to weigh on the market. Let’s not forget the US corn stock-to-use ratio expected by the end of this marketing year is 14.9% — the highest since the 2016/17 crop when Chicago corn averaged USD 3.62/bushel.

The US is expected to continue experiencing warmer than normal temperatures, including rains in the corn belt. Few rains are forecast in some areas of Brazil and hot and dry weather is expected in Argentina. Europe is expected to receive rains and mild temperatures.

Russian Wheat Weighs on Market

The 4 million tonnes of additional grains exports allowed by Russia – which is mainly in the form of wheat — is also weighing in the market. The European market reacted first, and the contagion spread to Chicago, which must compete in price for export markets.

But the market was supported despite conditions in France improving slightly. About 69% of the crop is now in good or excellent condition, up from 68% the previous week but much lower than the 95% recorded last year.

Extreme Weather Harms Argentinian Corn, Soybeans

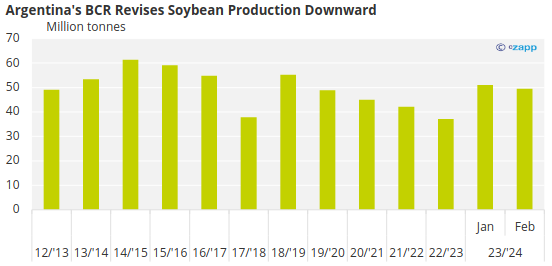

In Argentina, despite good rains in the previous week, it became clear that the damage from the previous very hot and dry weather is done. In fact, BCR lowered its forecast for soybeans by 2.5 million tonnes to 49.5 million tonnes. This is lower than Bage’s forecast of 52.5 million tonnes.

Source: BCR

The corn forecast was lowered by 2 million tonnes to 57 million tonnes – just slightly higher than Bage projections of 56.5 million tonnes. Only 31% of the soybean area and 28% of the corn area is in good or excellent condition.

In Brazil, the soybean harvest was 29.4% complete. This led to Safrinha corn planting advancing faster than last year, having reached 45.3% compared with 33.3% last year. The first corn crop is 2.8% harvested.

Spec Short Presents Vulnerability

The only vulnerability to the upside is coming from the sizable spec short, which is the largest of the last five years. There are question marks over what could trigger strong buying to cause a short covering rally.

There are no obvious influencing factors from the northern hemisphere, where corn was harvested last autumn. Impacts could only come from weather in the southern hemisphere crops that are currently in their growing stage — most precisely in Argentina and Brazil. The market is already pricing in a lower Brazilian crop due to dry weather, and a higher Argentinian crop benefitted from better weather compared with last year’s very poor crop.