Insight Focus

Corn prices rebounded but remained below USD 5/bushel. US wheat rallied alongside European grains. The February WASDE report on Tuesday is expected to show lower US and global corn stocks, which could push Chicago corn above USD 5/bushel, though delays in recognising these changes may trigger long liquidation.

February WASDE Likely to Impact Market

The February WASDE report will be released this week, and we are expecting some changes to the US corn supply and demand balance, as well as to global production estimates.

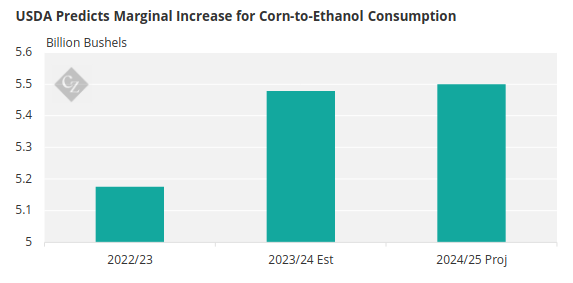

In the US, we believe corn-to-ethanol consumption has some upside. The January WASDE report left it unchanged at 5.5 billion bushels, or 0.4% higher than the 5.48 billion bushels recorded for the 2023/24 season.

Source: USDA

Actual ethanol production from September 2024 to January 2025 is already up 4.5% year over year. If that growth were to hold for the entire year, it would push corn-to-ethanol demand to 5.725 billion bushels.

However, we don’t believe there is enough ethanol demand to absorb such a production increase. Instead, we expect corn-to-ethanol demand to be in the range of 5.55 billion bushels to 5.6 billion bushels. We anticipate this adjustment will be reflected—if not in this WASDE, then in one of the upcoming reports.

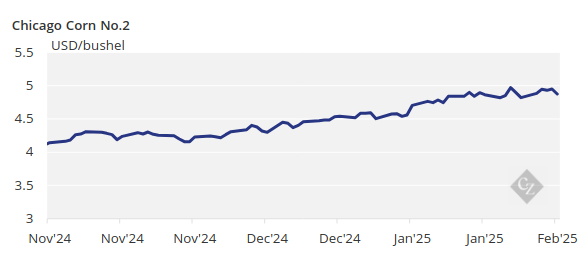

There is no change to our forecast for Chicago corn for the 2024/25 crop (September/August) to average USD 4.55/bushel. The average price since September 1 is running at USD 4.36/bushel.

Corn Rebounds Briefly

Corn in Chicago rebounded from a negative opening last Monday after the US, Canada and Mexico agreed to put the tariffs on hold for a month to allow for negotiations. However, the end of the week was negative, as risk of winter killing dissipated on expectation of snow fall in the US wheat regions.

In Brazil, Safrinha (second corn crop) planting is 5.3% planted compared with 19.8% last year, which is mainly due to the very slow soybean harvesting pace. The very slow planting of Brazil’s second—and larger—corn crop is concerning, as it will push planting outside the ideal window, potentially impacting yields. This may prompt CONAB to lower its current estimate of 119.5 million tonnes, while the USDA will likely revise its January estimate of 127 million tonnes downward.

A similar situation is unfolding in Argentina, where the January WASDE projects 51 million tonnes, while local agencies BAGE and BCE forecast 49 million tonnes and 48 million tonnes, respectively. Corn planting in Argentina is now 99.3% complete.

If we do see changes in US and global production estimates, stocks will decline, and corn in Chicago should reach USD 5/bushel this week. However, any delay in acknowledging lower stocks could trigger long liquidation, given the large net speculative long position in Chicago. This assumes no disruptions from tariffs imposed by China or elsewhere.

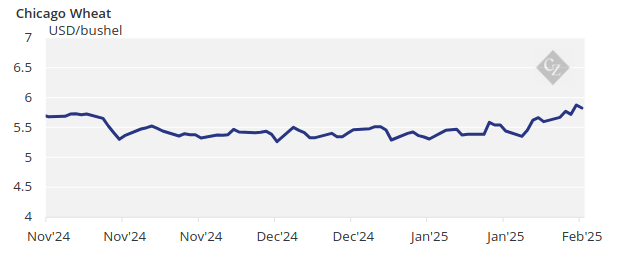

Cold Snap in US Impacts Wheat

Cold weather is expected again in the US, with snow in the corn belt and the northern plains, which will keep wheat dormant.

t

t

Brazil and Argentina are expected to receive rain again, but in Brazil, it will be significant, potentially continuing to delay soybean harvesting and, consequently, the planting pace of Safrinha corn. Rain and cold weather are also expected in northwestern Europe, while the Black Sea region is expected to remain dry.