517 words / 2.5 minute reading time

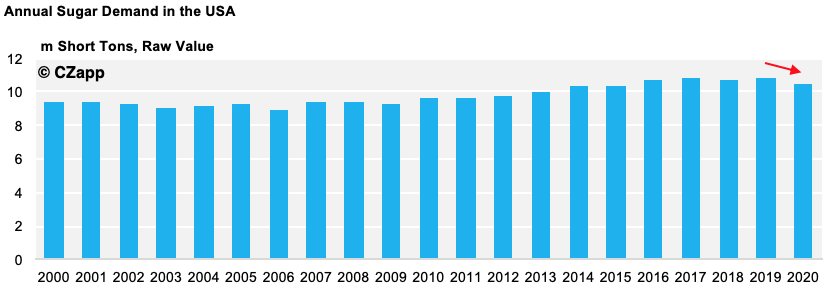

- US sugar consumption could fall by 2.5% this year due to the impact of the coronavirus.

- A significant decrease in consumption over 2020 and 2021 would reduce the need for imports from the world market.

- Sugar production should remain mostly unhindered, however, as the food industry remains a vital one.

How Will US Consumption Cope Against COVID-19?

- Whilst the short-term rush to stockpile food is beneficial for consumption, the long-term impact is harder to measure.

- We are seeing a surge in retail demand for sugar as people fill their cupboards with basic goods and snacks. However, the long-term impact of a sustained period of self-isolation could be destructive for US demand.

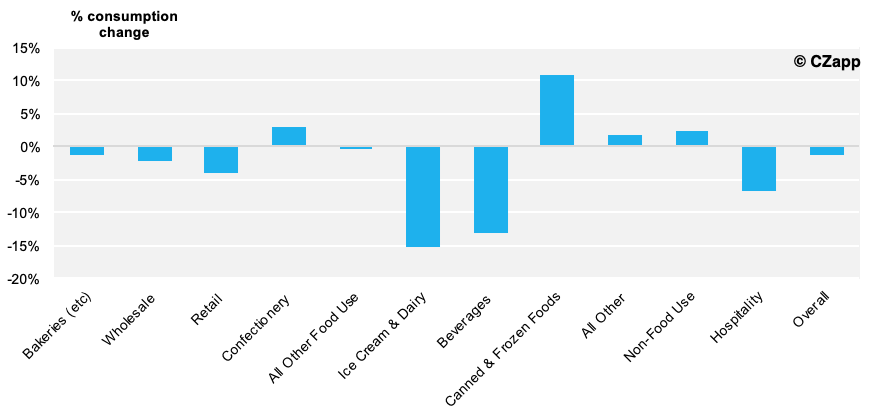

- The sugary beverage industry is at particular risk; this will have a knock-on effect on the hospitality industry.

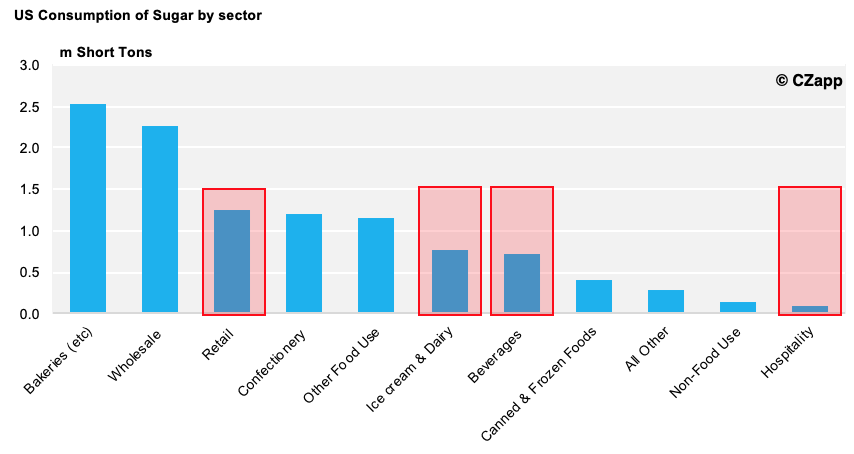

- Some major sources of sugar consumption could receive a boost; most notably bakeries and canned goods.

- But beverages, confectionary and dairy products will likely see a sustained shortfall in consumption.

- The most obvious reason for this is that people are not traveling or going out to bars, restaurants or cinemas.

- On top of this, the economic impact of the quarantine could see a more sustained loss of consumption.

Loss of Annual US Consumption After 2008 Recession by Sector

- Overall sugar consumption fell by 1.2% year-on-year (YoY) after the 2008 recession.

- The effects of prolonged social distancing could mean sugar consumption reduces by even more than this in the next 12 months.

- We think that up to 2.5% of US sugar consumption could be lost in 2020/21 due to the impact of the coronavirus.

What Impact Could This Have?

- The US is a controlled market with various import mechanisms in place to ensure the supply is adequate but not overwhelming.

- Adequate supply is defined as 13.5% stocks-to-use (STU) on the WASDE monthly balance sheet release.

- A fall in demand of 2.5% would reduce the need for imports, but this would not mean that imports are not required.

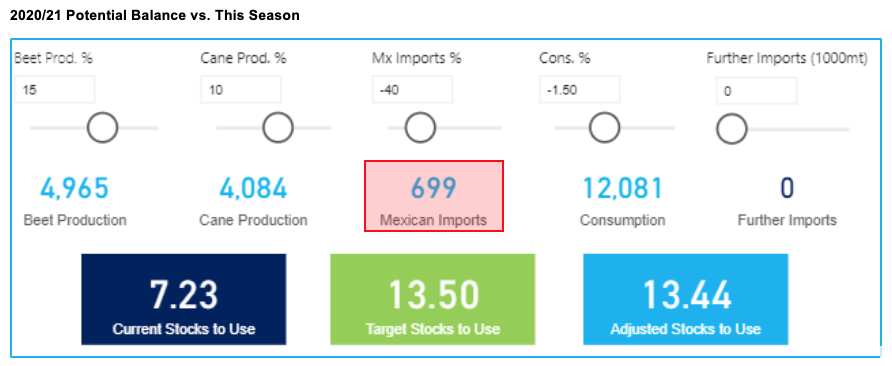

The WASDE Scenario Planner

- Our WASDE Scenario Planner allows you to adjust different variables and see how they affect the WASDE balance.

- These variables include beet and cane production, the consumption number, Mexican imports and any other imports.

- If consumption were to fall 11.96m Short Tons, Raw Value (STRV), then the USDA would project a 10% STU ratio.

- This would mean further imports of around 435k tons would be necessary (as is currently expected).

- However, it is unlikely the USDA will be able to estimate the impact on supply until later on in the season.

- This could mean the 20/21 season opens with larger stocks than expected, reducing the need for imports that season.

- This scenario assumes a recovery in the domestic beet and cane crops, as well as the opening stocks remaining consistent.

- If this were to be the case, import needs from Mexico would reduce to 799k tonnes.

- The likelihood for any further import measures this season is minimal as production recovers and demand weakens.