Insight Focus

- The new law requires disclosure of Scope 1, 2 and 3 emissions for companies with over USD 1 billion in revenues.

- Similar rules are being rolled out on a federal level, alongside other initiatives around the world.

- This forms the basis of a global emissions reporting system.

California has become the first US state to pass a law requiring large corporate emitters to disclose their company-wide greenhouse gas emissions, ramping up the pressure on US federal regulators to broaden the scope of their own disclosure rules.

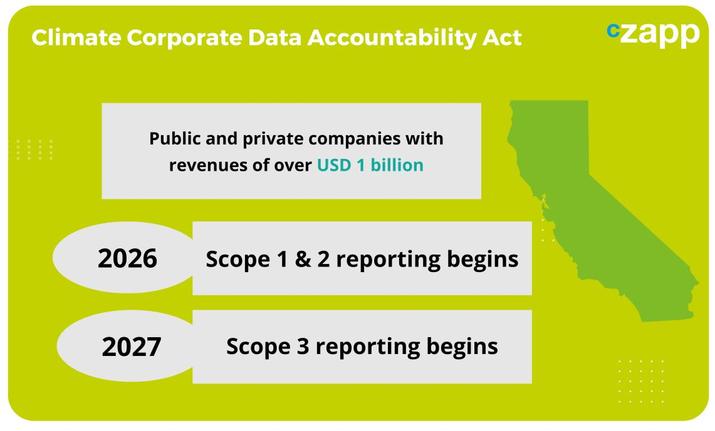

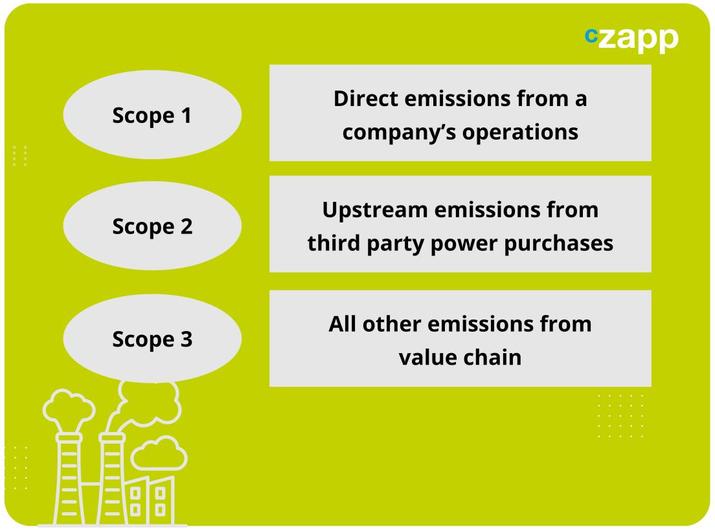

The Climate Corporate Data Accountability Act will go into effect from 2026 and will require both public and private companies with more than USD 1 billion in revenues to report their Scope 1, 2 and 3 emissions. A second bill also approved by the legislature and signed into law by the state governor this month requires companies to disclose their climate-related financial risks.

California’s new regulations represent an enhancement of proposed federal laws being developed by the Securities and Exchange Commission, which will initially apply to publicly listed companies with a market capitalisation of more than USD 700 million. The SEC is reported to be nearing the completion of work on its rules and may publish them by the end of the year.

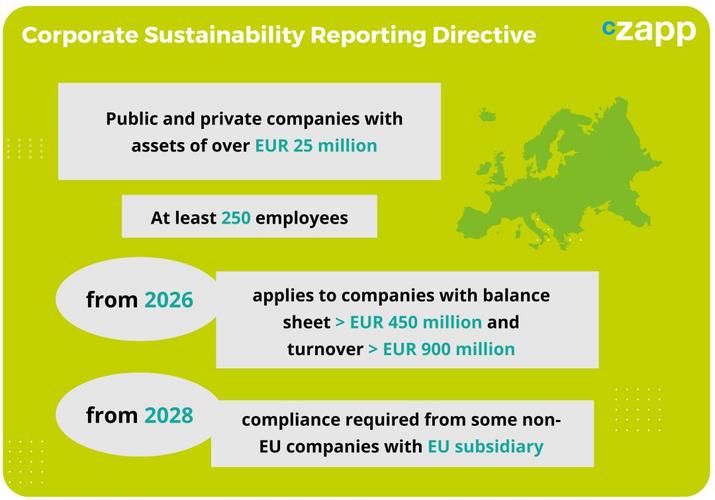

Some other major economies are also developing climate disclosure regulations. The EU’s Corporate Sustainability Reporting Directive (CSRD) went into effect in January this year and requires compliance from 2024.

CSRD applies to entities with over EUR 25 million in total assets, a net turnover of EUR 50 million and/or at least 250 employees and is expected to cover more than 11,000 companies operating in the EU. Smaller companies with a balance sheet of more than EUR 450,000 and turnover of more than EUR 900,000 will need to comply starting in 2026.

The EU legislation covers more than climate impacts, since it refers to “sustainability”, but it specifically requires companies to disclose their greenhouse gas emissions targets for 2030 and 2050, and to describe the potential impact of these targets on both their financial performance and on the environment.

The European legislation also requires non-EU companies to comply with the regulations from the start of 2028, if they have generated turnover of more than €150 million in the two previous years and if they own at least one EU subsidiary that generated at least €40 million in turnover.

Similar initiatives are taking place in Singapore, India, Australia, Brazil, Canada and Hong Kong. The emergence of this patchwork of climate disclosure laws has prompted calls for international standardisation. In 2021, the International Financial Standards Board established the International Sustainability Standards Board (ISSB) to develop “standards that will result in a high-quality, comprehensive global baseline of sustainability disclosures”.

The advent of corporate climate reporting heightens the pressure on companies to develop a deeper understanding of their climate impact, the carbon footprint of their entire value chain and of its financial impact. This in turn may lead to a surge of interest in making net zero commitments involving the use of carbon credits to offset hard-to-abate emissions.

Investors are already focusing on companies that take a proactive approach to climate and sustainability. The rapid growth of ESG-focused investment funds, for example, demonstrates that investors are actively seeking out opportunities in companies that understand and are taking action to reduce their environmental impact. With the advent of more climate-related disclosure laws around the world, these opportunities will only become clearer.