Insight Focus

Corn rallied on supportive November data, boosting prices. Wheat remained neutral, limiting gains in both markets. Market sentiment may shift based on Trump’s trade decisions. His election is potentially bearish if tensions with China rise.

The latest WASDE report released last week, despite surprising on both the corn and wheat sides, did not make substantial changes to the supply and demand picture, either for the US or globally. At this time of year, northern hemisphere harvests have virtually finished, and attention turns to South America, where rains have arrived, and conditions are looking good.

A point of concern is what Trump may say in the coming days or weeks, and the potential revival of a trade war with China, which could negatively impact US agricultural exports and be bearish for the market.

We expect some volatility in the short term as the market adjusts to the new WASDE figures—which, in reality, don’t change the big picture. However, much of the focus will be on Trump’s decisions regarding China and other trade barriers, which could be bearish.

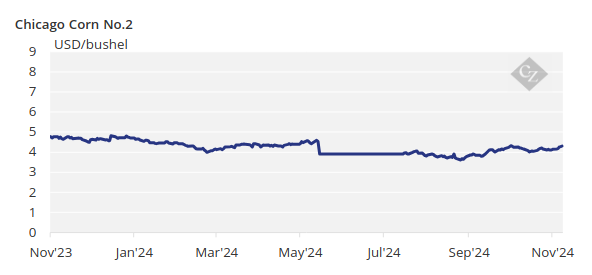

There is no change to our forecast for Chicago corn for the 2024/25 crop (September/August), which is expected to average USD 3.90/bushel, with an upside bias. The average price since September 1 is running at USD 4.10/bushel.

Corn Rallies Following November WASDE

Corn rallied following a supportive November WASDE, which was neutral for wheat, capping any upside in both Chicago and Euronext markets.

Corn in Chicago closed the week 4% higher due to strong demand and a supportive WASDE published on Friday, which reduced corn production contrary to expectations. The rally was most pronounced last Wednesday once Trump’s victory was confirmed, which seemed odd, as a potential revival of a trade war with China should not benefit US corn exports.

The rally persisted despite US harvesting pace exceeding expectations and was likely bolstered by short covering, given the sizable net short position held by spec funds.

The November WASDE left the old crop carry unchanged, but it made small adjustments on the demand side, reducing demand for feed and residual consumption in favour of ethanol, leaving the overall demand number unchanged.

New crop carry was reduced by 61 million bushels due to the reduction in production, following a downgrade in yield to 183.1 bushels/acre, compared with 183.8 bushels/acre previously. All other items were left unchanged. The lower carry leaves the stock-to-use ratio at 12.9%, down from 13.3% previously. The market was expecting a carry of 15.25 billion bushels, compared to the 15.14 billion estimated by the WASDE report.

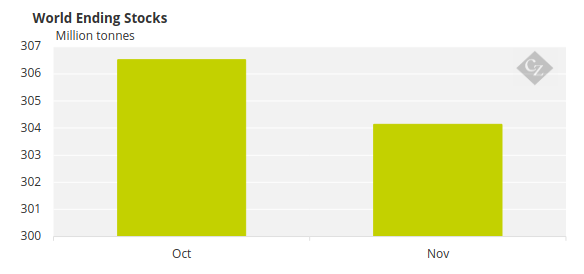

World ending stocks were reduced by 2.38 million tonnes to 304.14 million tonnes, with the yearly stock draw projected at 10.1 million tonnes. The lower ending stocks were largely due to a 6 million tonne increase in consumption, with major producers left unchanged or with minor adjustments.

Source: USDA

US corn is 91% harvested, compared to 78% last year and the five-year average of 75%. The French corn condition was 76% good or excellent, flat week-on-week and down from 82% last year. Harvesting in France is 58% complete, up 20 percentage points week-on-week, but still very slow compared to 93% harvested at this time last year and the five-year average of 89%.

Ukrainian corn is 83% harvested, with a yield of 6.06 tonnes/ha, compared with 7.05 tonnes/ha last year. Russian corn is 82.3% harvested, with a yield of 4.91 tonnes/ha, compared to 60.2% harvested last year, with a yield of 6.69 tonnes/ha.

Summer corn planting in Brazil is 42.1% complete, compared to 40% last year. Planting in Argentina is 37.2% complete, with 89% of the crop in good or excellent condition, up 3 percentage points week-on-week.

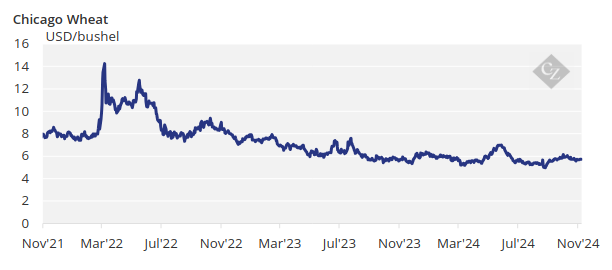

Wheat Pressured by Higher US Planting

US wheat planting exceeded expectations, which led to a negative start to the week. The rally in corn in Chicago pulled wheat higher until Friday, when the WASDE report showed higher stocks than expected, and the market fell.

The November WASDE increased wheat carry for the new crop marginally by 3 million bushels to 815 million bushels, due to 5 million bushels of higher imports but offset by 2 million bushels of higher food demand. Production was left unchanged. The market was expecting a carry of 810 million bushels.

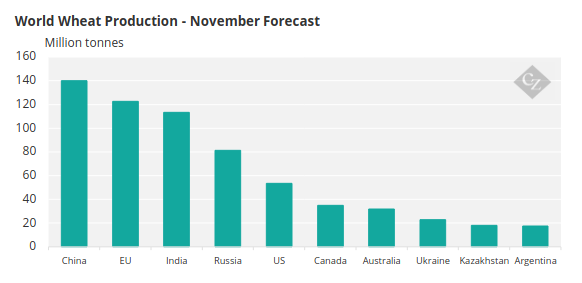

World ending stocks for the new crop were left unchanged, with a marginal reduction of 150,000 tonnes. There were minimal changes to production in Argentina, the EU and some other countries, with the biggest revision being a 500,000-tonne reduction in Russia’s production to 81.5 million tonnes.

Source: USDA

US winter wheat planting is 87% complete, compared to 88% last year and the five-year average of 89%. Its condition is 41% good or excellent, up by 3 percentage points week-on-week and down from 50% last year. Drought areas for US wheat improved, now at 57%, down from 62% the previous week. Winter wheat planting in Ukraine is 96% complete, compared to 89% last year. Winter wheat planting in France is 62% complete, compared to 65% last year and the five-year average of 77%.

Dry and warm conditions continue in Eastern Europe and the Black Sea region, while the northwest is expected to receive moderate rains. In the US, corn areas are expected to receive moderate, beneficial rains, while wheat areas will remain dry. Brazil is expected to receive rain across the whole central-south region, and rain has also been forecasted in Argentina’s main growing regions.