576 words / 3.5 minute reading time

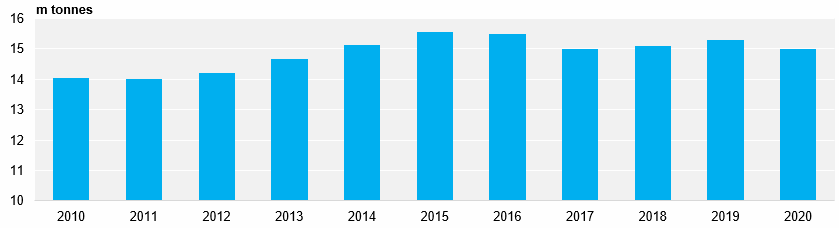

- We have reduced our forecast for Chinese sugar consumption in 2020 from 15.3m tonnes to 15m tonnes due to the COVID-19 outbreak.

- Large-scale quarantines and restrictions on travel have led to lower out-of-home food and drink consumption and stretched supply chains.

- This lost consumption is unlikely to be regained once the virus is under control.

2% Drop in Sugar Consumption in 2020 Due to COVID-19

- The coronavirus COVID-19 first appeared in December 2019 in the city of Wuhan, Hubei province.

- In response to the outbreak, the Chinese authorities imposed quarantine measures and travel restrictions on major cities across the country.

- More than 170m people were affected by these restrictions, with the majority being told to self-isolate at home to prevent the spread of the virus.

Medical Workers in Wuhan Streets

- The travel restrictions began to take effect around the time of Chinese New Year.

- This is normally the largest human migration on earth, with up to 3 billion passenger trips in the space of 40 days.

- The Lunar New Year is also the time when public gatherings and out-of-home food consumption also peaks.

- In 2020, this hasn’t happened and as a result we have reduced our forecast for Chinese sugar consumption by 2% to 15m tonnes.

Chinese Sugar Consumption by Year

What Has Happened to Out-Of-Home Consumption?

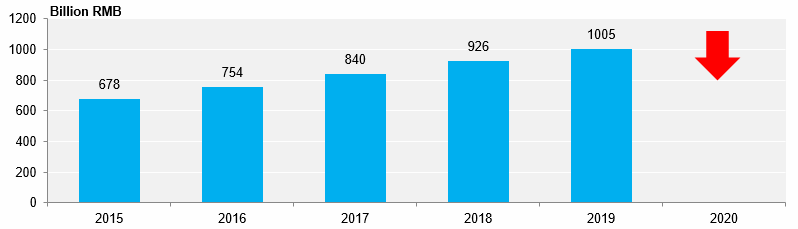

- In 2019, retail and catering sales in the New Year week exceeded RMB 1000b (USD 144b).

- Of this, “tourism” sales were RMB 514b.

Retail and Catering Sales of National Spring Festival Golden Week in 2015-2019

- However, major chains like Starbucks and Haidilao have shut many of their stores through the New Year period.

- Luckin Coffee’s mobile app data indicated that sales in H2 January were 76% lower than the Q4’19 average.

- During the same period, more than 70% of Luckin’s stores were closed.

- Smaller businesses will be even harder hit and many have shut operations since quarantine measures came into effect to avoid running out of cash.

- A further example: all cinemas have shut in China to avoid public gatherings; Cinema takings during New Year 2019 were RMB 5.7b.

Offline Loss, Online Gain

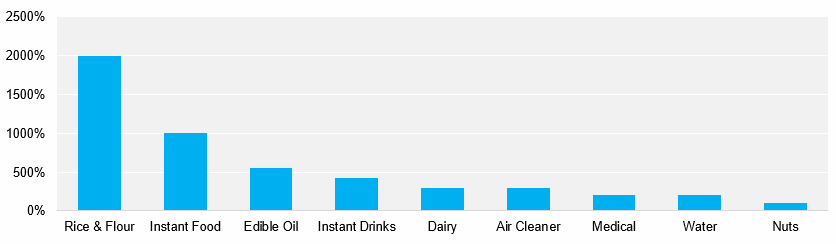

- With many consumers stuck at home and supply chains stretched, online shopping has boomed.

- The two largest online retailers in China are Taobao (Alibaba) and Jingdong.

- Jingdong has reported a significant increase in online health, home goods, and food & beverage sales in the New Year week.

- However, isolated “celebrations” at home are likely to involve less sugar consumption than larger gatherings in restaurants, bars, cinemas and public events.

Increase Rate of Sales Value of Jingdong Online Supermarket Commodities during New Year’s Week

The Future

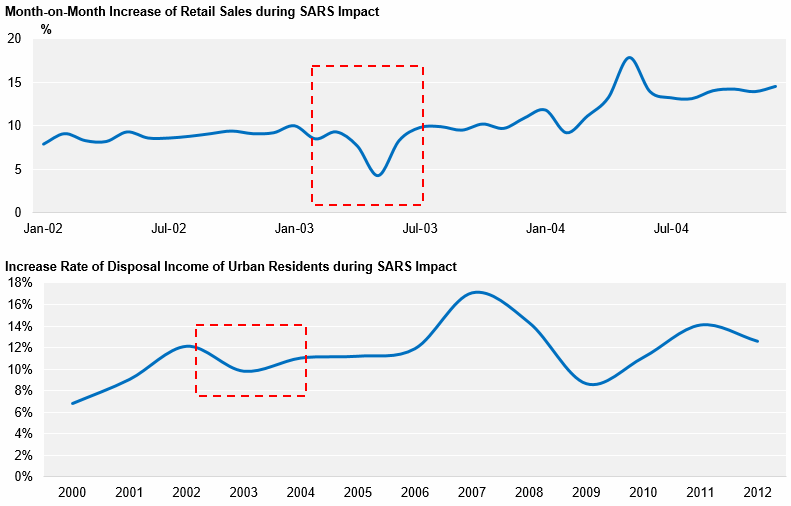

- Once the virus is under control, sugar consumption patterns should return to normal.

- However, people are unlikely to consume more sugar later in the year to make up for lost consumption in January and February 2020.

- For this reason, we think COVID-19 has led to sugar demand destruction in China this year.

Chinese Sugar Market Impact

- This change is neutral for the Chinese sugar market because we have also cut our forecast for 2019/20 sugar production from 10.5m tonnes to 10.2m tonnes.

- This is because cane yields are lower than we had previously expected.

- Many sugar milling groups have also been unable to provide virus protection equipment to their workers and so have been unable to operate during the recent quarantine measures.