Insight Focus

Chicago corn prices briefly rose on global production concerns but are expected to fall with harvest pressure. While the September WASDE confirmed most expectations, higher US yields added a bearish tone. Forecasts remain cautious, with rain expected to ease drought conditions.

The market was shaken last week by the September WASDE report, the expiry of the September futures in Chicago and Europe and dry weather concerns. The September/December contango in Chicago gave the false impression that we are back above USD 4/bushel for Chicago corn, but we think the market will try to close the gap with the expiry of the September future and will trade below USD 4/bushel again.

We think most of the data published in the September WASDE report was already known and therefore priced in. If anything was not anticipated, it was the higher US corn yields, which is therefore bearish and will have to be confirmed given that drought area has increased significantly. But rains are expected this week in the US, which should benefit soil moisture.

We are expecting harvest pressure for Chicago corn and a return to the sub USD 4/bushel region. There is no change to our forecast for Chicago corn for the 2024/25 crop (September/August) to average USD 3.9/bushel. The average price since September 1 is running at USD 3.84/bushel.

Corn Supported by Lower Production

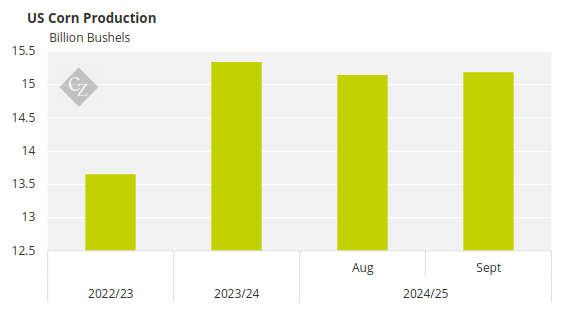

An end of the week rally took Chicago corn above 4 USD/barrel again, pulled higher by lower world production and dry weather concerns. The September WASDE report showed higher US corn production but lower volumes globally.

Price action last week was very much influenced by the September WASDE report but also by the expiry of the September futures in Chicago with the December futures now being the front month. Part of the reason why Chicago corn is back above USD 4/bushel is the contango between the September and December futures.

The US corn area impacted by drought is now up to 18% when just two weeks ago it was 8%. This information helped to fuel the end of the week rally last week.

The September WASDE report was published last Thursday and reduced US 2023/24 corn ending stocks by 55 million bushels all coming from higher demand and higher exports. For the new 2024/25 crop, production was increased by 39 million bushels due to yield being revised higher to 183.6 bushels/acre versus 183.1 bushels/acre in the August WASDE report.

Source: USDA

The lower old crop ending stocks, together with higher new crop production, resulted in 16 million bushels of lower carry out as of the end of August 2026. Stock to use is basically unchanged at 13.7%.

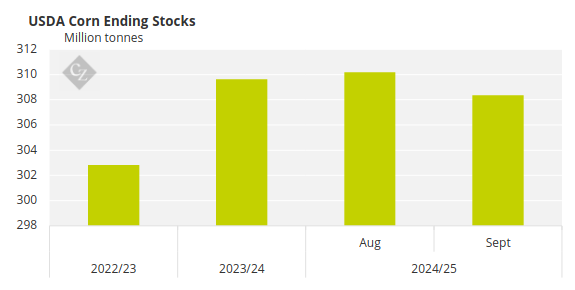

World corn stocks were reduced by 1.8 million tonnes in a combination of 1.1 million tonnes of higher initial stocks coming from the 23/24 crop, and then lower production in the US, Russia and the EU, and higher in Canada. This has reduced global stocks by 1.3 million tonnes year over year.

Source: USDA

Conab in Brazil confirmed its estimate of 115.7 million tonnes for the crop that just finished, and it will publish its estimate for 2024/25 this week on Tuesday.

The US corn condition was 64% good or excellent, one point lower week on week and compared with 52% last year. The first corn harvesting data is showing 5% of the area harvested, just ahead of 4% last year and the five-year average of 3%.

The area under drought condition rose to 18% up from 13% a week earlier. The French corn condition was 79% good or excellent, unchanged week on week but slightly down from 82% last year.

Russian corn is 8% harvested with a yield of 2.98 tonnes/ha – significantly lower than the 7.11 tonnes/ha reported last year. Ukrainian corn is 6% harvested with an average yield of 4.32 tonnes/ha or 8% lower than last year.

Wheat

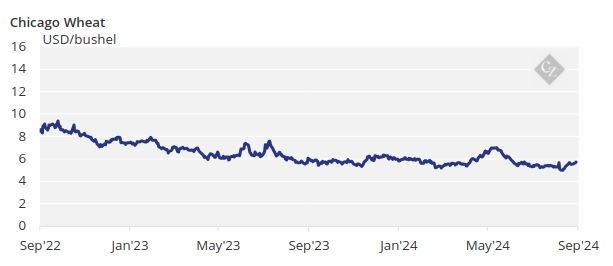

On the wheat side, the September WASDE report left wheat carry unchanged for both old and new crops with a 2024/25 carry of 828 million bushels.

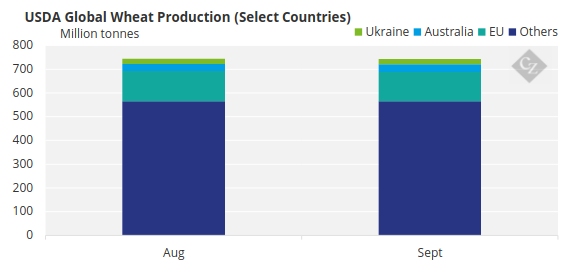

Global wheat stocks were increased by 600,000 tonnes with 2.9 million tonnes coming from higher initial stocks from the 23/24 crop and then lower production in the EU, and higher production in Australia and Ukraine.

Source: USDA

US spring wheat is 94% harvested – on par with last year and the five-year average. Winter wheat planting is 6% complete. Russian wheat is 72% harvested with a yield of 3.3 tonnes/ha, down slightly from 3.73 tonnes/ha last year. Winter wheat planting in Ukraine is 2% complete.

On the weather front, it looks like Brazil is finally going to receive some rains and although these will mostly be concentrated in the south, they will reach the centre east too. Rains are expected in the US as well as colder weather across the corn belt. France and Germany are expected to receive ample rains and mild temperatures. Eastern Europe and the Black Sea region are expected to be hot and dry again.