508 words / 2.5 minute reading time

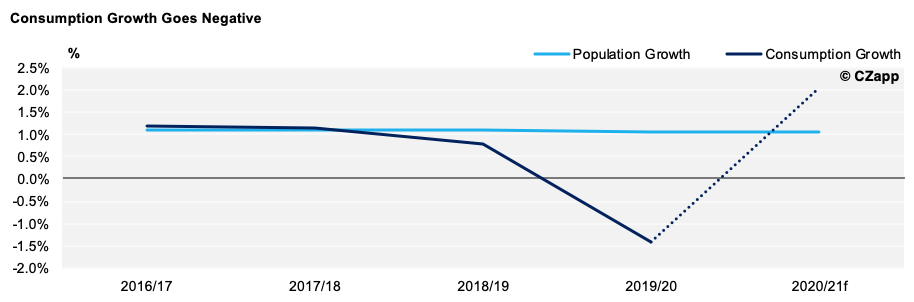

- Global sugar consumption will fall by nearly 2m tonnes (1%) this year compared to 2019, due to coronavirus lockdowns.

- This means sugar consumption per capita will also fall.

- Consumption will not recover fully until life can return to normal in affected countries; at the moment this looks like being in 2021 at the earliest.

Total Consumption Falls

- We expect global sugar consumption to fall by 2m tonnes this season.

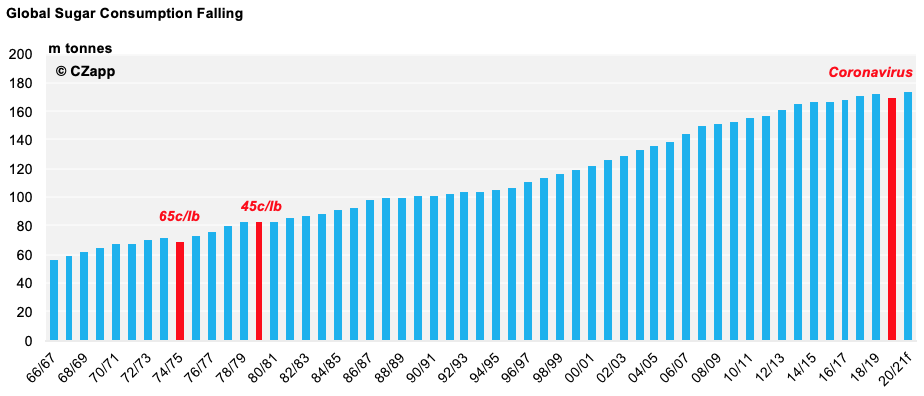

- This is the first time we’ve seen a year-on-year sugar consumption decline since 1980, when raw sugar prices hit 45c/lb.

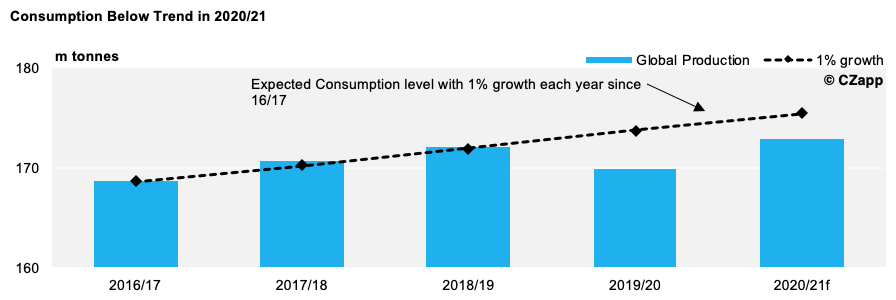

- This is a reversal of the recent trend, where consumption was growing in line with population, by 1% every year.

- We have reduced our consumption estimates for countries where lockdown measures are in place by up to 5% for the year.

- However, sugar consumption is hard to forecast accurately so we will continue to adjust our estimates as we receive more information.

- We believe the decrease of out-of-home sugar consumption (in bars, restaurants, theatres, etc.) will be larger than the increase of in-home sugar consumption.

- Soft drink sales have been particularly affected by the abrupt end to social gatherings outside the home.

Coca Cola Report Sales Volumes are Down 25% in April

- At this early stage, we forecast sugar consumption to rebound next season.

- However, we think it will fall short of the pre-coronavirus 1% growth per year trend line.

- For everything to return to ‘normal’ in our pre-coronavirus lives, there needs to be some form of herd immunity, either because enough people have caught the virus, a safe and effective vaccine has been developed, or because the virus has disappeared.

- It seems this won’t happen in 2020 (or perhaps even in 2021) and the effect of the virus on the world’s economy will be profound for the coming months and years.

- Until then, it is unlikely that people will be happy to visit pubs, bars, cafes, restaurants and coffee shops in the same way they did before.

- Many premises may operate on takeaway-only basis.

- Others will have a reduced capacity so they can offer better distancing measures for staff and customers alike.

- We will probably see similar effects at concerts, cinemas, sporting events, festivals and theatres.

- Footfall is likely to be lower as consumers stay away to avoid the risk of infection too.

Scenes From the Past

- This means the drop in out-of-home food and beverage consumption we’ve seen in countries under lockdown will continue even if lockdown is lifted.

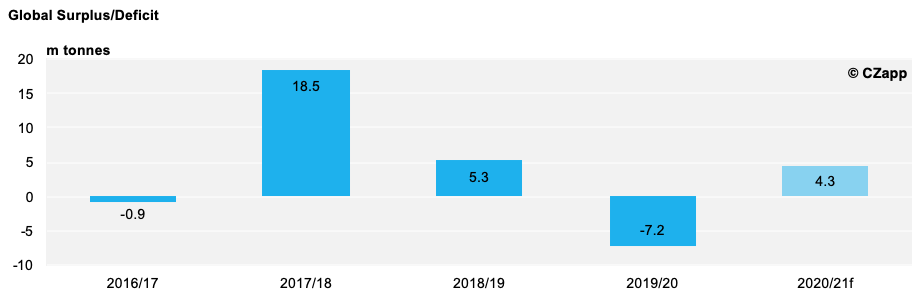

2019/20 Still Faces a Large Production Deficit

- Despite the decline, sugar consumption will still exceed production by 7m tonnes in the 2019/20 season.

- This is largely because of cane crop shortfalls in India and Thailand.

- This deficit is well-known around the sugar market and we think is already priced in with raw sugar close to 10c/lb.

- Stay up-to-date with all these changes using the Balance Sheet Changes tool in the Interactive Data Section.