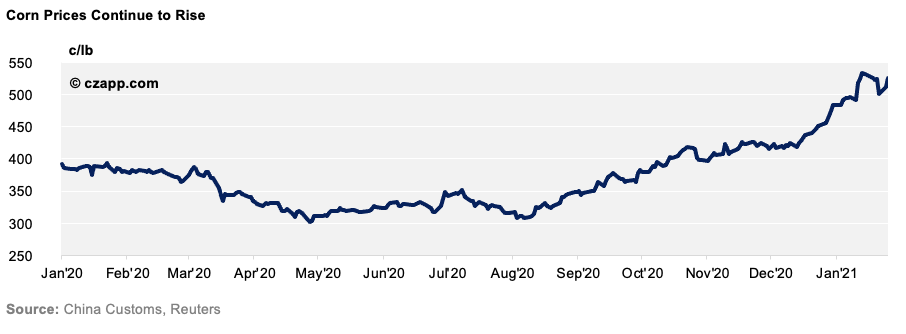

- Global corn prices are at an eight-year high as China continues to import large amounts of corn to feed its recovering pig herd.

- Just last week, China bought at least 5.8m tonnes of corn.

- This is hurting food ingredients where corn is used as a key raw material during the production process.

China’s Strong Corn Buying Fuels Rally

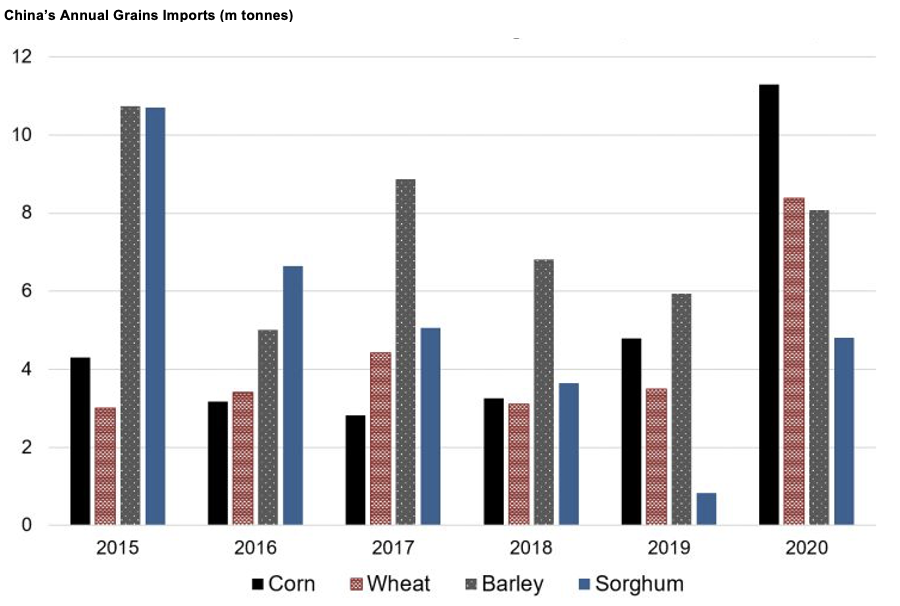

- China imported more than 11m tonnes of corn in 2020 to feed its recovering pig herd.

- These imports were facilitated by its Government’s continued issuance of low-tariff quotas to animal feed buyers.

- China’s continued buying spree has tightened global supply and corn prices have risen as a result.

- However, China’s strong grains imports are not the only reason we’ve seen corn rally.

- Poor production in the US and snowy conditions in South America are putting further pressure on planted corn.

- There’s also trouble in the Black Sea region, as the Ukrainian corn crop is performing poorly due to both excess rain and travel restrictions meaning key workers cannot gain access to the country.

- It produced just 29.3m tonnes of corn in 2020, down 6.6m tonnes year-on-year, meaning it must import 7.5m tonnes of corn to cover domestic demand.

- Its newly confirmed plan to import 10.5m tonnes of corn in 2021 will likely place further strain on global grain stocks and raise corn prices further still.

What Does This Mean for the Food and Ingredients Sector?

- The ongoing corn rally is impacting corn derivatives.

- This is especially prevalent for those where corn is the main raw material in the production process (citric acid, glucose and fructose syrup).

Citric Acid

- The sugars used in citric acid production can be derived from sugarcane, corn and wheat.

- Citric acid is therefore feeling the direct impact of the world’s tight corn supply as processors often hold large inventories to ensure they can always meet the high demand.

- However, the rising corn price means processors have exhausted their existing stock and are now processing on a demand basis, running at nil inventory in China.

- Chinese processors have warned of the possible risk of stock out.

- Moreover, consumers are constantly finding new uses for citric acid, making it all the more sought after (and expensive).

- It’s now being used in food and beverages, cosmetics, pharmaceuticals, cleaning products, and chelating, to name a few.

- The market should grow at 5.1% Compound Annual Growth Rate (CAGR) in 2021.

- All in all, the citric acid price has increased by 40% year-on-year as corn’s rallied.

Fructose and Glucose Syrup

- As for fructose and glucose syrups, a great deal of the issues faced throughout the rally are centred around Turkey.

- When COVID first broke out, the Turkish Government stopped subsidising the export of grains and its derivates to Africa.

- It did so to ensure it had ample supply to suit its domestic needs as supply-chains quickly grew more unstable.

- Consequentially, the price of corn products climbed even higher and could continue to do so.

- However, the new Black Sea corn crop will commence in September 2021, which could ease things slightly.

- But it’s too early to predict how the new crop will be priced as we don’t know how the ongoing cold and snow will impact the crop.

- Despite this, we suggest buyers place orders between now and the end of February to secure availability.

Other Opinions You Might Be Interested In…