- The Brazilian frost and US heatwave could impact corn production.

- Corn rallied on the back of this last week.

- The weather looks more favourable in the coming days, which may ease things slightly.

Nixal’s Forecast

Our 2020/21 (Sep/Oct) average price for Chicago corn remains unchanged in a range of 5.1 to 5.5 USD/bu. The average price since the beginning of the old crop (Sep/Aug) is running at 5.24 USD/bu.

Our initial outlook for the 2021/22 (Sep/Oct) crop is also unchanged with Chicago corn averaging 4.5 USD/bu. This is because our acreage forecast was highly aligned with the USDA’s.

We think the USDA’s yield forecast is too optimistic, however, and should be more towards 177 bpa, which would shift our forecast towards 5 USD/bu. It’ll all depend on what the weather does over the next three months though.

Nixal’s Market Commentary

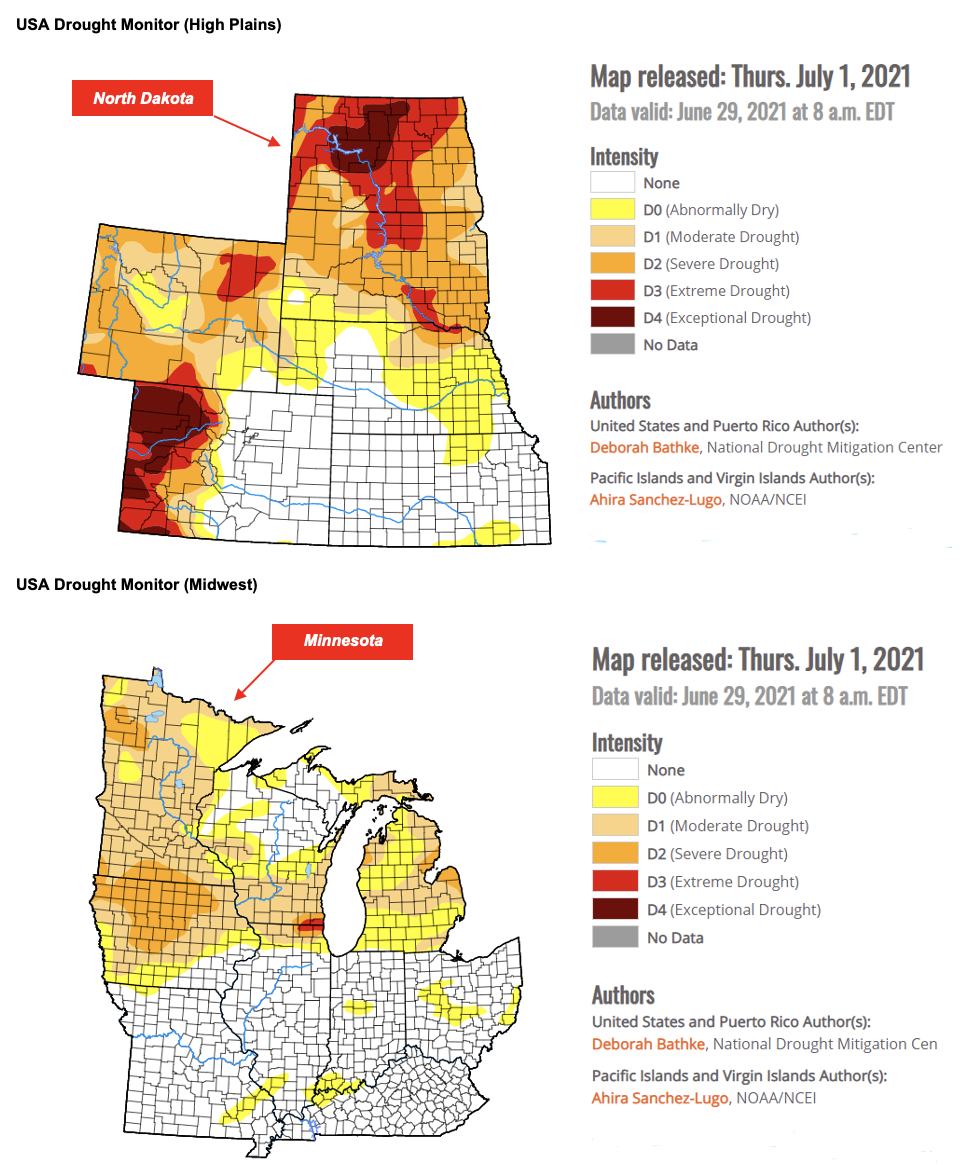

Corn rallied last week because frost in Brazil could make its old crop supply even tighter and the US heatwave may limit acreage and crop development.

Chicago corn rallied the most (10%), with Brazilian and European corn climbing slightly less (7% and 5%). Corn and soybean pulled wheat higher too, only with more moderate weekly gains as harvesting is underway.

These rallies happened before the USDA published its acreage report on Wednesday. This lowered Brazilian corn production by 4.5m tonnes, meaning it’s now sat at 94m tonnes (below Conab’s estimate).

We still think Brazil will produce closer to 90m tonnes of corn.

As it stands, the safrinha harvest in Mato Grosso is 9.7% complete, down 21.8% year-on-year. This was somewhat expected though, as planting was delayed.

The USDA said nothing about yields so we’ll have to wait until the next week’s July WASDE for clarity there.

The reality is that the corn condition has dropped to 64% good-to-excellent, down 9% year-on-year. This marks the fourth downward revision in a row, and we’ve not yet seen the impact of last week’s US heatwave. Its condition should therefore worsen again next week meaning yields could be down in the forthcoming WASDE. Having said that, the weather forecast looks good across the next 10 days, so we’ll have to wait and see how things develop there.

The French corn condition remained unchanged last week at 89% good-to-excellent, up 6% year-on-year.

The quarterly stocks for corn, soybeans and wheat were in line with our expectations, significantly down year-on-year (as of June 1st). Corn stocks were at 4.1b bu down from 5b bu last year. Soybean stocks came in at 767m bu down 17m bu year-on-year. Wheat stocks were at 844m bu, down 151m year-on-year.

The US wheat harvest is 33% complete, up 6% year-on-year. The farmers have made up for their earlier delays and are moving closer to the five-year average (40%). In France, the wheat condition looked stable at 79% good-to-excellent, well above last year’s 56%.

Global wheat supply looks good at this stage, with the balance sheet showing 3m tonnes of stock build from the new crop alone. Prices will suffer some harvest pressure but will also have some influence from the volatility seen in corn and soybeans.

Going forward, expect some weather volatility. If the weather in Brazil and the US behaves in the coming days, we could see some profit taking, but this should be limited. By the end of the week, we’ll have additional volatility as players position themselves ahead of the next Monday’s WASDE.

Other Opinions You Might Be Interested In…